Northeast NatGas Forward Price Weakness Reflects Nymex Strength, Not Market Fundamentals

Some Northeast natural gas forwards markets were resuscitated from Monday May 11 through Thursday May 14, with prompt-month prices falling by the double-digits even as market fundamentals remained fairly stagnant.

The most significant declines occurred at Texas Eastern M3, where June basis plunged 22.1 cents between Monday and Thursday to reach minus $1.236/MMBtu, according toNGI’s Forward Look.

Similar decreases were seen across the front of the curve, with July tumbling 19.4 cents to minus $1.026/MMBtu and the balance of summer (July-October) dropping 17.1 cents to minus $1.167/MMBtu.

But while price weakness is no surprise during the spring shoulder season, a regional trader said the sharp price drops at M3 and other Northeast points are more a reflection of the strength seen in Nymex futures this week.

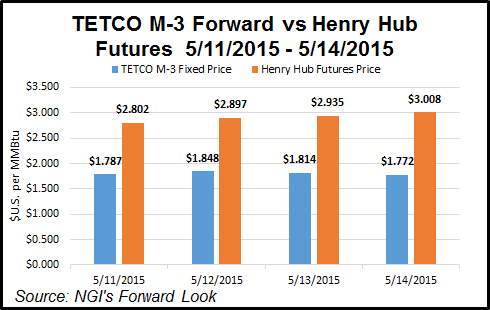

The Nymex June gas futures contract jumped 20.6 cents between Monday and Thursday, largely on storage injections that came in below market expectations.

“The net price has stayed somewhat the same,” a trader said of prompt-month prices at M3 and other Northeast points.

Indeed, the fixed price for June at M3 hit $1.772/MMBtu on Thursday, just 1.5 cents below where it started the week.

A similar trend played out at Transco zone 6-NY, where June basis fell 12.9 cents between Monday and Thursday to minus 29.6 cents/MMBtu, but the June fixed price slipped just 2.8 cents to $2.712/MMBtu.

Despite the current slide in prompt-month prices, rising temperatures and ongoing nuclear outages in the region could reverse the trend and offer basis some support.

Entergy’s Indian Point-3 nuclear plant in Westchester County, New York, shut down May 9 after a transformer caught fire. There was no word on when the unit would return to service.

The shutdown occurred just two days after Exelon’s 630-MW Oyster Creek nuclear plant shut down due to an electrical disturbance on the non-nuclear side of the plant. The plant is expected to remain offline for the next few months as the unit undergoes refueling and scheduled maintenance.

The timing of the plant outages could not be better as weather conditions in the region remain mostly mild, aside from storms that continue to move across the region.

“We expect the pattern late next week through the end of the month to play out in a fairly similar fashion, with weather systems continuing to tack across the northern U..S at times with periods of showers, thunderstorms, and slight cooling,” said forecasters with NatGasWeather. “But besides these nuisance systems, conditions will be relatively mild to warm over the northern U.S., while over the southern U.S., including Texas, temperatures will remain warm to very warm with highs in the 80s to lower 90s, driving moderate demand for cooling.”

Going forward, the forecasters said they will be watching for increasing temperatures as the final days of May approach, as there is potential that high pressure will strengthen over the southern and eastern United States.

Over in the West, NGI has previously noted the rapid pace at which storage stocks are being refilled in California. That trend continues in Southern California, where inventories currently sit at more than double year-ago levels and more than 20 Bcf over the five-year average.

This week, NGI has learned that SoCal Gas is scheduled to being an upgrade to a dehydration unit at the Aliso Canyon storage field, which will reduce withdrawal capacity by 750 MMcf/d.

Maintenance is scheduled to begin May 18 and will last through the summer, with a projected end date of Oct. 16, according to industry consultant Genscape.

“While the summer season typically sees storage fields fill up, SoCal will withdraw from storage during the hottest days of the summer to meet demand from power plants,” said Genscape’s Rick Margolin, senior natural gas analyst.

The highest withdrawal during the May through October period came in 2009, when SoCal took about 1.24 Bcf/d on Sept. 3, Margolin said. More recently, the previous three-year max average is just north of 1 Bcf/d at 1.06 Bcf/d.

“The higher withdrawals occur when Southern California population-weighted temperatures near or exceed the 80.0 degree threshold,” he said.

While SoCal will see a significant capacity reduction at Aliso (40%), the pipeline still has about 1.1 Bcf/d worth of withdrawal capacity at Aliso, and another 1.9 Bcf/d spread throughout three other SoCal operated storage fields, he said.

Meanwhile, the National Oceanic and Atmospheric Administration’s three-month outlook is forecasting an above-normal probability for higher-than-normal temperatures during the latter end of the summer, right when SoCal historically draws from inventory.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9915 | ISSN © 2577-9877 |