Ohio to See Biggest Economic Impact From Planned Rover Pipeline

Energy Transfer Partners (ETP) LP said its ET Rover Pipeline would generate roughly $153 million in ad valorem taxes and $98 million in sales tax revenue in the four states it will cross to deliver Marcellus and Utica shale natural gas to multiple markets.

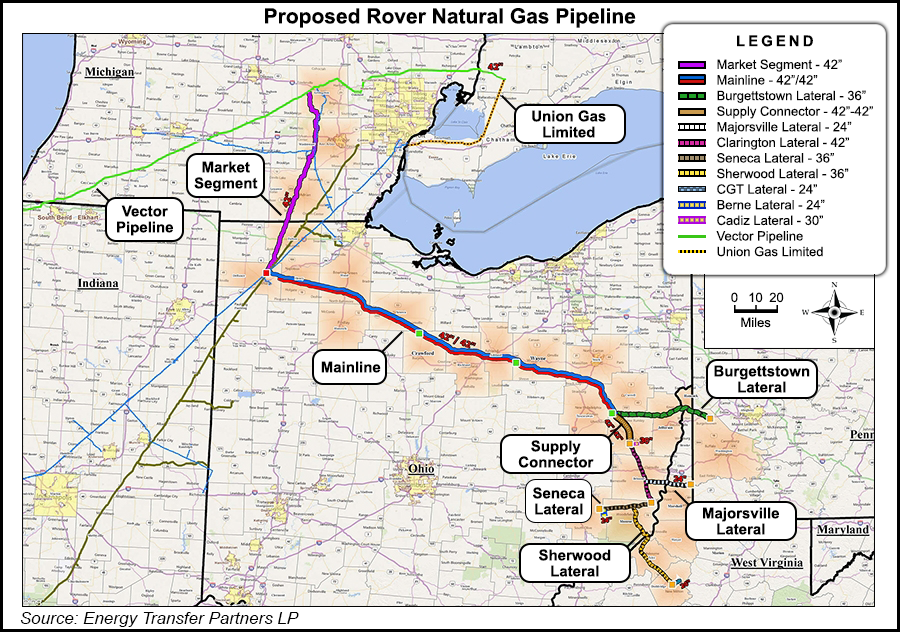

Most of the tax dollars would be generated in Ohio, where the Rover project would cross 18 counties. The company said it expects the pipeline to generate more than $135 million in ad valorem taxes, of which it calculates $91 million would be directed to 36 local school districts. About 570 miles of the 711-mile, 3.25 Bcf/d Rover are expected to be built in Ohio (see Shale Daily, Oct. 31, 2014).

Ad valorem taxes are based on the actual value of the pipeline, factored by the value of its materials and labor costs. The taxes are paid annually while the pipeline is in service to local authorities that are then responsible for distributing them to each jurisdiction, where they’re typically used for libraries, roads, schools or other public entities.

ETP also said it expects to pay about $11 million in Michigan, $3.4 million in West Virginia and $1.3 million in Pennsylvania for ad valorem taxes each year. About $77 million in Ohio, $16.5 million in Michigan, $66 million in Pennsylvania and $4.9 million in West Virginia are expected to be generated in sales tax revenues.

The pipeline would cost more than $4 billion and gather natural gas from processing plants and interconnections in northwest West Virginia, eastern Ohio and western Pennsylvania for delivery to the Dawn Hub in Ontario, where it would be sent back to U.S. and Canadian markets (see Shale Daily, June 26, 2014).

The project is expected to employ up to 6,500 workers throughout its construction. ETP filed its formal application with the Federal Energy Regulatory Commission earlier this year and construction is expected to begin in 2016 (see Daily GPI, Feb. 23). Part of the Rover is expected to be in service late next year, while the rest is expected to come online by mid-2017.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |