All Physical Natural Gas Market Points See Weekly Gains

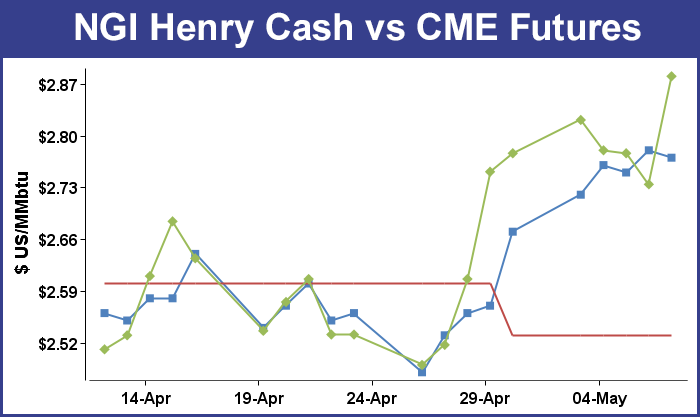

The week saw a solid natural gas market performance with most points adding at least a dime and solid double-digit gains widespread. For the week ending May 8, the NGI Weekly Spot Gas Average rose 17 cents to $2.56. May bidweek buyers who did basis deals off the Nymex not only had the gains of last week to enjoy, but any baseload gas offered onto the spot market this week enjoyed further gains.

The point showing the smallest move was Texas Eastern M-2 30 Delivery in the Northeast with a penny gain to $2.20 and the location showing the largest advance was also in the Northeast, where Iroquois Zone 2 added 43 cents to average $2.98. Regional gains were tightly bunched. The Midcontinent, Midwest, and California all held a tight grip on the cellar with 13-cent rises to $2.59, $2.84, and $2.79, respectively. The Northeast pulled down top honors with a 21-cent rise to average $2.13.

The Rockies added 14 cents to $2.52, and both South Texas and South Louisiana rose 15 cents to $2.68 and $2.72, respectively. East Texas tacked on 16 cents to $2.70.

June futures for the most part were outdone by individual market points, and for the week the contract added 10.4 cents to $2.880

In Thursday’s trading the futures opened up about a penny but the main market driver was the Energy Information Administration (EIA) announcement of an increase of 76 Bcf in working gas storage, a figure largely anticipated by the market. Prices retreated nonetheless. At the close Thursday June was down 4.2 cents to $2.734 and July was off 4.3 cents to $2.785.

Prior to the report the thinking was that this will be the last injection of less than 100 Bcf before what are expected to be some monster 100-plus Bcf builds. This week’s build was supposed to be in line with historical averages, so no major changes to the year-on-year surplus or year-on-five-year deficits were expected.

The reported 76 Bcf build fit nicely with last year’s 75 Bcf increase and a touch ahead of the five-year pace at a 68 Bcf increase. IAF Advisors calculated a 75 Bcf build, and Genscape split the difference between its pipeline model and its supply-demand model. “Our estimate for [Thursday’s] EIA storage announcement is for a 79 Bcf injection for the week ended May 1, about 4 Bcf higher than last year’s same-week injection,” said analyst Tony Franjie. “Our pipeline-based model estimates an 82 Bcf injection, while our supply-demand model has a 61 Bcf. The S-D model has last week’s production at 73.5 Bcf/d and demand at 67.6 Bcf/d.”

Once the number hit trading screens June futures fell to a low of $2.741 and by 10:45 EDT June was trading at $2.754, down 2.2 cents from Wednesday’s settlement.

“I had heard 75 Bcf as an average, and the range was 68 Bcf to 84 Bcf. The initial knee-jerk reaction was lower,” said a New York floor trader. “I think it was about in line with expectations and we are not seeing [prices] out of any of the ranges. We are literally right in the middle of the $2.50 to $3 trading range.”

Inventories now stand at 1,786 Bcf and are 742 Bcf greater than last year and 67 Bcf less than the 5-year average. In the East Region 31 Bcf were injected and the West Region saw inventories increase by 7 Bcf. Stocks in the Producing Region rose by 38 Bcf.

In Friday’s trading both cash and futures markets rose, with overall gas for the weekend and Monday adding 2 cents and futures tacking on more than 14 cents.

Only scattered points in the Northeast on Friday showed gains, and losses reached 5 cents. But those declines were outweighed by gains in the Gulf Coast, Midwest and Midcontinent and elsewhere. Futures prices scooted higher on indications of short-covering prior to the weekend and an unexpected nuclear plant shutdown. At the close, June had risen 14.6 cents to $2.880 and July was up 14.3 cents to $2.928.

“It looks like short-covering,” said a New York floor trader. “I think a lot of guys were short [Thursday], and we couldn’t sell off on the number. We had heard of a nuclear plant going down, but it looked like more short-covering than anything else. There’s a lot of shorts in this market, and if we are not lower Monday it [the rally] could continue. Some guys said $3.25 today, but I thought they were crazy. When you look at supply there is no reason to be where we are and we are here. I am at a loss,” he said.

According to the NGI NRC Power Reactor Status Report, the Exelon 619 MW Oyster Creek Nuclear plant is offline and not producing power. According to reports, the plant shut down due to an electrical disturbance in the “non-nuclear” part of the plant, spokesperson Suzanne D’Ambrosio said. “Operators responded appropriately and all systems functioned as designed,” she said in an e-mail. “Notifications were made to the NRC and state officials as per procedure. The shutdown did not present any public health or safety risks.”

Oyster Creek is about 50 miles east of Philadelphia.

Others saw short-covering as well. “Remember the funds are in the market trading as well,” said a Florida broker. “It’s the weekend, and that provides incentive to close out positions, realize some gains and call it a day. I saw the reports of the storm in the Atlantic, but that didn’t provide a reason to buy. The market hasn’t consolidated enough,” he said.

In its 2 p.m. EDT Friday report the National Hurricane Center (NHC) said subtropical storm Ana was meandering off the coast of South Carolina. It’s position was little changed at about 275 miles south-southeast of Myrtle Beach, SC, and it was sporting winds of 45 mph. It had not moved since the NHC’s 8 a.m. report.

NHC said the storm was expected to move more toward the north-northwest later today. “A turn toward the northwest with a slight increase in forward speed is expected [Saturday].” A tropical storm warning could be issued later Friday.

Going into Friday’s trading, traders saw Thursday’s price slide following a neutral storage report as indicative of market weakness.

“[T]he 76 Bcf injection was much in line with average industry ideas as well as last year’s seasonal upswing,” said Jim Ritterbusch of Ritterbusch and Associates in closing comments to clients Thursday. “But the longstanding deficit against five-year average levels narrowed further to only 67 Bcf, and we look for at least half of this shortfall to be further erased per next week’s EIA report.

“We still expect a couple of triple-digit storage increases to flip the deficit to a surplus in the process of weighing further on nearby futures. We’re still short term bearish-long term bullish.” He added that although the market had failed to reach his sell objective of $2.90, he advises holding on to existing short positions.

“Although this market’s selloff following the release of the EIA report was orderly, a 1.5% decline following a seemingly neutral supply figure is still a bearish portent. We are still not seeing much appetite for the short side of the market on the part of the large funds. But we also don’t see much support off of the weather factor, nor do we see any technical indicators supportive of a long position.”

Going forward, the supply dynamic is expected to change considerably. Tim Evans of Citi Futures Perspective sees triple-digit builds for the next three weeks, which take the current year-on-five-year deficit to a modest surplus by May 22.

Consensus seems to be that those builds are already baked into the market. “You’ll see the market fall off 5 or 6 cents from a big number, then rebound and fall off again. We’ve been stuck in a range and I don’t know if those numbers are going to make a big difference unless we close and stay below $2.50, which hasn’t really happened,” said a New York floor trader. “We are kind of in limbo right now.”

In the physical market next-day prices in the East were mostly lower as spring-like, though above normal temperatures were forecast. Wunderground.com said Friday’s high of 70 in Boston was expected to reach 73 Saturday and 78 Monday. The normal high in Boston in early May is 64. New York City’s Friday high of 82 was forecast to drop to 72 Saturday but climb back to 84 Monday. The normal high in the Big Apple is 69.

Gas for delivery over the weekend and Monday at the Algonquin Citygate fell 13 cents to $1.82, and parcels on Millennium were 8 cents shorter at $1.43. Gas on Tennessee Zone 6 200 L fell 3 cents to $1.95.

Prices in the Mid-Atlantic and Marcellus were mostly mixed. Gas on Transco Leidy fell 3 cents to $1.46, and gas on Tennessee Zone 4 Marcellus added 2 cents to $1.37. Deliveries to Dominion South were seen 7 cents lower at $1.52.

Gas bound for New York City on Transco Zone 6 managed to add 6 cents to $2.83, and packages on Tetco M-3 changed hands 4 cents lower at $1.61.

Major Hubs were mostly higher. Gas at the Henry Hub for weekend and Monday delivery fell a penny to $2.77, but gas at the Chicago Citygate rose 2 cents to $2.77. Gas on El Paso Permian was quoted 2 cents higher at $2.56, and gas at the PG&E Citygate added a nickel to $3.19.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |