Northeast Natural Gas Basis Prices Soften on Moderate Temps, Stable Demand

Natural gas forwards basis markets in the Northeast softened considerably this week as long-term weather forecasts failed to offer up much support, keeping demand stagnant.

While most market hubs across the U.S. slid around 10-12 cents on average — in line with the Nymex July contract, which shed 11.2 cents from Monday to Thursday — Northeast points plunged as much as 34 cents.

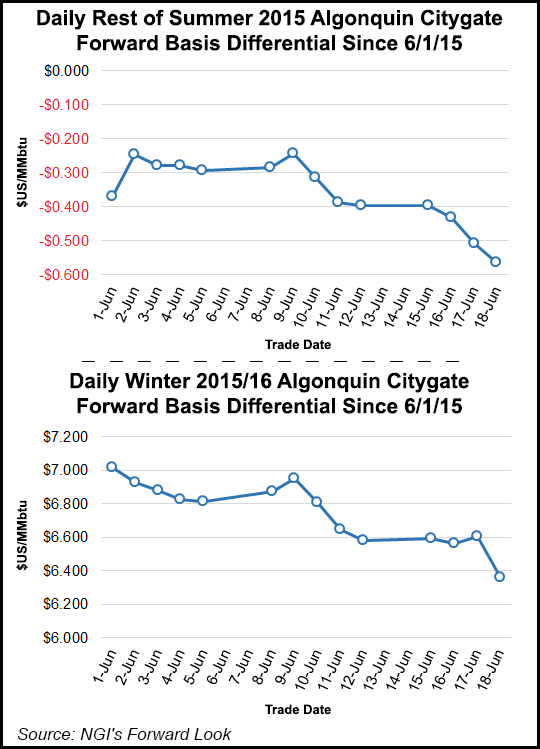

The hardest hit location was New England, where Algonquin Gas Transmission Citygates July basis was down 23.1 cents to minus 61.4 cents, according to NGI’s Forward Look. July fixed prices were down 34.3 cents to $2.163.

Further out the curve, the balance of summer (August-October) basis price fell 14.4 cents to minus 54.6 cents, while the fixed price slid 25.5 cents to $2.27.

The ongoing weakness at Algonquin comes as demand is expected to remain fairly stagnant over the next couple of weeks given the ongoing moderate weather.

Genscape shows New England demand rising from 1.87 Bcf/d June 22 to 2.00 Bcf/d June 26, in line with the previous seven-day average of 1.95 Bcf/d. The industry consultant shows demand for the following week, June 29-July 3, falling from 1.97 Bcf/d to 1.94 Bcf/d, also near the recent seven-day average.

Despite a heatwave that temporarily boosted demand in the region during the first week of June, AccuWeather forecasts show temperatures remaining quite comfortable in the 70s and low 80s for the remainder of the month and into the first week of July.

The lack of significant heat is credited to Canadian weather systems that continue to sweep across the northern U.S., providing rain and cooler temperatures to the region.

“We have been watching this closely to see which air mass would win out during the last five days of June, and the latest data continues to support the more comfortable bearish pattern,” forecasters with NatGasWeather said. “This turns the next area of focus to what happens in early July and whether additional Canadian systems can follow into the northern U.S., keeping the bearish end of June pattern ongoing.”

Meanwhile, Algonquin is set to start pigging operations on June 18 that will restrict capacity through its Burrillville Compressor Station in Rhode Island. The maintenance, which is scheduled to last until July 2, will reduce capacity from 810,000 Mcf/d to 670,000 Mcf/d.

Flows through the compressor station have averaged just 550,000 Mcf/d during the past 30 days, according to Bentek Energy. If this trend continues, little impact is expected on prices.

Elsewhere in the Northeast, New York prices also posted substantial losses for the week with little in the way of weather-induced demand.

Transco zone 6-New York July basis tumbled 16.8 cents between Monday and Thursday to reach minus 72.3 cents, while July fixed prices dropped 28 cents to $2.054.

Further out the curve, the balance of summer basis price was down 9.6 cents to minus 98.7 cents, and the fixed price was down 20.7 cents to $1.83.

Other market hubs in the region also posted losses for the week, though not as pronounced as in New England and New York.

Fixed prices for July at Dominion South point and Tetco M3 fell between 14 and 17 cents, while the balance of summer dropped between 15 and 18 cents.

Meanwhile, prices across the rest of the country fell more uniformly with the Nymex, which weakened this week as futures traders focused on returning production and a storage injection that only slightly missed analyst expectations, but still put inventories 1.9% above the five-year average of 2,387 Bcf and 42.9% above last year’s level of 1,703 Bcf.

Along the Gulf Coast, Houston Ship Channel July basis fell a half cent between Monday and Thursday to reach minus 1.5 cents. Fixed prices were down 11.7 cents to $2.762.

The balance of summer at HSC priced Thursday at $2.79, down 11.3 cents for the week and 3 cents below Henry Hub.

At Florida Gas Transmission zone 3, July basis edged up about a half cent to plus 6.2 cents, while the July fixed price dropped 10.6 cents to $2.839. The balance of summer priced Thursday at $2.88, down 10.9 cents for the week and 6 cents above Henry Hub.

The drop in prices comes even as demand in the Southeast/Mid-Atlantic region has soared to summer-to-date highs amid warmer-than-normal temperatures in the region and sustained power demand growth.

According to Genscape, demand on June 16 hit 17.05 Bcf/d, the highest single-day mark in Genscape history for summer-to-date in the region. The previous high was 14.32 Bcf/d, established in summer 2012. Demand all summer has averaged a record 13.29 Bcf/d, beating the previous record of 12.31 Bcf/d established in 2012.

The push has come from the power sector, Genscape said, where power burn this summer-to-date has averaged 7.58 Bcf/d, exceeding the 2012 record of 7.46 Bcf/d.

Population-weighted temperatures for the Southeast and MidAtlantic have been slightly higher than normal as well, averaging 71.2 degrees this summer-to-date versus the 10-year average of 70.1.

“When normalizing for temperature, we see power burn this summer-to-date approaching summer 2012 levels,” said Genscape’s Rick Margolin, senior natural gas analyst. “Burn this summer, when temperatures have been within the 10-year normal range, has averaged 7.43 Bcf/d, just shy of 2012’s record 7.54 Bcf/d.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9915 | ISSN © 2577-9877 |