Natgas Cash, Futures Barely Move; June Expires Less Than a Penny Lower

Physical gas for Thursday delivery overall worked modestly higher in Wednesday’s trading as strength in the West was able to outperform steady to lower quotes in the East, Gulf, Midwest and Midcontinent. The overall market added a penny to $2.59. Futures trading was even less inspired with the June contract expiring at $2.815, down seven-tenths of a cent and July easing two-tenths of a cent to $2.847. July crude oil fell 52 cents to $57.51/bbl.

Traders took a bearish posture on the market. “Even with the numbers showing less and less rigs, we continue to see a lot of production come out as higher efficiencies enable drillers to be more effective. As a result I don’t anticipate we are going to see production fall all that dramatically,” said Al Levine, principal with Powerhouse LLC, a Washington, DC, risk management firm.

“Other than weather-induced demand as we come into June and July, I would anticipate the market will move lower. Any move back to $3.00 would be a hedging opportunity for producers. You do have some carry in the market, and I think it would be advantageous to hedge some of those back months. Summer 2016 is over $3.00 and a $1.00 here is much different than $1.00 at $6.00.

“At $2.81, we are not oversold in the least, and I anticipate we will move down a little bit more. It’s really hard imagining producers cutting off production. They are not operating out of their own pocket and are leveraged up. They have important reasons to want to keep producing. $2.17 looks like long-term support, and I see no reason why we wouldn’t see a retest of the recent low at $2.44.”

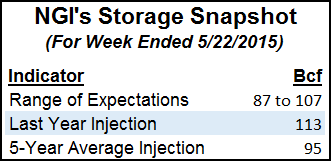

A trend lower such as Levine envisions may be in sight Thursday when the Energy Information Administration (EIA) announces weekly inventory figures. Injections are expected to lag year-ago builds but stay ahead of five-year averages. Last year 113 Bcf was injected and the five-year pace stands at 95 Bcf.

For the week ended May 22, IAF Advisors of Houston forecasts an injection of 105 Bcf, and Stephen Smith Energy is looking for an increase of 93 Bcf. A Reuters poll of 21 traders and analysts revealed a sample average of 99 Bcf with a range of 87 Bcf to 107 Bcf.

Weather forecasts show a moderating trend, and Tim Evans of Citi Futures Perspective doesn’t see tempered weather as a market driver strong enough to initiate a bearish trend. Forecasts may not be “supportive enough to prevent a short-term price drop, [yet] we don’t see the latest weather forecasts as bearish. Given the background tightening of the supply-demand balance implied by recent storage reports, we see near-average storage injections over the next few weeks.”

Evans is forecasting a build of 87 Bcf for the week ended May 22, and by June 12, the year-on-five-year deficit has narrowed from its current 35 Bcf to 10 Bcf. “The decline does confirm that the market is becoming marginally better supplied on a seasonally adjusted basis, but at a rather moderate rate. This does still suggest weak downward fundamental pressure on prices, but in our view not a compelling bearish case. We think nearby natural gas might find support in the $2.65 area, making a constructive higher low than in late April, with prices to turn higher again once that support is confirmed.”

Tom Saal, vice president at FC Stone Latin America LLC, expected a short-covering rally as the June contract goes off the board. In his work with Market Profile, he was anticipating a test of Tuesday’s value area at $2.817 to $2.797, and “maybe” a test of a second value area at $2.929 to $2.901 and $3.003 to $2.949.

In physical market trading, next-day quotes at eastern locations were generally lower. Next-day gas at the Algonquin Citygate added 22 cents to $2.50, but gas on Iroquois Waddington shed a nickel to $2.95. Packages on Tennessee Zone 6 200 L fell 5 cents to $2.93.

Gas on Millennium fell a penny to $1.52, and gas on Transco Leidy was seen 8 cents lower at $1.48. Deliveries to Tennessee Zone 4 Marcellus came in flat at $1.35, and gas on Dominion South changed hands 7 cents lower at $1.55.

In the Mid-Atlantic, next-day packages on Tetco M-3 fell 11 cents to $1.61, and gas bound for New York City on Transco Zone 6 skidded 7 cents to $2.86.

Western Hubs outperformed traditional market centers. Gas at the Henry Hub was flat at $2.82, and deliveries to El Paso Permian rose 13 cents to $2.59. Gas at Opal rose 6 cents to $2.59 and deliveries to the SoCal Citygate were quoted 14 cents higher at $2.87.

Weather forecasts are calling for a slight moderation. WSI Corp. said Wednesday’s “six-10 day period forecast is warmer than the previous forecast across the Plains, Midwest into the Northeast due to model trends and the day shift. The Southeast and interior West are cooler.” Period population-weighed cooling degree days “are down 0.5 to 33.1. Forecast confidence is average and has increased since [Tuesday] as medium-range models are in good agreement with the large-scale pattern.”

WSI sees “a slight upside risk across the central and northern U.S. The Southeast and Southwest have risks to the cooler side.”

In bidweek trading, gas at the Chicago Citygates was seen between $2.80 to $2.86, packages on Panhandle Eastern came in at $2.49 to $2.66 and gas on Northern Natural Demarcation was quoted at $2.71 to $2.82.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |