‘Terrible’ Demand Sends Northeast Forward Natural Gas Prices Tumbling

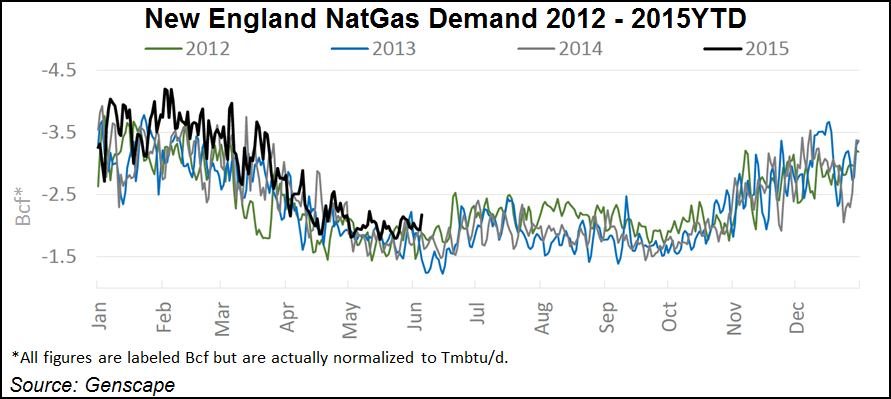

Northeast forward market prices took a nosedive during the first week of June as weather systems in the region sent temperatures and demand tumbling to fall-like levels, leaving market players wondering whether demand will increase as summer gets under way.

Prices fell hardest in New England, where Algonquin Gas Transmission citygates July basis was down 18.2 cents between Monday and Thursday to minus 22 cents/MMBtu, according to NGI’s Forward Look.

Algonquin July fixed prices were down 20.5 cents during that time, reaching $2.406/MMBtu by Friday.

The slide in Algonquin prices comes even as supplies will be somewhat strained for the remainder of the summer.

According to industry analyst Genscape, Algonquin will implement capacity reductions through its Stony Point compressor station through the end of October, lowering capacity to 1,260 MMcf/d from the current 1,350 MMcf/d.

While flows through Stony Point during the past seven days have averaged 1,327 MMcf/d, June through October flows have averaged 1,076 MMcf/d during the past three years, peaking at 1,373 MMcf/d, said Genscape’s Rick Margolin, senior natural gas analyst.

Meanwhile, forward prices further out the Algonquin curve were less volatile, with the balance of summer (August-October) basis falling 12.9 cents to minus 29.7 cents/MMBtu, and the fixed price shedding just 7.7 cents to $2.38/MMBtu.

In New York, Transco zone 6-New York July basis dropped 17 cents between Monday and Thursday to reach minus 67 cents/MMBtu, while the July fixed price slid 19.3 cents to $1.956/MMBtu.

Unlike Algonquin, New York prices continued to post steep losses further out the curve, with the balance of summer basis price easing by some 35.9 cents to minus 83.9 cents/MMBtu and the fixed price tumbling 14.7 cents to $1.84/MMBtu.

The weakness in the Northeast may come as surprise given the retirement of several coal plants in the region this month.

But as Genscape noted, the roughly 8 GW of coal nameplate capacity scheduled to be retired this month had an average utilization rate of only about 21%.

“Were you to replace the actual generation entirely with gas, you’d get about 194 MMcf/d of incremental burn,” Margolin said. “But not all that generation is going to be replaced with gas as there are growing renewables, energy efficiency/load management, and other sources that can pick some of that up.”

Meanwhile, demand in the Northeast is virtually nonexistent as temperatures in the Boston area failed to reach 50 on two days this past week, while New York temperatures were only a few degrees higher.

“There is terrible demand out there,” a Northeast trader said. “Lots of based gas, too, so any base over demand just crushes prices.”

The outlook for the rest of the month isn’t too convincing either.

“The weather data has been struggling on the second half of June pattern, with it flip-flopping between very warm and just warm solutions,” according to NatGasWeather. “The latter being quite bearish if true due to Canadian weather systems bringing timely bouts of showers and cooling, keeping northern U.S. temperatures very comfortable.”

Over in the West, and in the rest of the country, prices moved slightly lower for the week.

At Pacific Gas & Electric citygates, July basis slipped just 1.5 cents between Monday and Thursday to reach plus 39 cents/MMBtu. Fixed prices were 3.8 cents lower, falling to $3.016/MMBtu.

Further out the curve, the balance of summer at PG&E sat Thursday at $3.07/MMBtu, down 3 cents for the week.

The moderate price weakness comes as storage inventories at PG&E remain well above year-ago levels.

“Genscape is estimating that current storage inventories as of June 1 across the PG&E system are 76% full, with working volumes slightly over 182 Bcf,” Margolin said. “2014 levels stood much lower at 113 Bcf, while the three-year average stands at 129 Bcf.”

As expected, storage activity has slowed its pace this year, he said, with May injections averaging 540 MMcf/d compared with May 2014, where injections averaged 975 MMcf/d.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9915 | ISSN © 2577-9877 |