Weekly Cash Natgas Sees Solid Gains; Futures Near 3-Month High

Trading figures for the week ended May 18 were not quite as illustrious as those of the previous week, but solid double-digit gains were the rule at most all market points outside the Northeast. The NGI Weekly Spot Gas Average added 9 cents to $2.65, only 8 market points posted losses and these were all in the Northeast.

ANR SW made the top seed with a gain of 27 cents to $2.71, and Texas Eastern M-2 30 Delivery had the greatest loss of 36 cents to $1.84.

Regionally, the Northeast came in with smallest gain, up 2 cents to $2.15, and the Midcontinent showed the largest improvement, adding 14 cents to $2.73.

South Louisiana added 13 cents to $2.85 and three regions, the Midwest, East Texas, and South Texas all rose 12 cents to $2.96, $2.82, and $2.80, respectively.

California was higher by 11 cents to $2.90, and the Rockies also gained 11 cents to $2.63.

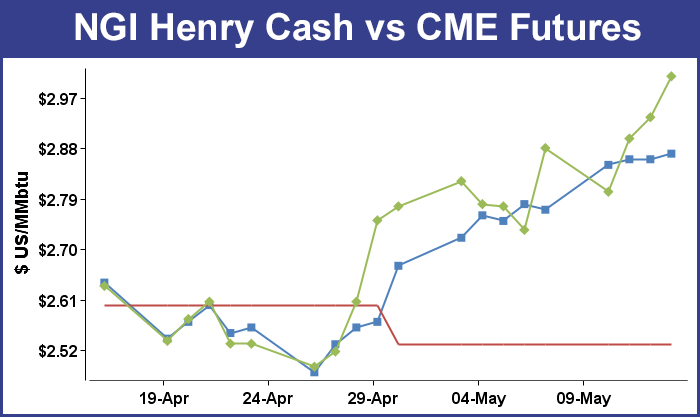

June futures for the week gained 13.6 cents to close over $3 at $3.016, the highest since late February, and a big chunk of the move came following the weekly Energy Information Administration (EIA) storage report. Expectations were about 116 Bcf and following the release of the actual figure of 111 Bcf futures immediately responded by reaching the high of the day at $3.020. At the close, the June contract managed to hold on and posted a 7.3-cent advance to $3.008. July settled 7.9 cents higher at $3.063.

Most traders and analysts were not expecting the 111 Bcf build and were looking more toward an increase about 5 Bcf higher.

Last year 101 Bcf was injected, and the five-year average is for an 82 Bcf increase. Estimates for this week’s figure were closely bunched just below 120 Bcf. Ritterbusch and Associates was looking for a build of 109 Bcf, but analysts at ICAP Energy calculated a 116 Bcf increase. A Reuters poll of 26 traders and analysts indicated a sample mean of 116 Bcf with a range of 99 Bcf to 135 Bcf.

Industry consultant Genscape combined the output from both its supply-demand model and pipeline model and came up with a 119 Bcf injection. “For this week, our pipeline model has a 118 Bcf injection, while the supply-demand model is at 121 Bcf. The S-D model is based on production estimated to have run at 72.8 Bcf/d,” the company said in a report.

“Production peaked early in the week at 73.4 Bcf/d then fell to a low of 72.1Bcf/d on gas day May 5 before rebounding towards the tail end of the week. Production for this storage week is more than 4.5 Bcf/d greater than last year’s same storage week. Demand is estimated to have averaged 58.1 Bcf/d with power now accounting for more than 50% of demand. Last week’s power demand (non-weather adjusted) averaged 22.33 Bcf/d, the highest power demand has run in gas week 19 since 2012.”

Analysts saw a somewhat tighter supply-demand balance. “The 111 Bcf net injection for last week was still above the 82-Bcf five-year average rate, but it was below the consensus expectation and bullish relative to our weather-driven model,” said Tim Evans of Citi Futures Perspective. “The data implies a tightening of the background supply/demand balance which is at least more constructive than prior data suggested. It’s a bullish report, at least in terms of short-term price impact.”

“The market would have to close above $3 if we are going to see anything significant on the upside,” said a New York floor trader. “Given the actual number, I wouldn’t have expected a market reaction much different.”

Analysts see the market over the remainder of the injection season having difficulty finding a home for all the produced gas. “Despite the forecast miss, today’s record build could hardly be categorized as bullish as it establishes a new record for the reference week,” said Teri Viswanath, director of natural gas strategy at BNP Paribas.

“After putting in a calendar low two weeks ago, natural gas futures prices gained $0.50 or roughly 20% with the early arrival of summer. It would appear that the above-normal temperatures in the eastern half of the US prematurely raised expectations that cooling demand will soon temper the robust stock build underway.

“To be sure, while last week’s stock build well exceeded last year’s injection, the decline in daily storage receipts so far this week suggests that cooling demand has tightened supply/demand balances. The problem is, with milder weather ahead and prices moving above $3, electric power demand will likely falter. With supplies remaining reasonably supported and a containment problem looming ahead, we expect that the market will need to keep prices discounted for an extended period.”

Going forward, weather-driven demand is going to be hard to come by. The National Weather Service for the week ended May 16 forecasts fewer degree days for both heating and cooling in major U.S. markets. New England is forecast to see a combined 46 HDD (heating degree days) and CDD (cooling degree days) or 23 fewer than normal. New York, New Jersey and Pennsylvania are expected to experience 44 degree days, or 13 fewer than normal, and the greater Midwest from Ohio to Wisconsin is seen enduring 43 degree-days or 25 fewer than its seasonal norm.

For the following week a Reuters poll shows an average 105 Bcf with a range of 90 Bcf to 116 Bcf. That would compare to a build last year of 106 Bcf and a five-year average of 89 Bcf.

Analysts see gas-fired generation as a significant driver in the recent price advance.

“This market continues to exhibit surprising resiliency as it managed to post another new high extending back to February even amidst negligible impetus from the weather factor,” said Jim Ritterbusch of Ritterbusch and Associates in closing comments Friday. “As is the case in any market, much of the momentum behind price swings tends to be driven by changing focus from one factor to another. In assessing the upside price acceleration of the past couple of weeks it appears that increasing attention is being given to a surprisingly strong pace of power demand. Although various factors are likely at work in boosting EG [electric generation] consumption, a common theme amongst most observers appears to be one in which coal to gas substitution has been cranked up appreciably following the recent gas price decline to around $2.50. While we can concede to such a development, we will also note that the impact on the balances hasn’t been that great as [Thursday’s] 111 Bcf injection was only about 5 Bcf smaller than average industry expectations.

“Looking ahead to next week, this seasonal supply build will almost certainly be downsized by as much as 15-20 Bcf as a result of some hot temperature trends that have scattered across the eastern half of the nation. Nonetheless, impact on the supply deficit against five-year averages should prove limited given the average decline of about 89 Bcf during the second week of May. All in all, we have shifted off of a bearish and into a neutral camp temporarily as we concede to a bullish looking chart picture that suggests limited resistance until about the $3.13 area per nearby futures. Although our long term downside possibilities remain virtually undisturbed at about the $2.50 area, attainment of this level has now been pushed back to next month and will likely require some cooperation from a cool start to the summer.”

Other observers are a little perplexed about the recent strength in futures prices in light of triple-digit storage builds and expectations of record season-ending inventories. “More gas has been injected since March compared to this time last year, and storage remains on track to beat record,” said Breanne Dougherty, an analyst with Societe Generale in New York.

“While we would like to have a definitive explanation for the persistent upside pressure gas has seen over the last couple of weeks, we find ourselves at a bit of a loss. Supply looks good, and there has yet to be any information that would have us change our base-case flat profile this summer. Demand is also performing as expected. We continue to feel a price above $2.75/MMBtu has the ability to detrimentally impact generation loads through June considering the looseness in the coal market and reduced elasticity in the segment, but are becoming increasingly fond of the spiking core summer profile that we have held in our expectation and are neutral on our base-case fall price profile at the moment.”

Market technicians are less concerned with storage and supply than they are with Elliott Wave and retracement parameters. “With the $2.939 level in our rear-view mirror, bulls can now set their sights on the next area of contention at $3.399-3.494,” said Brian LaRose, a technical analyst with United ICAP. “This zone represents 0.236 of $6.493 to 2.443 and 0.500 of $4.544-2.443.

“[We] see $3.034 and $3.249 as the only hurdles standing between here and this objective. At this point, we do not anticipate encountering any significant resistance from these levels,” he said in closing comments Thursday.

In Friday’s trading gas for weekend and Monday delivery rose as a warm, humid weekend was forecast for eastern population centers and Monday on-peak power surged.

Futures worked higher and did manage to hold the technically significant $3 level. At the close, June had added 0.8 cent to $3.016 and July was higher by 0.7 cent to $3.070.

Short-term traders are optimistic about prices. “We’ve settled above $3 twice, so that is a positive sign. We may even come in higher on Monday just based on the close,” said a New York floor trader.

“You could now peg support at $3, but I don’t think that is going to last very long. I still think you are looking at $2.75 on the downside, and at the moment the market is right at $3 resistance. I still see a $2.75 to $3 trading range, unless it stays above $3. We have to see what the market does over the weekend.”

Marketers didn’t see any reason to chase the physical market higher. A Michigan marketer said “it just keeps going up and up and who knows how much farther it will go. Our price on Consumers for the weekend would be $3.11, and at first we were going to buy, but then backed off thinking it might [eventually] go lower.”

“We also think that our customer’s usage might be less in the summer and may hold off buying for storage until then.”

In the physical market prices for Midwest weekend and Monday delivery posted solid gains. Deliveries on Alliance gained 6 cents to $2.94 and packages at the Chicago Citygate rose 6 cents also to $2.93. On Consumers, gas changed hands at $3.10, up 5 cents and gas on Michcon added a 6 cents to $3.10. Gas at Demarcation was also 6 cents higher at $2.85.

In the Gulf, gas on ANR SE rose by 8 cents to $2.90 and gas on Columbia Gulf Mainline came in 9 cents higher as well at $2.91. At the Henry Hub weekend and Monday packages rose 9 cents to $2.96, and at Katy gas was seen at $2.91, up 9 cents.

Temperatures over the weekend were expected to rise, and Monday on-peak power surged. AccuWeather.com forecast that Boston’s Friday high of 67 would make it to 70 Saturday and 71 by Sunday. The normal high in Boston this time of year is 66. New York City’s Friday peak temperature of 74 was expected to reach 79 Saturday and a toasty 85 on Sunday. The normal mid-May high in the Big Apple is 71.

Intercontinental Exchange reported that on-peak Monday power at the PJM West terminal jumped $19.67 to $57.67/MWh, and Monday power at the ISO New England’s Massachusetts Hub added $3.57 to $28.98/MWh.

Gas buyers for power generation in the Northeast may be looking at some hefty weekend loads. According to Brian Lada, a meteorologist with AccuWeather.com, “Much of the Northeast is in for a warm and humid weekend following the cooler weather that occurred during midweek. Shorts and short sleeve shirts will be common attire around the region as cities such as Pittsburgh, Baltimore and New York City all experience an uptick in temperatures and humidity.

“This weekend will prove to be a good opportunity for people to test out their air conditioners before the heat of summer builds over the coming weeks. A slight rise in temperature will take place on Friday before the warmth and humidity builds throughout the weekend. Sunday appears to be the warmer of the two days this weekend with some locations flirting with the 90-degree mark on Sunday afternoon.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |