Firm Physical Natgas Outpaces Futures Gains

Physical natural gas values for Thursday delivery and the near-month futures contract continued to charge forward and post gains in Wednesday’s trading on a burst of summer heat. Hefty increases in next-day peak power made purchases for power generation attractive, and only a handful of points fell into the loss column.

Most losing points were in the East, and the overall market rose 7 cents to $2.69. Futures trudged higher, but traders are skeptical of any significant change in the trading landscape.

At the close July had risen 4.5 cents to $2.891 and August was up 4.3 cents to $2.921. July crude oil continued its run higher adding $1.29 to $61.43/bbl.

Expected high temperatures in New England, along with stout next-day peak power prices, helped lift some Northeast prices. Wunderground.com forecast that Boston’s high of 83 Wednesday would jump to 88 Thursday before settling back to 86 on Friday. The seasonal high in Boston is 74. Hartford, CT on the other hand was expected to see its Wednesday high of 78 vault to 91 Thursday and ease to 89 Friday. The normal high in mid-June is 76.

Gas at the Algonquin Citygates rose 57 cents to $3.13, and deliveries to Tennessee Zone 6 200 L jumped 52 cents to $3.12. Gas at Iroquois Waddington rose 14 cents to $3.11.

In the Mid-Atlantic and Marcellus, gains were not quite as pronounced. Gas bound for New York City on Transco Zone 6 rose 2 cents to $3.01 and packages on Tetco M-3 were quoted down a penny at $1.60.

Deliveries to Millennium added 9 cents to $1.44, but deliveries to Transco Leidy came in 8 cents lower at $1.27. Gas on Tennessee Zone 4 Marcellus rose 3 cents to $1.26, yet packages on Dominion South shed 4 cents to $1.49.

Intercontinental Exchange reported that on-peak Thursday power at the ISO New England’s Massachusetts Hub rose $8.61 to $42.45/MWh. Peak power Thursday at the PJM West Hub was quoted at $58.12, up $15.70/MWh.

In spite of low shoulder season demand, Northern Natural Gas reported a force majeure in its Seminole Subsystem in West Texas (see related story). Flow for Thursday and Friday (June 11 and 12) has been dropped to zero from operational capacity of 287,000 MMcf/d.

“Flows out of Kansas will probably be good, but southern New Mexico and the Panhandle of Texas are likely having some issues so they won’t be able to flow quite as much,” said a Houston pipeline veteran. “It may also be just regionalized to the Seminole System.”

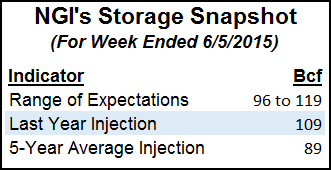

Thursday’s Energy Information Administration (EIA) storage report for the week ending June 5 will be watched for signs of any letup in the trend of storage estimate misfires. Last week’s 132 Bcf injection report confounded analysts, who had been expecting an increase as much as 10 Bcf less.

This week analysts at Ritterbusch and Associates calculate a 109 Bcf injection, and IAF Advisors expects a 114 Bcf build. A Reuters survey of 25 industry cognoscenti showed an average 112 Bcf with a range of 96 Bcf to 119 Bcf. Last year 109 Bcf was injected and the five-year average is for a 89 Bcf increase.

Futures traders were skeptical of the gains posted over the last three days.

“The market has been feeding on itself,” said a New York floor trader. “I think if we get a 115 Bcf-120 Bcf build the market pulls back a little bit, and we test $2.75 again. All you have seen the last three days is short covering and shorts are getting squeezed out. If it comes out 105 Bcf to 110 Bcf, I think we will run up.”

Consensus thinking is that upcoming heat will lessen storage builds going forward, but if analyst projections are correct, upcoming injections will not be as great as last year, but well ahead of the five-year pace.

“Expectations that increased summer heating demand will mean smaller storage injections in the weeks ahead continued to help support the price recovery, along with a specific weather forecast that has trended warmer since last week,” said analyst Tim Evans of Citi Futures Perspective.

Evans’ figures show the range of injections for the next four weeks between 90 Bcf and 115 Bcf. The five-year average ranges from 74 Bcf to 89 Bcf. By June 26, Evans has the year-on-five-year surplus currently at 22 Bcf up to 87 Bcf. For Thursday’s inventory report he expects a 115 Bcf increase.

“This still shows the market becoming better supplied on a seasonally adjusted basis, but at least represents less of a headwind than the prior scenario,” he said. He recommended standing aside the market pending identification of a low-risk entry.

Weather forecasts Tuesday night were calling for a duel between cooler Canadian air and resilient heat in the Southeast. Natgasweather.com in its Wednesday morning report said, “We now view longer-term weather patterns as trending slightly warmer as well. This is besides when Canadian weather systems track into the northern U.S. with showers, thunderstorms and slight cooling.

“But what’s different with the coming pattern compared to previous months is high pressure over the southern and eastern U.S. will hold strong and should be difficult to budge by approaching Canadian weather systems. Therefore, we still expect the South, Southeast and up through the Mid-Atlantic Coast to remain very warm, likely into the start of the last week of June.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |