Three-Day Natural Gas Price Rally Ends on Profit-Taking

After a three-day string of price gains in both the natural gas physical and futures markets, bullish traders appeared to take a rest on Thursday as both markets made minor retreats on the day.

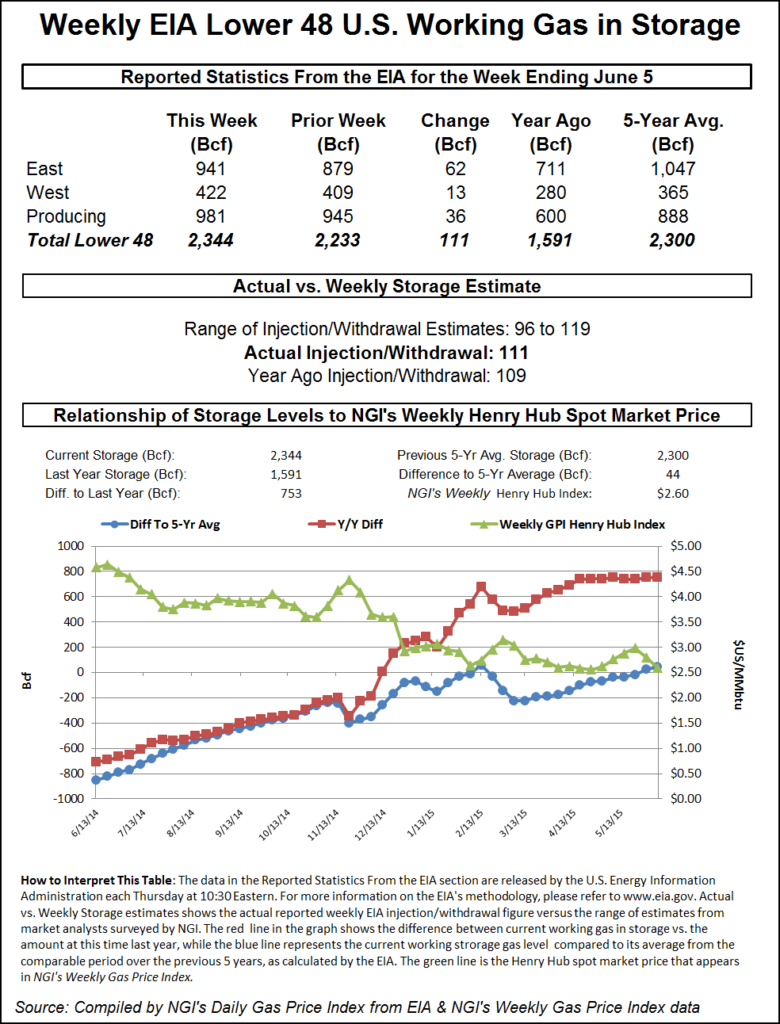

One non-factor on the fundamentals side was the Thursday morning storage report, which for the first time in a couple of weeks actually came in close to most industry expectations. The Energy Information Administration reported that 111 Bcf was injected into underground stores for the week ending June 5.

Over the three previous days of trading, NGI‘s National Spot Gas Average jumped 50 cents to $2.69 on Wednesday for gas to be delivered Thursday, while the July natural gas futures contract jumped 30.1 cents to $2.891 over the same timeframe. Trading on Thursday put an end to both streaks as the National Spot Gas Average slipped 5 cents to $2.64 and the July futures contract held a tight range in lackluster trading before finishing the regular session at $2.825, down 6.6 cents.

In the physical market, losses were widespread, with a little more than a handful of scattered points nationally in the black. Down in the Gulf region, the Henry Hub stayed within a nickel of the front-month futures contract, with gas for delivery Friday at that benchmark point averaging $2.87, down 5 cents on the day.

Most losses across the country were similar, with points declining from a couple of pennies to about a dime.

In the Northeast, the unusual trend of the typically premium-priced Algonquin Citygate trading at a discount to Transco Zone 6 NY was exacerbated on Thursday. Algonquin came in Thursday at 2.22, down 91 cents from Wednesday, while Transco Zone 6 NY averaged $2.95, down 6 cents. The anomaly, which has been happening almost daily since the end of April, has been chalked up, in part, to seemingly low demand and various pipeline issues in the Northeast (see related story).

Looking at the short- to medium-term weather picture, analysts at NatGasWeather.com said Thursday that the next period of focus will be on what happens to a strong ridge of pressure during the last week of June as the next series of weather systems tracking across southern Canada arrives. “If it cedes ground, cooler air will again be allowed to spill into the northern U.S. (bearish), while if it holds, a very warm southern and eastern U.S. pattern will result (bullish),” NatGasWeather.com said. “It will be important to see how the weather data trends for the last week of June to see where weather sentiment goes next.

“We do feel stronger short-term demand this week provided some support to the natural gas markets, but still overall, it would need to get a bit hotter and without timely Canadian weather systems spilling across the border for this to continue.”

Commenting on Thursday’s pullback in futures after a three-day rally streak, Santiago Diaz, a broker with FCStone Latin America LLC, said he believes traders saw the opportunity to realize some gains. “I don’t know if we are done to the upside here,” he told NGI. “Power generation demand for gas is expected to ramp up a little bit because some warmer weather is expected in high-consuming regions of the United States, so that is firmly in the bullish column. On the other side, we’ve got bearish fundamentals such as excess gas supply. Right now it is a matter of fast money coming in and out. Traders are taking advantage of various cues and moving quickly.”

After a couple of weeks of storage report estimate misfires from natural gas analysts and traders, they finally got one right Thursday morning as news of a 111 Bcf injection into inventories for the week ending June 5 was nearly spot on with the industry consensus ahead of the report.

With no real surprise for the first time in a number of Thursdays, natural gas futures traders yawned. The July contract, which was hovering around $2.880 just ahead of the 10:30 a.m. EDT report, stayed right in the same vicinity in the minutes that followed. Just 10 minutes following the report, the prompt-month contract was trading at $2.860, down 3.1 cents from Wednesday’s regular session finish.

This week analysts at Ritterbusch and Associates calculated a 109 Bcf injection, and IAF Advisors expected a 114 Bcf build. A Reuters survey of 25 industry cognoscenti showed an average 112 Bcf with a range of 96 Bcf to 119 Bcf. Last year 109 Bcf was injected and the five-year average is for a 89 Bcf increase.

The actual 111 Bcf build was also a steep departure in size from the previous week’s 132 Bcf injection.

While the build was basically on target with most estimates, some industry experts were looking at the larger storage picture for direction. Citi Futures’ Tim Evans, who was on the record with a 115 Bcf build estimate, called the actual number “supportive,” noting that it was a bit smaller than some were expecting. “The 111 Bcf in net injections was less than the median estimate and confirmed a drop from the prior 132 Bcf surge, a constructive development,” he said. “This may also ease fears regarding the current background supply-demand balance to some degree.”

As of last Friday, stocks are 753 Bcf higher than last year at this time and 44 Bcf above the five-year average of 2,300 Bcf. For the week, the East Region injected 62 Bcf, while the Producing and West regions chipped in 36 Bcf and 13 Bcf, respectively.

NatGasWeather.com called Thursday’s storage report a nonevent but said “moderate to locally strong demand for cooling” will “cut into future weekly builds and keep them under 100 Bcf going forward, likely starting next week after heat and humidity from this week are accounted for.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |