Weekly Natural Gas Prices Fall Hard as Texas Rain

For the holiday shortened week ending Thursday, both physical and futures markets had the trajectory of a safe falling from a ten-story building. Declines were deep and pervasive and only a handful of market points were in positive territory. For the three-day trading week ended May 28, theNGI Weekly Spot Gas Average fell 17 cents to $2.54, and no region made it to the positive side of the trading ledger.

Of the actively traded points quotes at the Algonquin Citygate had the distinction of the greatest gain with a rise of 23 cents to $2.13. Gas at Chicago Peoples Energy and Panhandle Eastern brought up the rear both with losses of 27 cents to $2.73 and $2.48, respectively. Regionally the Midcontinent fell the greatest, with a loss of 24 cents to $2.58 and the week’s smallest loss was seen in the Northeast with a drop of 2 cents to $2.10.

For the month of May, AccuWeather.com reported that Houston had received 12.99 inches of rain or 273% of normal.

Quotes in California skidded 23 cents to $2.75, gas in the Rockies and Midwest gave up 22 cents to $2.47, and $2.82, respectively.

Weekly prices in South Louisiana shed 21 cents to $2.74, and both South Texas and East Texas fell 20 cents to $2.71 and $2.73, respectively.

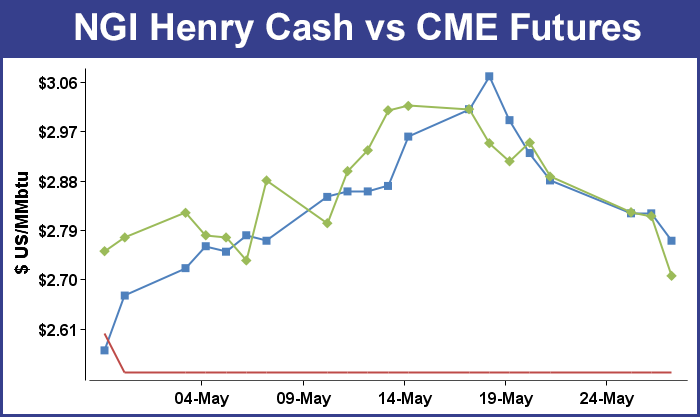

July futures were no less resilient than the falling physical market. July retreated 21.3 cents to $2.706 and much of the week’s decline in both physical and futures markets took place Thursday.

On Friday, the selling took up where Thursday left off, and July shed another 6.4 cents to $2.642. August fell 6.5 cents to $2.665.

In the physical market, trading for Friday through Sunday deliveries saw prices decline at every market point followed by NGI. Double-digit declines were common, and the overall market swooned 15 cents to $2.44.

Futures bulls had difficulties of their own as the Energy Information Administration (EIA) Thursday reported a plump build of 112 Bcf, a figure well above expectations, and prices sank. At the close, July had fallen 14.1 cents to $2.706 and August had erased 13.5 cents to $2.730.

The day’s plunge by futures had traders thinking of a new trading range of $2.50-2.75. “$2.75 is initial resistance, but not very much,” said a New York floor trader. “It’s not as though we haven’t been there and done that. $2.50 is the most likely support level.”

The 112 Bcf figure caught just about everyone off guard. Prior to the release of the data, analysts were looking for an increase closer to the 100 Bcf area. IAF Advisors calculated a 105 Bcf increase, and Ritterbusch and Associates was looking for a build of 102 Bcf. A Reuters poll of 21 traders and analysts showed an average 99 Bcf with a range of a 87 Bcf to a 107 Bcf injection.

“We had heard a build of anywhere from 99 Bcf to 102 Bcf,” said a New York floor trader. “We just went from a $2.75 to $3 trading range to a $2.50 to $2.75 range.”

That lower trading range itself may be subject to question as analysts see the report suggesting more bearish reports to follow. “The 112 Bcf in net injections was at the very top of the range of market expectations and above the 95 Bcf five-year average, sending a clear bearish message,” said Tim Evans of Citi Futures Perspective. “We don’t know the background details of supply and demand behind the swing, but this suggests that the apparent tightening in the data over the prior two reports was temporary. This will have at least some bearish implications for storage expectations over the next few weeks.”

Inventories now stand at 2,101 Bcf and are 737 Bcf greater than last year and 18 Bcf less than the five-year average. In the East Region 64 Bcf was injected, and the West Region saw inventories increase by 13 Bcf. Stocks in the Producing Region rose by 35 Bcf.

Natgasweather.com’s Andrea Paltrinieri suggested a number of reasons for the lofty build figure. Power burns declined when prices flirted with the $3 level last week and significant demand was switched back to coal. Less demand was likely due to the Memorial Day weekend and early office closures. “Production last week was higher than analyst estimates, [and] my view is that EIA implicitly revised the last couple of weeks that were too low,” she said.

“The framework we get from this number is bearish based on normal weather. I see us loosening both week over week and year over year, with end of season greater 4.1 Tcf. It will be important for summer to bring heat waves, otherwise we need to go lower.” she said.

Some did advance the idea that the number would be higher than what most were thinking, but didn’t quite take it far enough. Energy Metro Desk (EMD) in its weekly survey said, “The spread between the three categories we track [surveys, banks, individuals] is wide at 3.8 Bcf and thus signaling a surprise of 5 Bcf higher or lower than the market. All indications point to a build bigger than this week’s survey index of 99 Bcf. This week, we note that our EMDconsensus was 2.5 Bcf higher than the survey index — higher bias is the word.”

John Sodergreen, EMD editor, estimated 100 Bcf for the prior week’s number and came in way off the 92 Bcf actual figure. Sodergreen called for a 100 Bcf build this week and said, “Last week the 100 forecast was way off; this week, it should be close to spot on.”

Less gas is expected to be flowing out of the Marcellus in the next few days. Genscape reported Thursday that “REX [Rockies Express] east-to-west flows through Chandlersville [eastern Ohio] have dropped below 800 MMcf/d for the first time since late March due to apparent operational issues at upstream receipt points.

“REX receipts at the Eureka Hunter/REX Monroe gathering system interconnect have plummeted to just 42 MMcf/d today and yesterday after having run near record highs around 216 MMcf/d during the previous week, and averaging 153 MMcf/d during the previous 30 days. No notices or planned maintenance have been posted per this specific point, so it is not known when volumes will recover.”

Marcellus points took it on the chin, as did most locations. Gas on Millennium for Friday through Sunday gas was quoted 22 cents lower at $1.30, and packages on Transco Leidy shed 20 cents to $1.28. Gas delivered to Tennessee Zone 4 Marcellus changed hands 17 cents lower at $1.18, and gas on Dominion South came in at $1.40, down 15 cents.

Quotes for Friday through Sunday gas at the Algonquin Citygate tumbled 90 cents to $1.60, and gas on Iroquois Waddington shed 25 cents to $2.70.

Major market hubs saw double-digit declines. At the Chicago Citygate gas for the three-day period fell 9 cents to $2.67, and deliveries to El Paso Permian shed 13 cents to $2.46. Gas at Opal was seen 13 cents lower at $2.46, and at the PG&E Citygate Friday-Sunday gas fell 8 cents to $3.11.

The year-on-five-year storage deficit was cut to just 18 Bcf with Thursday’s reported EIA inventory build of an unexpected 112 Bcf. Should the deficit narrow even further and become a surplus, continued price weakness is likely in the cards, according to analysts.

Teri Viswanath, director of natural gas strategy at BNP Paribas said Friday that the rate at which storage is being filled is “unmanageable” and expects storage issues to ultimately surface. “Despite above-normal temperatures and elevated fuel-switching within the electric power sector, the industry has surpassed last year’s restocking effort with daily storage receipts increasing by an average 1.8 Bcf/d.

“Absent strong weather-related demand, US natural gas prices will have to remain discounted for an extended period in 2015 in order to encourage enough demand to absorb surplus production. Based on the average cost of coal deliveries, Gulf-based gas prices will need to remain much below $3 (and possibly below $2.50 with milder weather) in order to encourage sufficient power demand growth.”

Viswanath is sticking to her guns with a 2015 price forecast of $2.85/MMBtu. She admits that weather issues could surface July-September and could impact their Q3 forecast of $2.75, but “Based on our outlook for supply/demand balances, we see more downside risk ahead for natural gas prices.”

“Last month we recommended that investors remain short by rolling the recommended expiring May’15 Henry Hub position into a Nov’15 short. With prices now re-aligned with that entry level, we see an opportunity to enter or add to that existing position. Over the past seven -year cycle of excess, surplus production has forced the November futures contract to align with the summer futures strip (Apr-Oct). With the Nov’15 continuing to trade at a slight premium to the front of the curve, we think this positioning offers the greatest opportunity as the market recognizes the further need for demand-side balance.”

In Friday’s trading for Monday deliveries, physical market quotes were awash in red ink as eastern market centers were expected to get a break from recent warmth and humidity. Forecaster Wunderground.com predicted a Monday high in Boston of 55, well below its seasonal norm of 70 and New York City was expected to see a Monday maximum of 61, well off its normal high of 74. Philadelphia was seen reaching 65 Monday, 7 degrees below normal.

Gas for delivery Monday at the Algonquin Citygate was flat at $1.60 but gas on Iroquois Waddington dropped 31 cents to $2.39. Packages on Millennium fell 7 cents to $1.23.

Market observers have noted a slide in Algonquin Citygate quotes recently, but one marketer noted that it was all about a lack of demand. “There is just no load, and absent any demand Algonquin Citygate will gravitate towards a summertime Marcellus price plus fuel, plus a few pennies but that is about it. There is not enough load to the point where you need any incremental molecules except from the Marcellus.”

Marcellus points also weakened. Transco Leidy Monday deliveries fell 7 cents to $1.21 and gas on Tennessee Zone 4 Marcellus dropped 6 cents to $1.12. Gas on Dominion South skidded 16 cents to $1.24.

Gas bound for New York City on Transco Zone 6 added a nickel to $2.22, and deliveries to Tetco M-3 fell 10 cents to $1.34.

Gulf prices also softened. Gas at the Henry Hub for Monday fell 13 cents to $2.64 and parcels on Tennessee 500 L changed hands 8 cents lower at $2.61. Gas on Transco Zone 3 was seen at $2.61, down 13 cents and deliveries to Katy were quoted 13 cents lower at $2.58.

If National Weather Service (NWS) forecasts are correct, this week’s storage report may just be a plump one as well. NWS says heating and cooling requirements for the week ended May 30 are expected to be below average in major population centers, thus making it difficult to count weather demand as a market driver in next week’s storage report. NWS forecasts combined heating degree days (HDD) and cooling degree days (CDD) for New England at 33, or 10 below normal. New York, New Jersey and Pennsylvania show a combined DD level of 40, or one above normal, and the greater Midwest from Ohio to Wisconsin is expected to endure 44 DDs or eight below normal.

Gas buyers seeking to supply power generation across the MISO footprint may have an ample supply of wind generation to tap going forward. WSI Corp. in its Friday morning forecast said, “A south-southwest to northerly flow associated with the expected cold font will support increasing wind generation during the next couple of days. Output may peak tonight into early Saturday close to 9 GW. Wind generation is expected to decrease as the weekend progresses and remain modest early next week with output between 3-5 GW.”

WSI said the strong wind generation was the result of a cold front expected to advance south and east across the power pool Friday into the weekend, with outbursts of heavy showers and thunderstorms. Warm temperatures and humidity were expected ahead of the front, but cooler, drier conditions are expected once the front passes.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |