Lean Natural Gas Storage Build No Help For Bulls

Natural gas futures worked lower following an inventory report that curiously showed an increase in working gas storage that was somewhat less than what traders were anticipating.

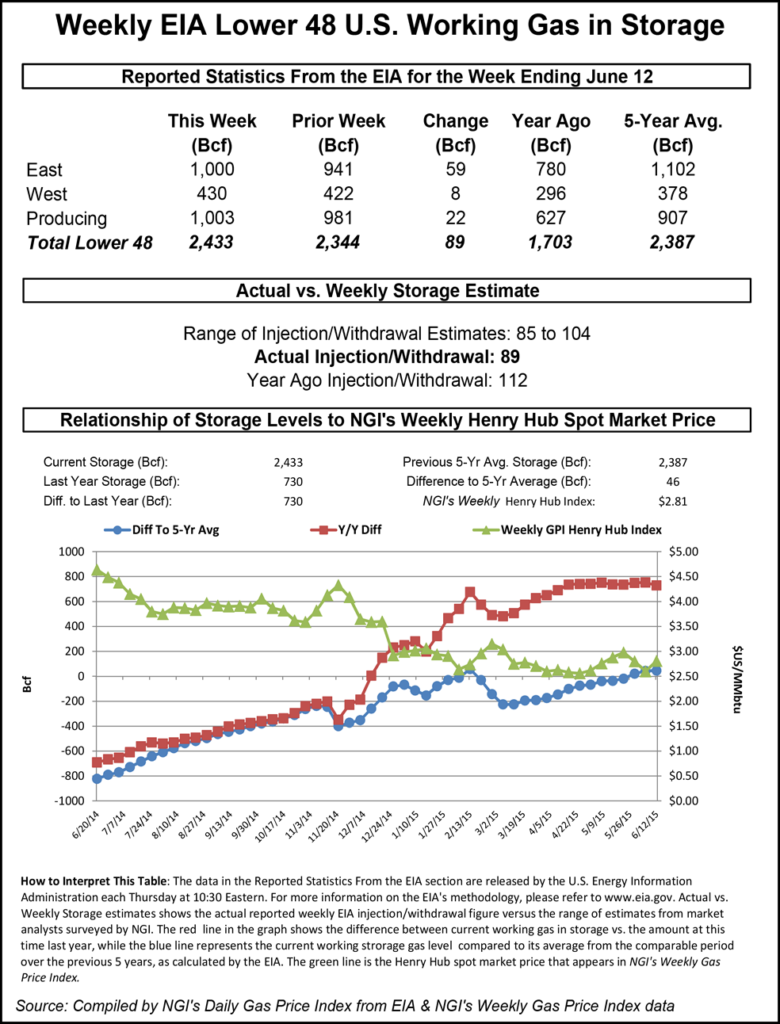

For the week ended June 12, the Energy Information Administration reported an injection of 89 Bcf in its 10:30 a.m. EDT release. July futures rose to a high of $2.882 after the number was released and by 10:45 a.m. July was trading at $2.834, down 2.1 cents from Wednesday’s settlement.

Prior to the release of the data, analysts were looking for an increase closer to 93 Bcf. Bentek Energy had calculated an 89 Bcf increase, but IAF advisors was looking for a build of 93 Bcf. A Reuters poll of 25 traders and analysts showed an average 93 Bcf with a range of a 85-104 Bcf injection. The 89 Bcf build came in well below the 112 Bcf that was injected for the week one year ago.

“It looks like the market doesn’t have much incentive to the upside,” a New York floor trader told NGI. “I think there are a lot of cautious bulls in here and as long as the market holds $2.81, those bulls will remain in the market.’

Tim Evans of Citi Futures Perspective sees the report imparting a bullish tone to the market going forward. “The 89 Bcf in net injections for last week was less than the consensus expectation and only marginally above the 86 Bcf five-year average for the week ended June 12. This implies a somewhat larger jump in summer air-conditioning demand than the week-to-week change in temperatures suggested. This tightening of the background supply/demand balance suggests smaller injections going forward as well.”

Inventories now stand at 2,433 Bcf and are 730 Bcf greater than last year and 46 Bcf greater than the five-year average. In the East Region 59 Bcf was injected, and the West Region saw inventories increase by 8 Bcf. Stocks in the Producing Region grew by 22 Bcf.

The Producing Region salt cavern storage figure was up by 4 Bcf to 295 Bcf, while the non-salt cavern figure increased 18 Bcf to 708 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |