OPEC Maintains Output, But ConocoPhillips CEO Warns U.S. Shale ‘Here to Stay’

Unremarkable commodity prices have done little to dull the ability of U.S. unconventional explorers to extract ever more resources from the ground, but OPEC’s decision to maintain current output levels may put more pressure on domestic production levels in the months ahead.

At its semi-annual meeting in Vienna, OPEC members on Friday voted to keep their collective oil output unchanged at 30 million b/d. Last November the cartel also took no action, despite the global glut and weak prices. The decision, considered a strategy to force the hand of U.S. operators, has dented drilling efforts and begun to reduce production levels.

Wall Street is forecasting crude oil prices to shoot higher in 2016, rising from $55.15/bbl in 2015 to $69.00/bbl in 2016 for West Texas Intermediate, and from $61.69/bbl in 2015 to $75.00/bbl in 2016 for Brent, according to Bloomberg consensus estimates. However, “the key to prices over the next several quarters may very well lie in the hands of U.S. producers,” said NGI‘s Patrick Rau, director of strategy and research.

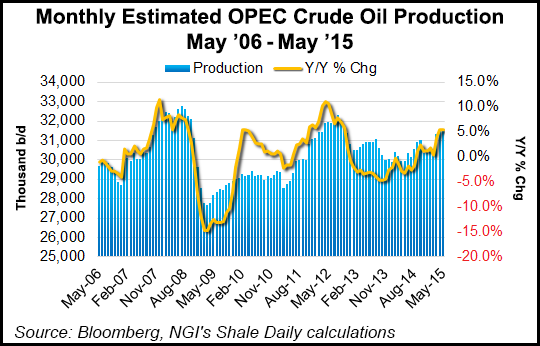

“OPEC continues to hold its production quota at 30 million b/d, but several member countries continue to cheat. Actual OPEC production has been accelerating the last three months on a year-over-year basis, and total production for May was approximately 31.6 million b/d, so OPEC production is creeping ever higher,” he said. “Meanwhile, U.S. oil and gas drilling rig counts are still down, but appear to be stabilizing. Given that OPEC isn’t cutting, if U.S. producers start putting rigs back to work at an accelerated pace, then those consensus Wall Street forecasts for 2016 may prove to be a bit optimistic.”

At an OPEC-sponsored seminar in Vienna ahead of the cartel’s vote, ConocoPhillips CEO Ryan Lance and other global exploration and production chiefs cautioned about any attempt to reduce the impact of the U.S. energy revolution.

“U.S. shale is here to stay,” Lance said. “This business will survive at $100 Brent oil pricing and it will survive at $60 or $70 Brent pricing.” The Houston operator estimates that the tier one areas of the onshore shale plays could generate returns of 10% even if oil prices were to fall to $40/bbl.

Eni SpA CEO Claudio Descalzi, who also was at the seminar, said the “shale industry is like a sprinter, very agile. They run, they win, they stop and rest, and they do it again…Shale is very resilient.”

BP plc Group CEO Bob Dudley told the audience that the shale revolution had created a “different age.” The new climate is going to test “every company’s ability to compete,” whether they are operators or contractors.

“This will be tough, and it will require new thinking, but I believe it will leave the industry leaner and fitter. For example, we have had a habit of seeing every project as a new challenge that needs unique solutions. That has led to some great technology, but in fact there is often a real case for using more solutions off the shelf.”

OPEC’s decision to keep output on track wasn’t a surprise, said Bernstein analyst Bob Brackett. “We believe that collapsing crude prices drove a significant fall in both U.S. and non-U.S./non-OPEC capital spend, which will result in falling supply growth that will balance global oil markets and allow oil prices to rise back toward $85/bbl in 2016.”

Over the next five years, liquids growth potential from non-OPEC countries has been reduced by more than 2 million b/d to 3.3 million b/d, according to research by Rystad Energy. The data shows investments in oil and gas production should drop around 20% this year from 2014. Outside OPEC, $200 billion in annual capital expenditures (capex) may be axed over a two-year period.

“Ultimately, for every $1 billion being cut in development capex on marginal projects, the production shortfall would amount to 10,000 b/d. Only U.S. production has been visibly impacted with the trend turning from 20% annual growth during the first quarter of the year to a flat trend in the second quarter. The shortfall of global offshore production may be steeper if oil prices stay low throughout the year,” the Norwegian-based firm said.

“In the longer run, anything below $90/bbl is not sustainable due to this steep but delayed supply response and increasing global base declines, while the cost of new production will remain high,” said Rystad oil trade analyst Nadia A. Martin.

Could the United States take the mantle from OPEC as the global swing producer? IHS Energy Senior Director Jamie Webster said OPEC “still matters. It is in hibernation for now, and its role has changed, but it remains a potent force should it choose to act. However, we do not see the prospects for that to occur at this time.

“The shift from OPEC to the U.S. as the swing supplier is not a sharp move; this transition is still very much evolving. Geopolitics remain important for the oil market and with Iran, Yemen as well as recent leadership moves in Saudi Arabia, it is crucial to understand how these giants may interact now and in the future.”

The oil industry and the market “are trying to find a new equilibrium after the disruption caused by the arrival of new supplies from shale oil in the United States,” said IHS Energy’s Bhushan Bahree, also a senior director.

The possibility exists for a prolonged period below $100/bbl. “$70 is the new $100,” said IHS analyst Roger Diwan.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |