Permian Decline Bottoming; Returning Rigs to Be New Soldiers, Analysts Say

Activity declines in the Permian Basin are likely bottoming out, and pricing for hydraulic fracturing services could see some recovery there, analysts at Wells Fargo Securities LLC said in a note with thoughts from the recent DUG Permian Conference.

“With operators generally in agreement that service providers have taken their fair share of pain, efficiency has returned as the key buzzword to driving incremental activity in the Permian,” Wells Fargo said.

“Further, the industry now appears keenly focusing on high-grading both their rig fleets and frack crews, with operators generally sticking to commitments to take newbuild deliveries (more efficient than the rigs that were dropped) and keeping continuity with their current (and in many cases new) frack provider.”

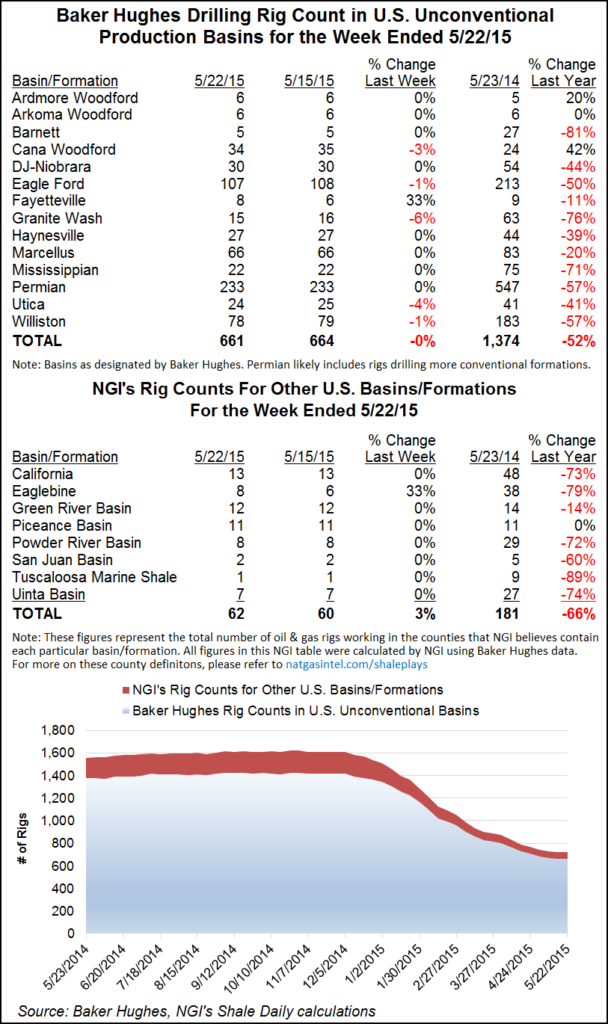

In the latest Baker Hughes Inc. rig count, the Permian Basin held steady with the previous week’s tally of 233. In previous counts this year, the liquids-rich Permian has been among the hardest-hit basins along with the Eagle Ford Shale. Indeed, the latest Baker Hughes count also found the Lone Star State holding steady with the previous week’s count of 373 active rigs, the Eagle Ford having lost only one rig to 107 in the latest count.

Among U.S. shale plays, notable in the latest Baker Hughes count is the return of two rigs to the Fayetteville Shale for a total of eight, and the increase by two rigs in the active count for the Eaglebine play in Texas, also to eight.

Meanwhile in Canada, Alberta lost six rigs, British Columbia lost one, Saskatchewan gained two, and the other provinces held steady.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |