U.S. Onshore Output Dipping, But Drilling Productivity Improving, Says EIA

Daily natural gas and oil production from the big U.S. unconventional plays is declining, but as better technology and more efficiencies are put into place, new wells are seeing stronger output, the Energy Information Administration (EIA) said.

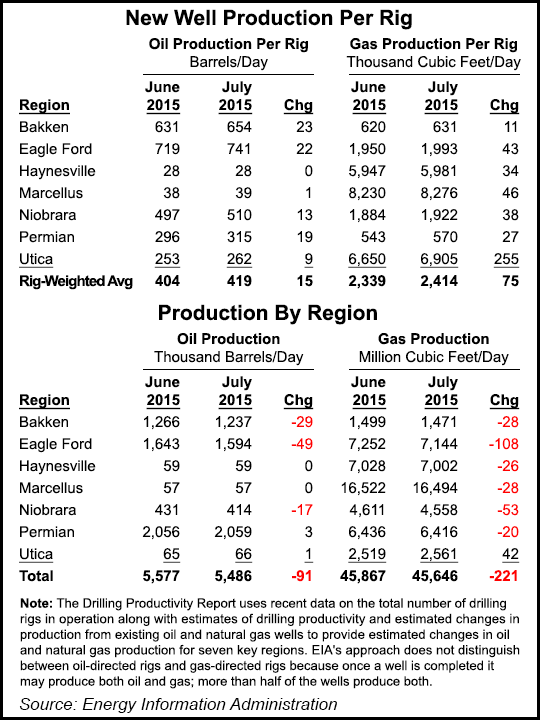

In their Drilling Productivity Report (DPR) released on Monday, EIA researchers said oil production from six of seven largest unconventional formations should slip by 91,000 b/d, about 2% of an estimated 5.49 million bbl expected in July versus 5.58 million bbl in June.

Only the Utica Shale is expected to see a bump in gas and oil production month/month, EIA said. A bump of about 1,000 b/d in oil production from June is expected to lift July output to 66,000 b/d, while gas production should improve by 42 MMcf/d to 2,561 MMcf/d.

The Permian Basin is seen as the only region with a bigger gain in oil output month/month, up by 3,000 b/d to 2,056 b/d. However, the basin’s gas production is forecast to fall by 20 MMcf/d to 6,416 MMcf/d.

Except for Utica, natural gas output is seen declining month/month in the other six plays, down overall by around 221 MMcf/d, or 0.5%, to 45,646 MMcf/d.

The monthly DPR covers U.S. output from regions that between 2011 and 2013 accounted for all gas production growth and 95% of oil production growth: the Permian, Niobrara formation and four shales: Eagle Ford, Haynesville, Marcellus and Utica.

EIA uses recent data on the total number of drilling rigs in operation, combined with estimates of drilling productivity and estimated changes in production from existing wells.

The biggest loser from June to July is seen in the Eagle Ford, where oil output is expected to fall by 49,000 b/d to 1,594 b/d. Gas output in the South Texas play is seen declining by 108 MMcf/d to 7,144 MMcf/d.

The Bakken is expected to see a 29,000 b/d decline in oil output to 1,237 b/d, with gas production down by 28 MMcf/d to 1,471 MMcf/d. Haynesville oil output is expected to be flat at 59,000 b/d, with gas production off by 26 MMcf/d to 7,002 MMcf/d.

In the Marcellus, oil production is forecast to be flat month/month at 57,000 b/d, while gas production should decline by 28 MMcf/d to 16,494 MMcf/d, EIA said.

Niobrara oil output is seen off by 17 b/d, while gas production may fall by 53 MMcf/d.

The declines were expected in the older wells. For new wells, however, that’s a different story. Fewer drilling days, multi-well pads, and most important, improving technology, have scotched forecasts that production would drop sharply following the plunge in commodity prices.

What is clear in the latest DPR is how better efficiencies are improving output from new wells. The report’s new well production/per rig uses several months of recent historical data on total production for each field divided by the region’s monthly rig count, lagged by two months.

EIA is seeing nothing but a surge from almost all of the new wells drilled, based on production estimates from June to July. In part, it’s expected on a forecasted gain in gas rigs, up 75 in July to 2,414, and on 15 more oil rigs, to 419 in July from 404 in June.

In the Bakken, new gas wells are expected to produce 11 Mcf/d more to hit 631 Mcf/d between June and July, while new oil well output is seen rising 23 b/d to 654 b/d.

New Eagle Ford gas wells should average 43 Mcf/d more to 1,993 Mcf/d, while new oil wells are expected to produce an additional 22 b/d to 741 b/d.

In the Haynesville, new gas wells are expected to see output improve by 34 Mcf/d to average 5,981 Mcf/d, with oil output flat at 28 b/d.

New Marcellus wells also are getting better, EIA data indicated.

Gas production from new wells in the Appalachian play is seen up by 46 Mcf/d from June to July to 8,276 Mcf/d, while oil production is expected to increase by 1 b/d to 39 b/d.

In the Niobrara, new gas well output should move the needle month/month by 38 Mcf/d to hit 1,922 Mcf/d, with oil production from about 13 b/d higher to 510 b/d.

Better efficiencies also are improving in the Permian, where new gas well output month/month should increase by 27 Mcf/d to 570 Mcf/d. New oil well production is expected to improve by 19 b/d to 315 b/d.

The Utica, with its still positive output, also is showing stronger production from new wells, with gas wells expected to improve by 255 Mcf/d to 6,905 Mcf/d, while oil wells are seen about 9 b/d higher to 262 b/d.

The EIA, which had issued a series of deflating natural gas price forecasts over the past number of months, also said Tuesday that it expects Henry Hub prices to average $2.97/MMBtu this year, a 4-cent increase from the agency’s previous month forecast (see related story).

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |