Feds Say Oil/Gas Downturn Surprised Investors, Dented Manufacturing Sector

The breadth of the downturn in the oil and gas industry took investors by surprise and negatively impacted the manufacturing sector in more than half of the country, especially in states that are dependent on the energy sector or are big energy producers themselves, according to a report by the Federal Reserve Board (FRB).

In the latest issue of its Beige Book, the FRB said manufacturers were affected in seven of its 12 districts: Boston, Chicago, Cleveland, Dallas, Kansas City, Minneapolis and Philadelphia. The board added that manufacturing production saw the sharpest decline in energy-producing states such as New Mexico and Oklahoma, which are both in the Kansas City district.

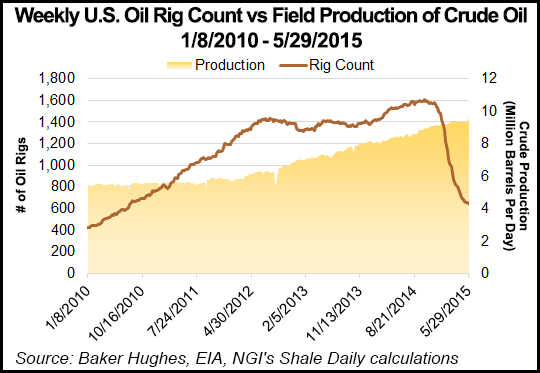

“The slowdown in the [Kansas City] District’s energy sector persisted and expectations remained cautious,” the FRB said. “The number of active oil drilling rigs declined moderately since the last survey period, and layoffs continued at regional oil and gas firms. Drilling activity was concentrated in more productive areas and in locations where drilling rights needed to be retained.

“Crude oil inventories at the key Cushing, OK, storage hub finally began to edge down in May as oil production slowed slightly in some key producing areas. Oil prices rebounded somewhat in April and May, but most contacts expected prices to remain volatile for the remainder of the year. Several respondents said that if a further rebound in oil prices occurs and holds, drilling could ramp back up later this year, as technology and other efficiency gains within the industry have led to somewhat lower breakeven prices. Natural gas prices increased somewhat in mid-May as demand for electrical generation grew.”

The Kansas City District includes Colorado, Kansas, Nebraska, Oklahoma, Wyoming, western Missouri and northern New Mexico, and includes the Niobrara and Woodford shales, as well as the Denver-Julesburg, Piceance and San Juan basins.

In the neighboring Dallas District — which includes Texas, southern New Mexico and northern Louisiana, thereby comprising the bulk of the Barnett, Eagle Ford and Haynesville-Bossier shales and the Permian Basin — the FRB said the “price of West Texas Intermediate (WTI) crude oil and natural gas rose over the reporting period, but firms remained pessimistic in their outlook for 2015.” The board noted the complexity of labor issues in the district, as “two energy firms said that after cutting new hires, contractors and some employees, they were now using retirements to reduce staff,” but added that “a few firms reported reduced wage pressure and said it was easier to find workers due to layoffs in the oil fields.”

Also in the Dallas District, the FRB said “oilfield machinery sales remained weak and were significantly below year-earlier levels. One contact noted that oil and gas equipment manufacturers were actively seeking work from aerospace and other industries.

“Demand in oil-producing areas of South Texas and the Permian Basin slowed notably…the rig count and demand for oilfield services fell in the [Dallas District], with losses concentrated in the Permian Basin. Outlooks remain negative, with most firms expecting a 30-40% drop in capital expenditures this year and further cuts in 2016. One silver lining is that contacts said industry costs continued to decline, with firms reporting 20-30% percent reductions in drilling and completion costs since the beginning of 2015.”

In the Cleveland District — an area that includes Ohio, western Pennsylvania and eastern Kentucky, and therefore large portions of the Marcellus and Utica shales — the FRB said the number of drilling rigs operating in the Marcellus and Utica “leveled out in April, after declining about 25% since late last year. Natural gas production remains at a high level, but the pace of growth is declining.

“We heard reports about a potential drop in wellhead prices as a result of storage levels above what is typical for this time of year. Otherwise, wellhead prices are holding within a narrow range. After adjusting capital budgets downward earlier in the year, spending is on plan, with monies being allocated mainly for maintenance projects and equipment. Reports indicate a more broad-based decline in prices for materials and equipment over the period.”

The Minneapolis District saw a plant that produces industrial gas-processing equipment shut down, citing reduced demand. The drilling rig count fell further since the last report.

“In a survey of [Minneapolis] District energy services firms conducted in March, 75% of respondents reported that revenues decreased compared with a year earlier, and half reported that capital expenditures decreased,” the FRB said. “Output at mines producing sand for hydraulic fracturing (fracking) was expected to decline this year; one facility was idled in Wisconsin.”

In the Philadelphia District — eastern Pennsylvania, southern New Jersey and Delaware — the FRB said “businesses involved in natural gas and pipeline work noted negative impacts from decreased drilling activity and lowered capital expenditures.” Meanwhile, the board said its contacts in the Boston District, which includes most of New England, had reported that “the slowdown in oil and gas investment has been much bigger and faster than anticipated.”

The Atlanta District — Alabama, Florida, Georgia, southern Louisiana, southern Mississippi and eastern Tennessee — also saw reduced drilling activity, thanks to low global oil prices. That in turn was “leading to decreased business activity and a pickup in layoffs,” according to the FRB. “Contacts continued to cite delays in investment of industrial refining and onshore drilling projects, specifically ones that had not already begun.”

Natural gas production was unchanged in the Richmond District since publication of the FRB’s last Beige Book. Meanwhile, middle market loan demand — especially in the oil and gas industry — was weaker in the Chicago District, while drilling fell in the San Francisco District as well, thanks to low oil prices.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |