MarkWest Processes Record 5.4 Bcf/d, Expanding Texas Plant, Delaying Others

MarkWest Energy Partners LP said it processed a record 5.4 Bcf/d of natural gas and became the nation’s second-largest processor in 1Q2015. The company also announced plans to expand its Carthage Processing Facility in Panola County, TX, to support wet gas production in the Haynesville Shale.

But the Denver-based partnership did not issue any equity for the quarter, and net income declined by more than 65% from 1Q2014 — with a net loss of more than $9 million to its unitholders. It also pushed back the completion dates for seven expansion projects in the Marcellus and Utica shales.

MarkWest reported that it processed 2.84 Bcf/d of gas in the Marcellus in 1Q2015, a 73.4% increase from 1Q2014 (1.64 Bcf/d). In the Utica, gas processing more than tripled between the two quarters, increasing from 251.3 MMcf/d to 755.3 MMcf/d. Processing in the Northeast segment increased 4.1% during the same period, from 255.6 MMcf/d in 1Q2014 to 266.1 MMcf/d in 1Q2015.

In the partnership’s Southwest segment — which includes East Texas, western and southeast Oklahoma and the Gulf Coast — natural gas processing and refinery off-gas processing totaled 1.07 Bcf/d in 1Q2015, a 21.8% increase from 1Q2014 (876 MMcf/d).

The partnership said the Carthage IV expansion would add 80 MMcf/d of processing capacity, which would boost the facility’s total capacity to 200 MMcf/d upon completion in 3Q2015. MarkWest said its utilization rate in East Texas was 96% during 1Q2015, with an average capacity of 520 MMcf/d and an average volume of 497 MMcf/d.

“We’re seeing a lot of successful drilling occurring in the Southwest…We keep doing expansions to match what the producers are pulling out of the Cotton Valley and the Haynesville Shale,” COO John Mollenkopf said during a May 6 earnings call to discuss 1Q2015. He added that the utilization rate at Carthage may be 90% by the end of 2015 or during 1Q2016.

“Today we actually are exceeding 100% on the capacity of the plants that we have, and the foresight that the operations and engineering teams had in East Texas was to install a plant that was capable of doing 200 MMcf/d, but they only initially installed the residue compression for 120 MMcf/d,” Mollenkopf said. “This expansion is very economic and just involves adding the additional compression to the back end of the plant…it’s a really efficient expansion.”

But as the expansion at Carthage moves forward, seven projects in the Marcellus and Utica segments have been delayed.

In the Utica, the completion dates for two expansions — Cadiz III and IV — at the Cadiz Plant, located in Harrison County, OH, were each postponed by one quarter, to 3Q2015 and 2Q2016, respectively. Each expansion will add 200 MMcf/d of capacity. At the partnership’s Seneca Processing Facility in Noble County, OH, completion of the planned Seneca IV (200 MMcf/d) expansion was delayed from 2Q2015 to 3Q2015 (see Shale Daily, Aug. 12, 2014).

MarkWest will also delay completion of processing (200 MMcf/d) and de-ethanization (20,000 b/d) units at its Fox processing complex in Washington County, PA, from 3Q2016 to 4Q2016; completion of the Majorsville VII expansion (200 MMcf/d) at the Majorsville Processing Facility in Marshall County, WV, from 1Q2016 to 2Q2016; and completion of the de-ethanization unit at the Sherwood Processing Facility in Doddridge County, WV, from 3Q2015 to 4Q2015.

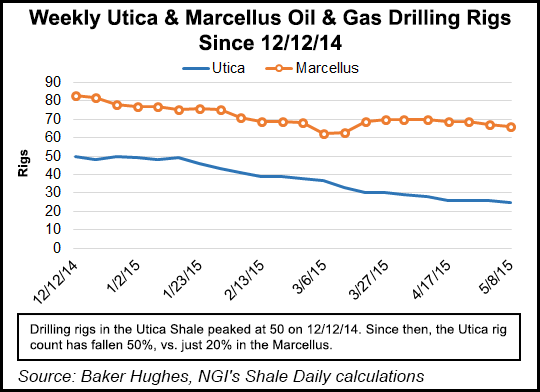

In a note Monday, analysts with Genscape Inc. said that while the number of active rigs targeting the Haynesville had declined to 13 from 21 year/year, the number of new producing wells had picked up in recent months. But Genscape called MarkWest’s decision to delay the completion of facilities in the Utica a “significant” development.

“It appears that the slowdown in Appalachian shale development is further delaying several processing plants in the Northeast,” Genscape said, adding that Cadiz and Seneca “are instrumental in the continued development of the Utica wet gas window, where gas needs to be processed before entering interstate pipelines. These delays build on top of already deferred completion dates from previous quarters.”

During the May 6 call, CEO Frank Semple said the partnership was not seeing shut-ins from where it operates, either in rich or dry gas areas.

“What you’re seeing is producers deciding to optimize our drilling programs and to the best acreage, optimizing their HBP [held by production] objectives,” Semple said. “And in some cases, they are drilling and choosing not to complete wells based on the timing of downstream capacity.”

Semple later added that a reduction in its capital expenditures (capex) in the Utica was “pure and simple, the result of a combination of factors — [including] the reduction in the drilling programs in the Utica by the producers, both in the rich and dry gas areas…We are managing our facility and service dates and capex to better match when those volumes are going to require new facilities.”

On the decision not to issue equity for the quarter, CFO Nancy Buese said analysts “shouldn’t read anything into that, other than we have significantly pre-funded…

“We just did not have a need to go out and hit the equity markets in 1Q2015, and we’ve still got a little bit of room to move. But we will issue equity opportunistically, as we always have, and the predominant vehicle for that in 2015 will be our ATM [at-the-market program].”

MarkWest reported net income of $5.52 million for 1Q2015, down 65.3% from 1Q2014 ($15.9 million). For 1Q2015, the net loss attributable to the partnership’s unitholders totaled $9.08 million (minus 5 cents/unit), compared to net income of $12.5 million (7 cents/unit) in 1Q2014. Adjusted EBITDA for 1Q2015 was $229.7 million, compared to $187.6 million in 1Q2014.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |