NatGas Futures Scoot Higher Ahead of Storage Stats; Physical Gas Struggles

Spot gas for Thursday delivery fell often in Wednesday’s trading, led for the most part by falling next-day power prices and forecasts of moderating trends in key eastern population centers. East and Northeast points suffered losses of up to a half dollar at some points, but the Gulf, Midwest and Midcontinent, and Rockies also weakened. California prices were steady to higher.

Overall, the market fell 11 cents to $2.50. Futures prices managed to buck the trend charted by physical prices and finished modestly in the black.

At settlement, July was 3.3 cents higher at $2.759, and August had risen 3.6 cents to $2.782. August crude oil fell 74 cents to $60.27.

Spot gas prices at California and Rocky Mountain points may be poised to jump pending what happens on the California Independent System Operator (CAISO) grid.

“There’s a little bit of a panic going on for July power across the West,” said a gas buyer for one of a state independent power generator and marketer.

Next-day prices at California points managed to counter the day’s trend of weaker prices. At the PG&E Citygate, next-day gas was seen flat at $3.13, and deliveries to SoCal Citygate added 1 cent to $3.12. Gas at SoCal Border points added a penny to $2.91. Gas on El Paso S Mainline changed hands at $2.97, up 3 cents.

“There has been some crazy stuff going on price wise with the drought. Mid-C prices went completely bonkers today. California is going to be the tail, because it is under the ISO and is efficient as it can be. Where you don’t have power managed by an ISO, then power prices can get crazy.”

Intercontinental Exchange reported a big difference in California prices compared to neighboring delivery points. Next-day peak power at NP-15, for example, closed at $45.89/MWh, up $4.26. SP-15 finished at $44.84/MWh, up $1.21. On the other hand, peak power at COB (California Oregon Border) jumped $9.23 to $67.23/MWh, and parcels at Mid-C surged $10.75 to $66.49/MWh.

The buyer said he thought the market instability would eventually filter down to California, but in the meantime pipes out of the Rockies and Canada able to deliver gas to Mid-C and COB would likely see the greatest rises.

The drought is not likely to leave much hydro power available in the power stack, and power and gas prices will respond accordingly, but “in the California ISO they will be able to measure that by what [generation] is scheduled in, plants will be going up and down and everything will be prioritized.”

If hot weather cause spower load on the CAISO grid to pass 40,000 MW, the real impact would be on Rockies prices, he said, “but the real inelastic part of it will be on the power price.”

“I think gas prices will run up to the point where ‘we’ve got everything fired up now and that’s all we can burn.” The buyer surmised that hot weather in July might cause such conditions.

CAISO forecast peak power load Wednesday at 37,404 MW.

Elsewhere, next-day gas prices slumped. Falling next-day peak power at eastern points gave gas buyers little incentive for additional purchases.

Intercontinental Exchange reported that next-day peak power at the ISO New England’s Massachusetts Hub fell $3.17 to $25.14/MWh, and power at the ISO New York’s Zone A (western New York) delivery point fell $11.42 to $32.33/MWh. At the PJM West terminal, Thursday on-peak power shed $5.64 to $33.75/MWh.

Gas at the Algonquin Citygates plummeted 45 cents to $1.51, and gas on Iroquois Waddington skidded 154 cents to $2.74. On Tennessee Zone 6 200 L gas for Thursday was quoted at $1.65, down 45 cents.

Gas bound for New York City on Transco Zone 6 fell 35 cents to $2.54, and packages on Tetco M-3 came in 16 cents lower at $1.34.

Major market centers also softened. Gas at the Henry Hub fell 6 cents to $2.77, and packages at the Chicago Citygates shed 6 cents to $2.75. On El Paso Permian, Thursday gas was seen at $2.69, down 4 cents, and Opal gas changed hands at $2.66, down 4 cents.

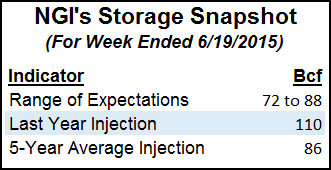

Analysts are preparing for a Thursday Energy Information Agency (EIA) inventory report that may show the first storage build of less than the five-year average in several weeks. Last week came close. For June 12, the EIA reported a build of 89 Bcf, slightly above the five-year average of 86 Bcf. For the week ended June 19, that may flip-flop.

Tim Evans of Citi Futures Perspective in closing comments Tuesday said industry consensus seemed to be forming in the 80-83 Bcf range, but the five-year pace stands at 87 Bcf.

Last year, 110 Bcf was injected, and for the week ended June 12, IAF Advisors predicted a build of 76 Bcf and Citi Futures Perspective analysts calculated an 83 Bcf increase. A Reuters survey of 25 traders and analysts revealed a sample mean of 77 Bcf with a range of 72 Bcf to 88 Bcf.

In its Wednesday morning report, Natgasweather.com said it expected another couple of days of warmth over the Mid-Atlantic and Southeast, but as the July 4 holiday approaches, “additional Canadian weather systems and relatively cool summer temperatures are expected to continue into the eastern U.S…which we would view as quite bearish for weather sentiment. We expect high pressure will again try to build back over the eastern and northern U.S. as the first week of July ends, although the data is far from convincing on how much success it will have…”

Weather patterns “will remain quite warm for another day or so over the South and Southeast, with cooling then following as additional Canadian cool blasts line up through the July 4 holiday. If bearish weather sentiment is going to ease or end, hot high pressure over the West will need to prove it will shift north and east over higher population and stronger natgas demand regions, with the next opportunity not expected until around July 6-7.”

Market technicians see the market poised at an important juncture.

“Technically, bears remain firmly in control. For that reason we have no incentive to add to long positions here,” said United ICAP market analyst Brian LaRose in closing comments Tuesday. “However, $2.641-2.616 is just below. If this area of contention can provide support, we will have good reason to add to length. If natural gas cannot find support into this zone, we will be forced to reevaluate the downside risk. Prepare accordingly.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |