Enterprise Buying Eagle Ford Gathering System From Pioneer-Reliance

Enterprise Products Partners LP has inked a $2.15 billion deal to acquire EFS Midstream LLC, which has 460 miles of natural gas gathering pipelines and other assets in the Eagle Ford Shale, from Pioneer Natural Resources Co. and Reliance Industries Ltd. Pioneer plans to use sale proceeds to fund its Permian Basin program.

Pioneer owns 50.1% of EFS Midstream and Reliance owns the remaining 49.9%. Besides gathering pipelines, EFS Midstream includes 10 central gathering plants, 780 MMcf/d of gas treating capacity and 119,000 b/d of condensate stabilization capacity.

As part of the deal, Pioneer and Reliance will dedicate their Eagle Ford acreage to Enterprise under a 20-year, fixed-fee gathering agreement that includes a minimum volume requirement for the first seven years. The companies will also dedicate their Eagle Ford acreage under related 20-year fee-based agreements with Enterprise for gas processing, natural gas liquids (NGL) transportation and fractionation, and for natural gas, processed condensate and crude oil transportation services.

Enterprise CEO Michael Creel said, “This ‘bolt on’ acquisition extends our integrated system deeper into the NGL and condensate-rich areas of the Eagle Ford, which will provide us with the ability to offer services to additional producers and increase volumes on our system.”

The purchase price is to be paid in two installments: $1.15 billion at closing, which is expected during the third quarter, and then $1 billion within a year of closing. Pioneer’s share of the net sale proceeds is expected to be about $500 million at closing and $500 million one year later. The company said it will use the capital to bolster its balance sheet and to fund development of its oil-rich Spraberry/Wolfcamp asset in the Permian Basin of West Texas.

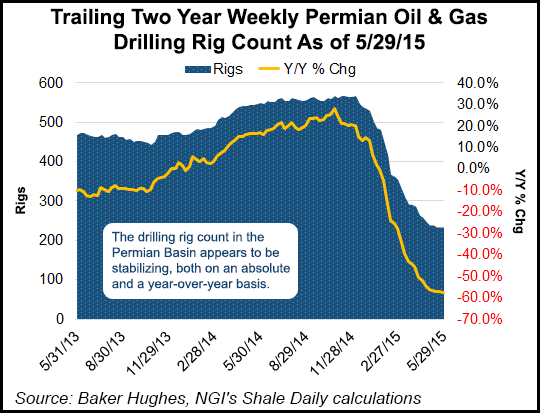

“We are currently operating 10 horizontal rigs in the Spraberry/Wolfcamp,” said Pioneer CEO Scott Sheffield. “Our strong balance sheet, combined with a strong derivatives position for 2015 and 2016, provides us with the financial firepower to ramp up drilling activity on high-return Wolfcamp B and Wolfcamp A horizontal wells during the second half of this year.”

Average production data from all of the Wolfcamp B and Wolfcamp A wells drilled since early 2013 in the northern Spraberry/Wolfcamp continue to support estimated ultimate recoveries of one million boe per well with oil content more than 70%, Sheffield said.

“We will also re-initiate horizontal drilling in the Lower Spraberry Shale interval where production from wells drilled since early 2013 supports EURs [estimated ultimate recoveries] ranging from 650,000 boe to one million boe per well with oil content of more than 75%,” he said. “Starting in July, we will add an average of two horizontal rigs per month in the northern Spraberry/Wolfcamp through the remainder of the 2015 as long as the oil price outlook remains positive. This additional drilling activity is expected to increase the company’s 2015 capital budget by approximately $350 million. The addition of these 12 rigs will have minimal impact on forecasted 2015 production growth of 10%-plus due to multi-well pad drilling.”

During the first quarter of 2016 Pioneer plans to add eight horizontal rigs to its program. Six are to be in the northern Spraberry/Wolfcamp and two are expected to target the Eagle Ford. The increase would bring the company’s total horizontal rig count to 36: 28 rigs in the Spraberry/Wolfcamp and eight in the Eagle Ford. This is about where Pioneer’s rig count was before the oil price collapse, Sheffield said. “Based on this planned increase in drilling activity, we expect to deliver compound annual production growth of 15%+ over the 2016 through 2018 period,” he said.

Topeka Capital Markets analyst Gabriele Sorbara upgraded Pioneer to “buy” from “hold” based on the transaction news and drilling plan revisions. “…[W]e believe the recent underperformance and this morning’s key catalysts (Eagle Ford midstream sale and re-acceleration) provides for a great entry point in a premier Permian Basin growth and value story.”

Wunderlich Securities analyst Irene Haas reiterated a “buy” rating on Pioneer. “To start 2016 with the same rig count as pre-crash level is outstanding, in our view,” she said in a note. “The company has used this downturn to compress costs and enhance its margin.”

Pioneer said it and Reliance will benefit from fee reductions under existing downstream processing and transportation contracts with Enterprise in exchange for extending the contract term to 20 years and dedicating additional Eagle Ford volumes. The reduced fees are expected to benefit Pioneer and Reliance over the original terms of the downstream contracts by $200 million on a net present value basis at 10%. Enterprise has also agreed to spend $270 million over the next 10 years on new facilities, connections and expansions to Eagle Ford development.

Pioneer will no longer receive cash flow generated by EFS Midstream, which was forecasted to be more than $100 million this year, the company said. This is expected to result in an increase in Eagle Ford production costs of about $3.00/boe and total corporate production costs of about 75 cents/boe.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |