Weaker Asian Natural Gas Demand to Pressure Some LNG Projects, IEA Says

Lower prices should feed a pick-up in global natural gas demand over the next five years following a marked slowdown in 2013 and 2014, but growth is falling short of previous forecasts, with liquefied natural gas (LNG) projects becoming “soft targets for investment reductions,” the International Energy Agency (IEA) said.

IEA on Thursday issued its 2015 Medium-Term Gas Market Report, which provides a detailed analysis and five-year projections of natural gas demand, supply and trade developments around the world. Global demand now is seen increasing by 2%/year to 2020, slower than the 2.3% projected a year ago (see Daily GPI, June 10, 2014).

However, even with falling prices and budget cuts, “the U.S. gas industry is showing an unparalleled ability to absorb shocks,” researchers said. “U.S. gas production increased robustly last year and has remained on an upward trend thus far in 2015. While companies’ cash flows are falling, producers are responding by quickly pushing the profits’ squeeze downstream.”

U.S. gas prices were higher in 2014, with Henry Hub benchmark futures averaging $4.40/MMBtu, the highest level since 2010.

“The need to stimulate a fundamental rebalancing, after an extremely cold winter, put upward pressure on prices throughout spring and summer. The scale of production response that followed was astonishing,” the report said. “At the end of March 2014, U.S. gas inventories stood a massive 27 bcm (953 Bcf) below levels reached the year before.”

By the end of last October, however, the gap nearly had closed, with cumulative annual production additions totaling 25 bcm (882.8 Bcf) over the period.

“The magnitude of the supply-side response brought about by a small price increase (about 4 cents/MMBtu between April and October) is further evidence of the surprisingly high supply-side elasticity of the U.S. gas industry.”

The United States remains attractive for energy-intensive industries because of the availability of ample and cheap feedstock, according to researchers. However, the sharp fall in oil prices “is chipping away at the economic advantage of its largely gas-based petrochemical sector in relation to naphtha-based industries, more prevalent globally. Similarly, concerns over the scale of natural gas liquids expansion as rig activity falls back sharply could lead to a slowdown of investments, resulting in a deceleration of industrial gas demand growth in the latter part of the forecast period.”

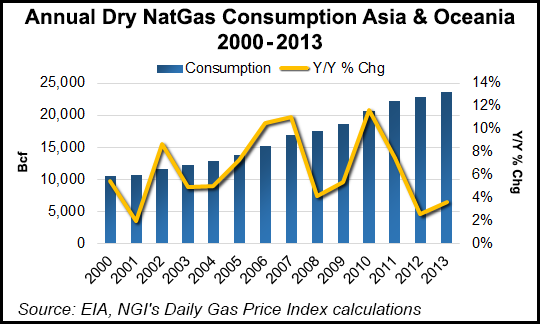

A significant reason for the downward revision in global gas demand is weaker than expected growth in Asia, where persistently high prices had until recently caused consumers to switch to less expensive options, i.e., coal.

“One of the key — and largely unexpected — developments of 2014 was weak Asian demand,” said IEA Executive Director Maria van der Hoeven. “Indeed, the belief that Asia will take whatever quantity of gas at whatever price is no longer a given. The experience of the past two years has opened the gas industry’s eyes to a harsh reality: in a world of very cheap coal and falling costs for renewables, it was difficult for gas to compete.”

Asian gas prices are linked to oil, and as oil prices hovered for several years above $100/bbl, the region’s consumers paid a premium for their gas. However, the plunge in oil prices that began in mid-2014 “has spilled over to natural gas markets in Asia and allowed the Asian premium to narrow substantially.” More distressing for the gas bulls: demand for gas in Asia may not recover as quickly as the drop in prices.

In the short term, gas demand should benefit from plunging prices but the long-term outlook has become more uncertain. A few Asian countries are moving ahead with plans to expand coal-fired power generation instead of gas-fired generation.

“For the fuel to make sustained inroads in the energy mix, confidence in its long-term competitiveness must increase,” IEA said. The lower demand overseas and resulting cutbacks in spending “will unavoidably lead to slower production growth over the medium term,” said researchers.

Their capital-intensive nature and long lead times make LNG projects particularly vulnerable. Proposed projects now “are soft targets for investment reductions and several of them are likely to be delayed or even canceled,” IEA said. “If current low prices persist, LNG markets could start tightening substantially by 2020, with demand gradually absorbing the large supply upswing expected over the next three years.”

The gas markets are going to face a flood of LNG supplies coming onstream, and some proposed export facilities face “an uphill battle,” researchers said.

“Today LNG prices simply do not cover the capital costs of new plants. Several projects have already been scrapped or postponed, and the number of casualties will rise if prices do not recover. Final investment decisions taken in the next 24 months will determine the amount of incremental LNG supplies available in the early part of the next decade. If current low prices persist, LNG markets could start to tighten up substantially by 2020.”

Global LNG export capacity is forecast to increase by more than 40% by 2020, with almost all — 90% — of the additions from Australia and the United States.

“The Australian projects are at an advanced stage of development, while project operators in the United States have limited price exposure once deals have been signed.” New projects may struggle at current prices.

“In LNG markets, large quantities of flexible supplies from the United States are on the way,” van der Hoeven said. “But from a consumer standpoint, the economic attractiveness of the Henry Hub-linked model has narrowed substantially relative to the traditional oil-based one. What the impacts will be on the next generation of LNG projects remains to be seen.”

In the short-term, “better affordability of gas imports is likely to result in higher consumption, particularly where this serves to reduce shortages rather than placing gas in direct competition with coal. But in the medium term, the picture becomes more complex.

“Trust in gas as an attractive strategic option must increase for the fuel to make sustained inroads in the energy mix of much of developing Asia. While environmental policies can play an important role in this regard, they will not do the job by themselves; thus the gas industry must prove it can deliver gas supplies at price levels substantially below those that have prevailed in the recent past.”

As LNG supplies surge over the next five years, Europe could offer an important outlet, with imports possibly doubling between 2014 and 2020, according to IEA forecasts. Despite the expected increase in LNG intakes, any meaningful reduction in European imports from Russia isn’t expected. Russian imports are forecast to remain about 5.3-5.6 Tcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |