Eastern NatGas Points Lead Market Lower; Futures Strike Out With Storage Stats

Spot natural gas for Friday delivery scooted lower in Thursday’s trading at about the same rate as the prompt-month futures contract, which failed to rally despite a somewhat bullish storage report. Broad weakness was present across all market points and only a handful of locations made it to the positive side of the trading ledger.

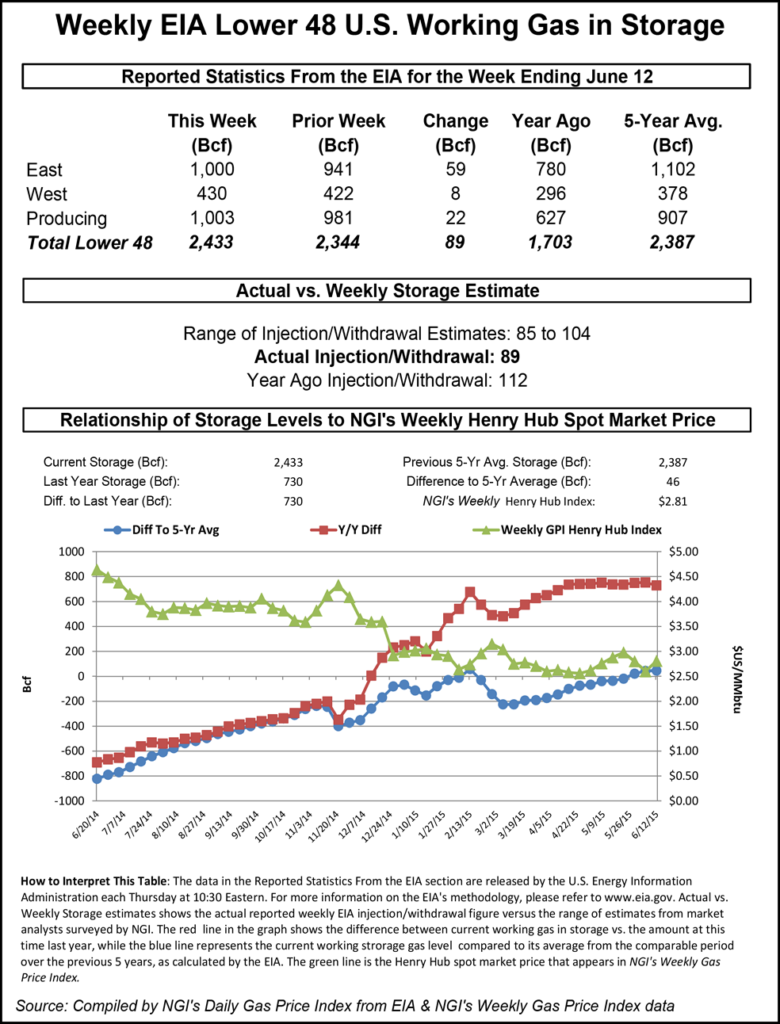

Overall the market was lower by 9 cents to $2.62 with New England and eastern points taking the biggest hits. The Energy Information Administration (EIA) in its weekly storage report for the week ending June 12 said inventories increased 89 Bcf, somewhat less than what traders were thinking, but prices fell anyway. At the close July had floundered 7.8 cents to $2.777 and August was off 8.4 cents to $2.799. July crude oil rose 53 cents to $60.45/bbl.

Midwest quotes slipped as weather forecasters called for a major cooling in large energy markets. Forecaster Wunderground.com said Chicago’s Thursday high of 82 would drop to 67 on Friday and climb back to 86 on Saturday. The normal high in the Windy City in mid-June is 81. Detroit’s expected Thursday high of 84 was predicted to slide to 74 Friday and bounce back to 82 Saturday.

Gas on Alliance for Friday delivery fell 6 cents to $2.85 and deliveries to the Chicago Citygates dropped 7 cents to $2.82. On Consumers next-day packages were seen at $2.92, down 6 cents and on Michcon gas was quoted at $2.91, down 7 cents as well. Deliveries to Demarcation changed hands at $2.72,down 8 cents.

A mixed power regime was also no help to market bulls. Intercontinental Exchange reported that on-peak Thursday power for delivery to the ISO New England’s Massachusetts Hub fell 37 cents to $24.50/MWh and power at PJM West Hub rose$2.67 to $38.16/MWh.

New England took some of the day’s largest losses. Deliveries to the Algonquin Citygate Friday were seen at $1.70, down 34 cents and gas on Iroquois Waddington shed 9 cents to $2.82. Parcels on Tennessee Zone 6 200 L fell 32 cents to $1.74.

One area that saw both weaker spot gas and also lower next-day power was California. Intercontinental Exchange reported that Friday on-peak power at NP-15 skidded $2.62 to $37.53/MWh and peak power Friday at SP-15 fell $4.29 to $36.20/MWh.

Gas at the PG&E Citygate fell 8 cents to $3.15 and deliveries to SoCal Citygate were quoted 7 cents lower at $3.10. Parcels at the SoCal Border dropped 5 cents to $2.91.

Traders greeted the release of storage data with a thundering yawn. For the week ended June 12, the EIA reported an injection of 89 Bcf in its 10:30 a.m. EDT release. July futures rose to a high of $2.882 after the number was released and by 10:45 a.m. July was trading at $2.834, down a counterintuitive 2.1 cents from Wednesday’s settlement.

Prior to the release of the data, analysts were looking for an increase closer to the 93 Bcf area. Bentek Energy had calculated an 89 Bcf increase, but IAF Advisors was looking for a build of 93 Bcf. A Reuters poll of 25 traders and analysts showed an average 93 Bcf with a range of a 85 Bcf to a 104 Bcf injection.

“It looks like the market doesn’t have much incentive to the upside,” a New York floor trader told NGI. “I think there are a lot of cautious bulls in here and as long as the market holds $2.81, those bulls will remain in the market.’

Tim Evans of Citi Futures Perspective saw the report imparting a bullish tone to the market going forward. “The 89 Bcf in net injections for last week was less than the consensus expectation and only marginally above the 86-Bcf five-year average for the week ended June 12. This implies a somewhat larger jump in summer air-conditioning demand than the week-to-week change in temperatures suggested. This tightening of the background supply/demand balance suggests smaller injections going forward as well.”

Industry consultant Bentek Energy hit the nail on the head and calculated that “Total demand picked up considerably compared to the previous week, gaining more than 3 Bcf/d, which was driven entirely by higher power burn demand. During the week, power burn hit a 2015 high of 31.4 Bcf/d, and this now sets the record for the earliest time of year where power burn has hit above 31 Bcf/d.”

Inventories now stand at 2,433 Bcf and are 730 Bcf greater than last year and 46 Bcf greater than the five-year average. In the East Region 59 Bcf was injected, and the West Region saw inventories increase by 8 Bcf. Stocks in the Producing Region grew by 22 Bcf.

Jim Ritterbusch of Ritterbusch and Associates thought that a “bullish” number such as the 89 Bcf build might set off a run higher, possibly testing $3, but after the report was released said the market has “sent off some very bearish signals given a downward price response following a seemingly supportive EIA storage report. However, we are not expecting much downside price follow through even allowing for some mild temperature expectations across a broad portion of the nation’s Midcontinent into the beginning of July.

“The expansion in the supply surplus against average storage levels has stalled at only about 46 Bcf. And, while a supply rebound would appear likely next week, we will further emphasize a production pace that appears significantly downsized relative to prior expectations of a month or two ago.”

Early data from Reuters shows next week’s build at 83 Bcf build with a range of 69 Bcf to 92 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |