Surging Eastern NatGas Prices Offset Broader Declines; Futures Weaken

Physical natural gas prices for Wednesday delivery were a deeply divided affair in Tuesday’s trading, with eastern quotes gaining on expectations of temperatures as high as 90 in some markets and all other points dropping close to a dime.

The overall physical gas cash market gained 2 cents to average $2.58, as broader losses faced off against eastern quotes averaging about 25 cents higher.

Futures slumped as near-term weather outlooks are more tempered in spite of the eastern heat, and upcoming additions to storage are likely to continue shaving long-term supply deficits. At the close, June had dropped 6.5 cents to $2.822, and July was off by 7.0 cents to $2.849. July crude oil plummeted $1.69 to $58.03/bbl.

“There are not a lot of bulls out here, and everyone here is looking for it to stay to the downside,” said a New York floor trader. “We are looking for prices to fall to $2.60 to $2.70, but when July kicks in on Thursday, look for it to make a run at $3.”

In the physical market, eastern prices surged as temperature forecasts called for readings 10 degrees or more above normal. AccuWeather.com predicted that Tuesday’s high in New York City of 88 would slide to 82 Wednesday and hold. The normal high in New York is 74. Philadelphia’s Tuesday high of 89 was anticipated to reach 86 on Wednesday before rising to 87 Thursday. The seasonal high in Philadelphia is 77. Washington, DC’s Tuesday high of 87 was seen advancing to 88 Wednesday and 89 on Thursday. The normal late-May high in Washington, DC, is 78.

Next-day gas at the Algonquin Citygate gained a stout 66 cents to $2.28, and deliveries to Iroquois Waddington rose 31 cents to $3.00. Gas on Tennessee Zone 6 200 L jumped $1.05 to average $2.98.

Gas bound for New York City on Transco Zone 6 rose 96 cents to $2.93, and deliveries to Tetco M-3 rose 15 cents to $1.72.

In the Marcellus, next-day packages on Millennium came in 19 cents higher at $1.53, and gas on Transco Leidy added 23 cents to $1.56. Packages on Tennessee Zone 4 Marcellus rose 18 cents to $1.35, and gas on Dominion South was quoted 11 cents higher at $1.62.

Analysts noted a big drop in deliveries on the Sierrita Pipeline in Arizona carrying gas from an interconnect with El Paso to Mexico. “The Sierrita Pipeline is reporting zero flows at its border delivery point into Mexico. Upstream, receipts from El Paso have fallen to just 6 MMcf/d from 119 MMcf/d on Monday. At present, no notices or planned maintenance has been posted from Sierrita to explain the drop,” said industry consultant Genscape. “I talked to El Paso and Sierrita and they said they were not having any operational problems, so it must be on the Mexican side,” said Genscape analyst Rick Margolin.

Major hubs were solidly in the red. At the Chicago Citygates next-day gas fell 5 cents to $2.78, and gas at the Henry Hub shed 6 cents to $2.82. Gas at Opal for Wednesday delivery changed hands 7 cents lower at $2.53 and parcels at the PG&E Citygate fell 3 cents to $3.20.

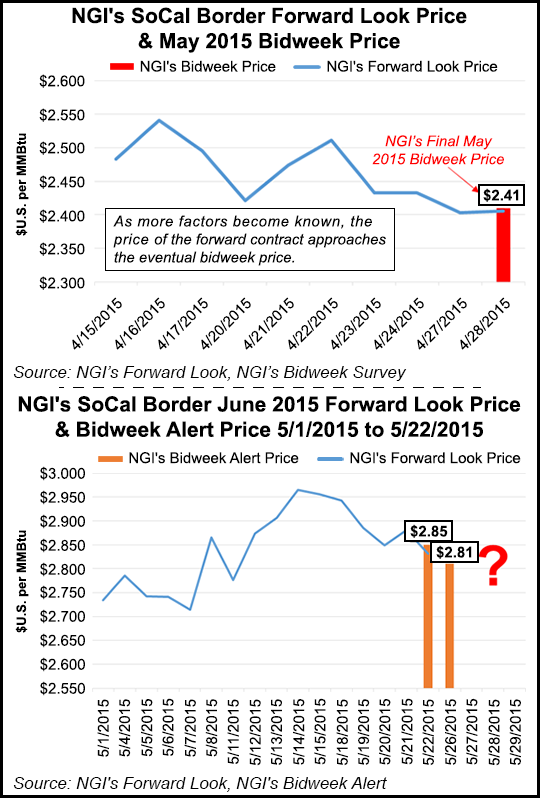

As the month comes to a close, there is reason to pay especially close attention to the last trading days of the June forward market versus early reports of bidweek fixed price and basis trading activity. NGI‘s Bidweek Alert indications at the SoCal Border have been sliding down from the mid-$2.80’s as the forward market traces its steps to $2.831, according to NGI‘s Forward Look data. At the Chicago Citygate, NGI‘s Bidweek Alert shows bidweek day 2 trading at $2.86 compared to $2.920 in Friday’s forward market at Chicago.

According to NGI‘s Bidweek Alert, which is published each of the last five business days of the month, Algonquin Citygate is currently averaging about negative 50 cents for June basis and that is lining up with its own forward market trading -$0.513 for June. For more information on NGI‘s Bidweek Alert or NGI‘s Forward Look products, visit naturalgasintel.com or call (703) 318-8848.

Weather forecasts near term are looking for some moderation in eastern heat and a cooler Midwest as well as a realignment from current patterns. Commodity Weather Group in its Tuesday morning forecast said, “National demand estimates are estimated to be a bit lower than Friday’s estimations, thanks to a combination of weaker heat on the East Coast this week as well as a stronger cooler interlude for the Midwest, Texas and even East early next week ahead of another round of heat. That second round of heat still looks like it will deliver some much above normal temperatures to the eastern third of the U.S. early in the 11-15 day, but it looks more short-lived than fixed toward any long-term pattern stability.

“In fact, over the past one to two days, the models have really converged on a new pattern look that shows stronger West heat ridging, including California that gets going stronger in the four-10 day range and carries into the 11-15 day. This new setup could open the door for a cooler-looking June pattern in the East. Meanwhile, the main cool (and very wet) spot continues to be the South Central U.S., especially Texas, for the next two weeks,” said Matt Rogers, president of the firm.

That cooling pattern has analysts thinking less air conditioning load and gas demand. “The six-10 day forecast changes were relatively significant over the weekend, with the notable absence of strong heat events across the country during the first week of June,” said Teri Viswanath, director of natural gas strategy at BNP Paribas. “This means that the very warm conditions on the East Coast will soon depart as an intrusion of high-pressure air ushers in cooler weather over the upcoming weekend. So far, the population-weighted cooling degree days in May are slightly outpacing year-ago levels, tracking in line with the top 11th observation since the 1950s. However, the forecasts for June reflect a very different outlook. The strengthening El Nino is largely to blame, likely producing mild summer weather across the heavy cooling regions of the South, which could potentially limit utility demand growth.”

Others see not only upcoming weather, but tempered coal to gas fuel switching as prices flirted with $3 last week.

“This market came under significant selling pressure at the start of this week apparently in response to some minor bearish adjustments to the short term temperature views and the likelihood that production will be ramped up following Marcellus maintenance,” said Jim Ritterbusch of Ritterbusch and Associates in a weekly note to clients. “The market may also be looking ahead to Thursday’s storage report when the EIA [Energy Information Administration] will likely be indicating another triple-digit increase, one slightly above the 100 mark, in our opinion.”

Ritterbusch noted that a drop below the $2.50 area ahead of Thursday’s EIA release would signal an “extremely weak undertone with additional slippage to our objective likely developing as early as next week. Otherwise, an EIA inspired selloff may require additional time unless the report offers a bearish shocker suggestive of stronger production or weaker demand than our expected storage injection would imply.”

According to NGI‘s Bidweek Alert, which is published each of the last five business days of the month, Algonquin Citygate is currently averaging about negative 50 cents for June basis and that is lining up with its own forward market trading -$0.513 for June. For more information on NGI‘s Bidweek Alert or NGI‘s Forward Look products, visit naturalgasintel.com or call (703) 318-8848.

Weather forecasts near term are looking for some moderation in eastern heat and a cooler Midwest as well as a realignment from current patterns. Commodity Weather Group in its Tuesday morning forecast said, “National demand estimates are estimated to be a bit lower than Friday’s estimations, thanks to a combination of weaker heat on the East Coast this week as well as a stronger cooler interlude for the Midwest, Texas and even East early next week ahead of another round of heat. That second round of heat still looks like it will deliver some much above normal temperatures to the eastern third of the U.S. early in the 11-15 day, but it looks more short-lived than fixed toward any long-term pattern stability.

“In fact, over the past one to two days, the models have really converged on a new pattern look that shows stronger West heat ridging, including California that gets going stronger in the four-10 day range and carries into the 11-15 day. This new setup could open the door for a cooler-looking June pattern in the East. Meanwhile, the main cool (and very wet) spot continues to be the South Central U.S., especially Texas, for the next two weeks,” said Matt Rogers, president of the firm.

That cooling pattern has analysts thinking less air conditioning load and gas demand. “The six-10 day forecast changes were relatively significant over the weekend, with the notable absence of strong heat events across the country during the first week of June,” said Teri Viswanath, director of natural gas strategy at BNP Paribas. “This means that the very warm conditions on the East Coast will soon depart as an intrusion of high-pressure air ushers in cooler weather over the upcoming weekend. So far, the population-weighted cooling degree days in May are slightly outpacing year-ago levels, tracking in line with the top 11th observation since the 1950s. However, the forecasts for June reflect a very different outlook. The strengthening El Nino is largely to blame, likely producing mild summer weather across the heavy cooling regions of the South, which could potentially limit utility demand growth.”

Others see not only upcoming weather, but tempered coal to gas fuel switching as prices flirted with $3 last week.

“This market came under significant selling pressure at the start of this week apparently in response to some minor bearish adjustments to the short term temperature views and the likelihood that production will be ramped up following Marcellus maintenance,” said Jim Ritterbusch of Ritterbusch and Associates in a weekly note to clients. “The market may also be looking ahead to Thursday’s storage report when the EIA [Energy Information Administration] will likely be indicating another triple-digit increase, one slightly above the 100 mark, in our opinion.”

Ritterbusch noted that a drop below the $2.50 area ahead of Thursday’s EIA release would signal an “extremely weak undertone with additional slippage to our objective likely developing as early as next week. Otherwise, an EIA inspired selloff may require additional time unless the report offers a bearish shocker suggestive of stronger production or weaker demand than our expected storage injection would imply.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |