Hess, Global Infrastructure Creating Bakken Midstream Venture

Hess Corp., one of the biggest operators in the Williston Basin, is launching a Bakken Shale midstream venture that is designed to take advantage of growing natural gas and oil infrastructure needs in the basin and beyond.

Under an agreement announced Thursday, Hess is selling Global Infrastructure Partners (GIP) a half-stake in its Bakken midstream assets for $2.68 billion to form a joint venture (JV) that initially would include 3,000 miles of pipelines and a combination of gas processing/compressor plants, rail/truck crude oil terminals and propane storage.

The partnership would give a liquidity boost to the bottom line for Hess, allowing it to reduce its capital expenditures, CEO John Hess said during a conference call. Longer term, the JV is a bet on continued gas and oil infrastructure growth, not only in the Williston Basin but across the country.

“The joint venture with its strategically located assets will be one of the largest midstream operators in the Bakken,” Hess said. “By capitalizing on the financial strength and midstream energy experience of Global Infrastructure Partners, the joint venture will be in a strong position to fund future energy infrastructure investments and continue to grow its midstream business.”

Newly created Hess Infrastructure Partners would own:

As well, the JV would include multiple fee-based contracts that offer adjusted tariffs for the first 10 years based on volume and capital, with fixed tariffs in the second 10 years. There also are three-year rolling commitments based on development plans.

A large scale expansion and upgrade of the Tioga gas plant was completed in 2014, and it likely is going to be expanded again, as are the gas gathering systems, COO Greg Hill told analysts. The Tioga plant now is the “single largest cryogenic plant” in North Dakota and it’s the only plant in the state capable of extracting ethane, which is sold under a long-term contract with Nova Chemicals Corp. in Canada.

For the Tioga gas plant, Hess is “evaluating a debottlenecking project to further upgrade the plant’s inlet capacity from 250 MMcf/d to 300 MMcf/d,” he added. Also to be expanded is the total throughput of the three gathering systems to more than 300 MMcf/d of gas and 200,000 b/d of liquids. Because of the midstream assets’ “strategic location in the heart of the field, we also anticipate capturing additional third-party volumes…

“Importantly, all of the three areas of infrastructure that I described will continue to be operated by the same Hess people that have enabled their successful operation to date.” Hess would operate the JV assets as a contract service provider. Employees who work in the assets today would remain Hess employees.

The New York City-based independent last year announced plans to launch a separate midstream business through a public offering (see Shale Daily,Sept. 24, 2014). Launching the midstream business as a separate business still is the plan, CFO John Reilly told analysts. Taking on more assets down the line also is a goal, “but we won’t do that unless it meets the investment threshold.”

With the midstream transaction, a big plus for Hess is going to be its ability to reduce 2015 capital expenditures (capex) because GIP would help fund the midstream business. Pro forma capex would be $4.1 billion, with an annualized run-rate based on the second half of 2015 of around $3.5 billion. Net debt-to-capital once the deal closes is estimated at around 10%.

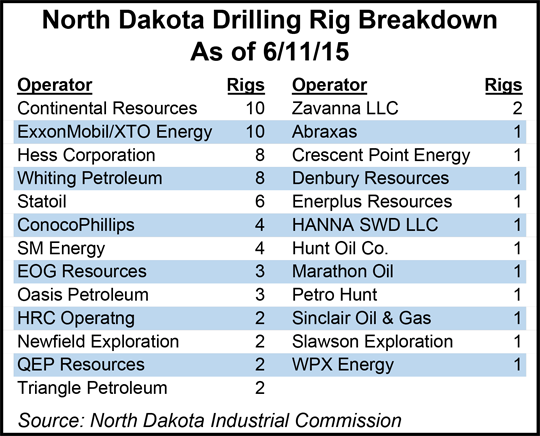

Even with less spending on midstream, don’t expect to see capital spending increase in the upstream business, Hill said. The plan remains to keep eight rigs running through this year in the Bakken, down from an average of 17 in 2014. The company is going to keep an eye on oil prices, but even if they were to increase, he said there may be staffing issues to ramp up production in the Bakken — or anywhere for that matter — because so many people across the industry have been laid off.

“Priority one, two and three” is to keep the balance sheet strong, Hess added. Acquisitions always are a possibility, but not likely in the current environment.

GIP, an independent infrastructure fund manager, is an old hand at investing in energy ventures, among other things. After helping Chesapeake Energy Corp. create its midstream unit, GIP acquired the profitable business, then sold half of it to Williams a few months later (see Shale Daily, Dec. 13, 2012; June 11, 2012). GIP then changed the name of the business to Access Midstream Partners LP, which also was sold to Williams (see Shale Daily, June 16, 2014). GIP also holds stakes in Freeport LNG Development LP (see Daily GPI, July 14, 2014). In addition, GIP investments include East India Petroleum Ltd., Terra-Gen Power Holdings and Switzerland’s Transitgas.

Once the JV transaction closes, which is expected early in the third quarter, the new company would incur $600 million of debt with proceeds distributed equally, resulting in after-tax cash of $3 billion net to Hess. The JV also would have independent access to capital, including a fully committed $400 million five-year senior revolving credit facility.

Once Hess Infrastructure Partners is up and operating, Hess would report the Bakken-related midstream operations as a separate segment. In 1Q2015, net income from the midstream segment was $27 million. Through 1Q2016, Hess expects the midstream segment to earn $290-300 million, before interest, tax, depreciation and amortization.

The board of directors for Hess Infrastructure Partners would be comprised of six directors, three members elected by Hess and three by GIP. Hess, through its elected directors, would retain control of the midstream operations and annual budgeting process. Other decisions, such as capital structure, debt/equity offerings and new contracts would require joint approval by the JV partners.

The transaction is similar to one created by Devon Energy Corp. in late 2013. Devon used most of its onshore midstream properties to form EnLink Midstream with Crosstex Energy Inc., which has proven to be a profitable venture (see Shale Daily, May 6; Oct. 21, 2013).

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |