Mexico’s Shales Present Opportunities, Challenges, Researchers Find

Mexico sits atop an estimated 545 Tcf of shale natural gas reserves, and additional trillions of cubic feet of conventional reserves. However, pipeline imports of U.S. natural gas have continued to climb in recent years. The country is on the cusp of reserves and infrastructure development that could change that, according to a new report.

The University of Texas at San Antonio’s (UTSA) Institute for Economic Development, the Universidad Autonoma de Nuevo Leon, the Asociacion de Empresarios Mexicanos, and the Woodrow Wilson Center have released a preliminaryreport to gauge the growth and the effects that the oil and natural gas industry will have for residents and decision makers in Mexico.

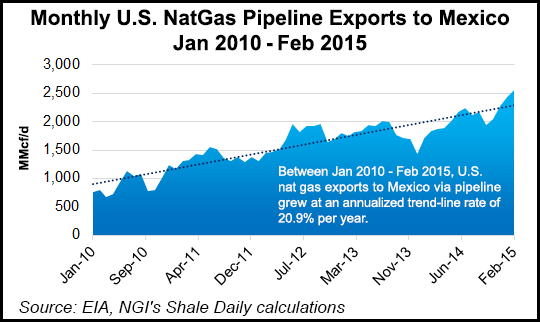

“Over the years, natural gas exports through pipelines from the United States to Mexico have increased from close to 365,000 MMcf to close to 740,000 MMcf per year, from 2008 through 2014,” the report said. “The shares of these exports with respect to total natural gas pipelines exports have increased from 39.5% to 49.0% for the same period.”

Mexico has its own shale natural gas and oil plays, and has introduced energy sector reforms with an aim of attracting private investment to develop these (seeDaily GPI, May 26; Aug. 7, 2014; May 2, 2014). After being elected in 2012, Mexican President Enrique Pena Nieto worked with other ruling parties to create a “Pact for Mexico” that included 11 reforms, one of which was energy. The initial proposed reforms focused on removing hydrocarbons from the sectors controlled directly by the government. Thus opening up oil and gas fields through exploration and production contracts with the Mexican government, as well the granting of permits for the development of a hydrocarbons infrastructure.

“Opportunities for unconventional or shale oil and gas productions in Mexico are in the earliest stages of development. Due to its close proximity to major shale field development in South and West Texas, Mexico is particularly well positioned to take advantage of unconventional extraction techniques,” said Thomas Tunstall, research director at the UTSA Institute for Economic Development.

The bulk of Mexico’s shale prospects appear to lie in the north and northeastern sections of the country, where infrastructure is often largely undeveloped, according to the report. This means that in order to tap the country’s bounty of shale oil and gas, infrastructure such as roads, housing, rail, pipeline and many others will have to be built out first. The ability to develop a suitably skilled workforce will be key to long-term success. Security issues must also be addressed, the report said.

The report contains a general overview of Mexico’s energy reforms, an economic background on oil and natural gas (especially trade between the United States and Mexico) a state level profile, infrastructure and educational certificates specific to oil and natural gas education. The core study area concentrates on the economic impact on the Mexican states of Coahuila, Nuevo Leon, Tamaulipas and Veracruz.

The second part of the report introduces a preliminary business road map for prospective operators in Mexico that briefly describes the necessary steps with which upstream activity in Mexico will have to comply in order to expand or initiate operations in Mexico.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |