A Couple of Gas Rigs Return; Analysts See Production Decline Next Year

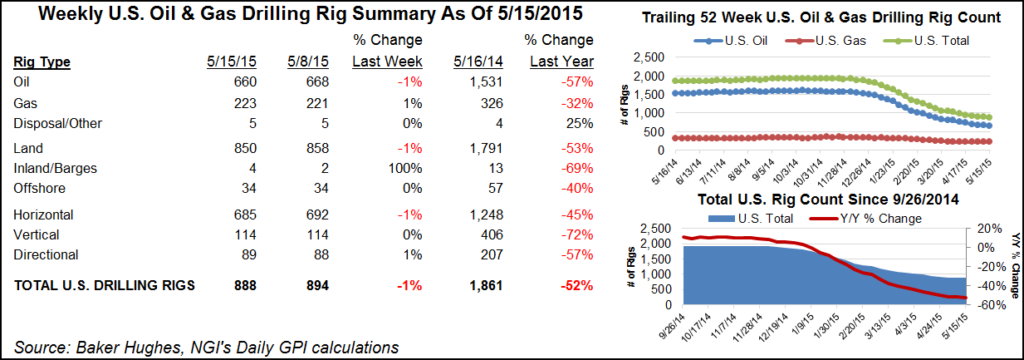

The U.S. count of natural gas-directed drilling rigs increased by two, according to the latest data from Baker Hughes Inc. for the week ending May 15, while the Barnett, Haynesville, Marcellus and Utica shales held steady with last week’s count.

“The pace of declining rig counts has definitively slowed, and there are even rumblings amongst onshore producers that some rigs might begin trickling back into select shales by 2H2015,” analysts at Societe Generale said in a note Thursday. “Establishing the nadir of the rig count trend is seen by us as critical. It implies that the large-scale rationalization has been completed and that after accounting for a drill-to-production lag, the production impact of that rationalization can be given a more defined time-frame expectancy.”

In the near term, analysts at Bank of America Merrill Lynch see natural gas prices moving lower “on economic headwinds,” weak industrial demand and production increases. But in the second half of this year things start to look better for gas producers, they said.

“Structural demand is on an upward path, just as production is set for an eventual decline in 2016,” they said. “For all of 2016, we project a 0.7 Bcf/d contraction in domestic gas output in the U.S., the biggest drop since 2005.”

Bank of America is calling $3.90/MMBtu for 2016 and said “…the U.S. natgas market should tighten rapidly in 2016…[W]e acknowledge that further strength in WTI and a potential return of associated gas output may pose downside risks to our forecast.”

For the week ending May 15, Baker data showed that oil rigs dropped by eight to 660, while natural gas added two to 223. Vertical rigs were flat at 114, while directional rigs added one to 89 and horizontals fell seven to 685.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |