Gas Demand Growth Projected For Southern Idaho

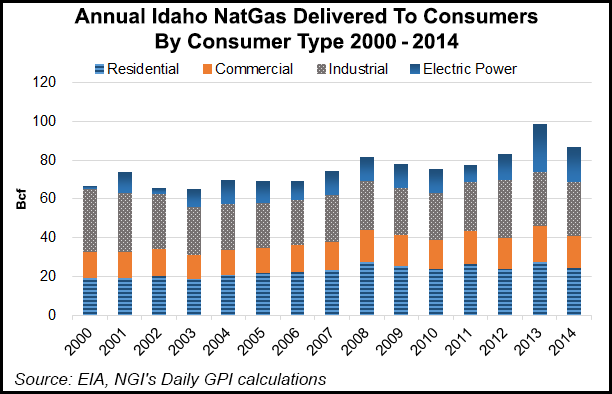

MDU Resources Group’s Intermountain Gas Co. on Thursday received approval from Idaho regulators for its updated five-year integrated resource plan (IRP), which anticipates increased demand among its residential, commercial and industrial customers spread across the southern half of the state.

Intermountain foresees slightly higher growth rates in demand than the overall Pacific Northwest regional forecast.

The 2015 IRP update is a switch from two years ago when Intermountain was planning for slow growth in its service area (see Daily GPI, July 23, 2013).

The latest projections from the Northwest Gas Association (NWGA), which includes Oregon, Washington and British Columbia, along with Idaho, estimates an annual growth rate in gas demand at 1.2% over its 10-year outlook, while Intermountain’s IRP is projecting a 2.32% annual growth rate in its service territory over the next five years.

In its 10-year outlook, NWGA said the Pacific Northwest now is “ideally positioned between two prolific natural gas producing areas [western Canada and the U.S. Rockies],” so it continues to “benefit from this abundant gas supply.” As a result, various manufacturers and other large energy users are considering locating or expanding in the region, according to the gas association report.

The report concluded that the U.S. and Canada are likely “to develop and deliver economically priced natural gas for years to come,” although prices “will likely continue to be vulnerable to volatility and spikes during periods of high demand (as seen in the winter of 2013-2014), but they are not expected to return to the sustained high price-environment of a few years ago.

“Even in the context of today’s low oil price environment, natural gas remains the best energy value by a factor of three.”

Intermountain Gas “does not anticipate any peak-day delivery deficits in the regions it serves over the next five years,” the Idaho Public Utilities Commission (PUC) said. The plan recognizes that in some areas, such as around Rexburg, ID, some customers may be at times required to use a portable liquefied natural gas (LNG) storage facility to meet peak day demands.

Similarly, some of Intermountain’s largest industrial customers have dual-fuel capability (diesel, fuel oil, coal, wood chips and propane) to cover peak use periods. The PUC encouraged the MDU utility to include “the costs of gas storage and distribution enhancements in its calculations to determine whether efficiency programs would be more cost effective.”

The region’s new-found bullishness is reflected in Intermountain’s updated IRP, which just two years ago reported being in the midst of an economic downturn in the region. But even then, the gas utility reported substantial gas resources and key pipeline infrastructure upgrades that put it in a position to handle the growth that now appears to be coming.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |