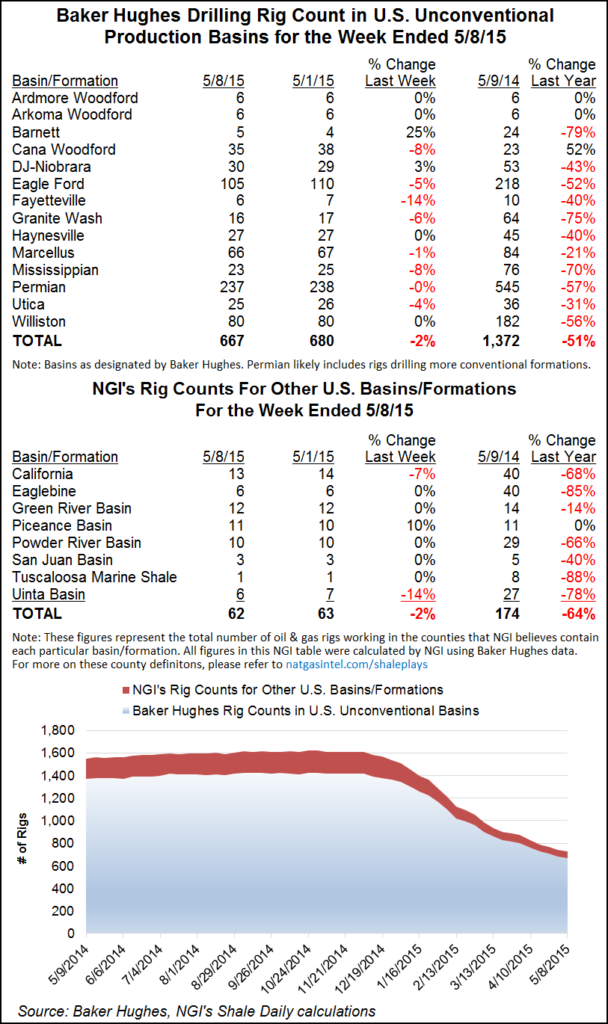

Rig Declines Moderate, Particularly in Eagle Ford, Permian

The liquids-rich Eagle Ford Shale and Permian Basin got something of a reprieve from substantial rig count declines in the latest census by Baker Hughes Inc. as the pullback across all basins was more modest than in recent weekly reports. Meanwhile, analysts are detecting positive trends for crude prices.

In the latest tally, which was recorded for the week ending May 8, the Permian count fell by only one, to 237, while the Eagle Ford lost five rigs, to 105 active. In the previous count, the Permian lost five and the Eagle Ford lost eight rigs (see Shale Daily, May 1).

Overall in the United States, 11 oil-directed rigs were lost compared with only one natural gas-directed rig. Oklahoma — where several producers have recently said they’re increasing their attention on liquids rich plays — lost six rigs, to 102, in the latest count.

While analysts were saying last week that the gas market continues to look oversupplied for the coming months, there were suggestions that supply could be tightening a bit for crude.

In a Wednesday (May 6) note, BMO Capital Markets’ Randy Ollenberger commented on the previous week’s report from the U.S. Energy Information Administration of a surprisingly large pull on crude inventories of 3.9 million bbl. A build of about 1.5 million bbl had been expected. “The surprise draw in crude inventories was the first of the year and should help ease concerns of crude stocks exceeding available storage,” Ollenberger wrote.

Societe Generale, in another note published Wednesday, said crude production had been almost unchanged for the week “and continued to stay broadly on a plateau, with declines expected to start in May.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |