No Runs and No Hits In Weekly Natural Gas Trading; All Points Show Losses

By the time weekly trading ended on Friday, every natural gas bull had left town. Not a single physical market point posted a gain for the week ended June 5, and the NGI Weekly National Spot Gas Average finished down a hefty 27 cents to $2.27.

Individual point losses on the week ranged from as much as $1.00 seen on Tennessee Zone 6 200 L in the Northeast to as little as 12 cents at the Perryville Hub in North Louisiana. Regionally there wasn’t a great deal of variation as most losses were in the vicinity of 20 cents with the exception of the Northeast, where the regional loss was a stunning 51 cents to average $1.59. California managed to scoot to the top of the leader board with a relatively modest decline of 16 cents to average $2.59.

Both the Midcontinent and Rocky Mountains sustained losses of 18 cents to $2.40 and $2.29, respectively, and South Louisiana was off 19 cents to $2.55.

East Texas, South Texas, and the Midwest saw prices slide 20, 21, and 22 cents to $2.53, $2.50, and $2.60, respectively.

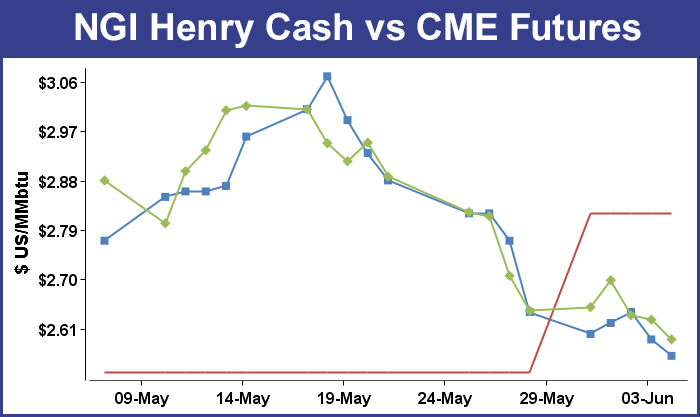

July futures for the week skidded 5.2 cents to $2.590, and the weekly release of storage data by the Energy Information Administration (EIA) had something of a curious twist to it. The EIA reported a much bigger than expected 132 Bcf injection. Prices promptly tumbled but recovered quickly giving the futures a small loss on the day. At the close on Thursday the July contract was down just eight tenths of a cent to $2.626 and August fell by nine-tenths of a cent to $2.654.

Traders saw the day’s action in the futures market as reflective of previous sellers seeking to take advantage of an opportunity to buy back their positions and book gains. “Previous shorts in the market used the number to cover, and subsequent sellers thinking the market would fall further had to buy back their positions when they realized the impact of the number wasn’t forcing prices lower as they expected,” said a Florida trader.

“Some gas is locked away where there is no infrastructure whatsoever, but we still have summer coming in and bringing its demand for electrical generation along with the shut-down of coal plants. All these factors are a little bit supportive.”

Prices rebounded quickly once the number hit trading screens. July futures fell to a low of $2.556 but by 10:45 EDT July was trading at $2.618, down just 1.6 cents from Wednesday’s settlement.

Prior to the release of the data analysts were looking for an increase closer to the 125 Bcf range. ICAP Energy had calculated a 126 Bcf increase, and industry consultant Bentek Energy was looking for a build of 125 Bcf. A Reuters poll of 25 traders and analysts showed an average 121 Bcf with a range of a 101 Bcf to a 130 Bcf injection.

“I was hearing a 121 number and one guy showed me a 129 Bcf figure, but I don’t think anyone was thinking this big,” a New York floor trader told NGI.

“Immediately we got down to $2.556, but it bounced back 2 1/2 cents immediately. If you blinked you would have missed it. $2.50 is going to be a big number here.”

Tim Evans of Citi Futures Perspective noted that “This was the second consecutive bearish weekly surprise, which tends to reinforce the idea that the background supply/demand balance has weakened from where it was just a few weeks ago. This has bearish implications for the data to follow, although it’s worth noting that today’s warmer temperature forecast will blunt some of that impact.”

Estimating storage during a holiday week such as Memorial Day has always presented analysts with a challenge inasmuch as it is often difficult to ascertain the balance between demand and gas bound for storage. Industry consultant Bentek Energy noted just such a dilemma and admitted that there was upside risk to their estimate of 125 Bcf. Bentek said the last five years have exhibited this trend, with the actual EIA figure surpassing Bentek’s estimate. Indeed. Make that six.

Inventories now stand at 2,211 Bcf and are 751 Bcf greater than last year and 22 Bcf greater than the 5-year average. In the East Region 73 Bcf were injected and the West Region saw inventories increase by 14 Bcf. Stocks in the Producing Region grew by 45 Bcf.

Futures were confined to a narrow range Friday, and although talk circulates of sharply lower prices, traders are not yet convinced those are in the cards at least in the short run. At the close July was down 3.6 cents to $2.590 and August had declined 3.3 cents to $2.621.

For the most part, traders aren’t willing to commit to a scenario of significantly lower prices, at least not anytime soon. “A lot of guys I talk to, but don’t believe, say we are looking at a $1 handle,” said a New York floor trader. “That’s what guys are saying, but I don’t think you are going to see that; $2.50 seems to be holding well here. If you trade under $2.50 and hold that for a few days, then you might see some new selling coming in. It’s not just a one-day deal. Traders will have to be convinced we’re under $2.50 for the duration.”

Others have a short-term bias higher, fueled by weather and coal plant retirements. “[Friday’s production] level is estimated down by 0.3 Bcf/d to 71.6 Bcf/d, again subdued as maintenance continues to curtail flows,” said Natgasweather.com’s Andrea Paltrinieri. “With Leidy pipeline maintenance finishing on June 19, we will able to add 1 Bcf/d to today’s production. Power burns continue to be relatively weak, but next week they are seen up as temperatures pick up coming back from the warm weekend.

“From the start of June, nearly 4.4GW of coal generation capacity will retire, but the impact on natty prices is difficult to evaluate. Going into the weekend and next week, weather forecasts need close watching to evaluate the potential for above-normal temperatures over the U.S. from the second half of June onward.”

Analysts are united in their bearish stance with what they see as a structural shift taking place. “Although the market appeared to have some difficulty digesting [Thursday’s] EIA [Energy Information Administration] report, we viewed the 132 Bcf injection as unequivocally bearish as it exceeded even our large expected build by 7 Bcf,” said Jim Ritterbusch of Ritterbusch and Associates in closing comments to clients Thursday.

“Given a string of larger than anticipated builds, some structural shifts appear to be taking place that are reinforcing our expectations for additional declines to the $2.50 area. But as we noted this morning, we expect support through [Friday’s] trade above the $2.54 mark and some additional possible consolidation early next week before another EIA release spurs more selling. On the upside, the market will have difficulty advancing much above the $2.70 level given the newly acquired surplus against the averages and the fact that today’s build was the second largest of all time.”

Others see not only ending storage north of 4 Tcf but also expect the oversupplied market to stick around for a while. “The 636 Bcf year-on-year storage surplus at winter exit has now expanded to 750 Bcf,” said Breanne Dougherty, an analyst with Societe Generale in New York. “With 149 days remaining before the ever-important end-of-October signpost, and a base case trajectory towards 4.1 Tcf, we see a need for some sustained ledger tightening ahead in order to avoid potential containment-type pricing behavior at the denouement of the season.

“Bottom line is that the supply side of the ledger has seen more sustained growth than the demand side over the last year. This is what leaves the market in a state of structural oversupply for, in our opinion, at least two more seasons.”

In Friday’s trading physical natural gas for weekend and Monday delivery worked lower as weather systems were confined mainly to load-killing rain and thunderstorms over much of the country and traders were reluctant to commit to three-day deals. Overall the market fell 5 cents to $2.19.

In the Rockies and West Coast, physical market prices slumped Friday, but one area of strong demand proved to be the Pacific Northwest. “Some heat is moving in and that along with the low hydro is starting to impact the market,” said an analyst with Energy GPS, a Portland, OR-based energy consulting firm. “On the gas side, I would expect to see higher power burns.”

The anticipated heat for the moment is yet to be seen. Weekend and Monday gas at Malin fell 9 cents to $2.31, and deliveries to PG&E Citygate shed 3 cents to $2.91. At the SoCal Border gas was quoted at $2.36, down 13 cents, and gas at the SoCal Citygate shed a stout 14 cents to $2.50. Gas on El Paso S Mainline was seen 11 cents lower at $2.38.

More than adequate gas storage is likely to keep upward price pressure subdued. “PG&E [storage] is at 215 Bcf out of a total 250 Bcf capacity, and if you look at imports, total imports including PG&E and SoCal for June are down about 1/2 Bcf/d. You have gone from 5.2 Bcf/d last year down to 4.7 Bcf/d, so it looks like additional gas is not coming into the system and not from the Rockies,” the analyst said.

Genscape is estimating that “current storage inventories as of June 1st across the PG&E system are 76% full…2014 levels stood much lower at 113 Bcf, while the 3-year average stands at 129 Bcf. As expected, storage activity has slowed its pace this year with May injections averaging 540 MMcf/d compared to May of 2014 where injections averaged 975 MMcf/d.”

Other markets also softened. In the Midwest, gas for delivery to Alliance fell a dime to $2.45, and packages at the Chicago Citygate shed 8 cents to $2.46. At Demarcation weekend and Monday packages dropped 7 cents to $2.38, and gas on Consumers was quoted 4 cents lower at $2.64. Gas on Michcon fell 2 cents to $2.64.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |