Natural Gas Forward Basis Sluggish, Even as Weak Hydro Output Boosts Gas Burn

Natural gas forward basis markets shifted less than five cents across the board this week despite some significant fundamental changes taking place in key regions.

Most notably, in the Pacific Northwest, gas burn continues to increase thanks to low hydro output in the region. While hydro output typically begins to ramp up in May and peak in June, warmer-than-average weather this spring created an early run-off, and hydro output actually peaked back in February.

So while total power load in the region’s Bonneville Power Administration is on par with previous years, gas burn is up substantially, according to Genscape’s Rick Margolin, senior natural gas analyst.

April gas demand for power generation averaged 345 MMcf/d, the highest since April 2010 and about 118 MMcf/d above the five-year April average due to the low hydro situation, Margolin said.

“Some of the hydro losses have, though, been picked up by wind,” Margolin said. “Load this April has been right at normal, but wind’s share of the portfolio increased to 12% this April versus 10% last April. But gas is still making up the lion’s share of the hydro losses.”

That trend should continue as runoff is expected to not only continue deteriorating, but at a pretty fast rate, he added.

Indeed, Saturday’s roughly 40-day scheduled refueling and maintenance of the 1,170-MW Columbia Generating Station, the only nuclear facility in the Pacific Northwest, will only add support to the gas burn situation in the region.

While such events historically start around the beginning of May, when hydro output is ramping up, this season will be different as hydro output has already reached its peak.

According to BPA generation data, the April-to-May timeframe sees a hydropower generation increase of about 19%, Margolin said. Carrying this assumption for May of 2015, 6,862 GWh of hydro generation is expected in the Pacific Northwest, 22% lower than last year and 19% lower than the five-year average for May.

“With less hydro in the stack, utilities may rely on gas-fired plants more heavily than before for additional generation in the next 40 or so days to come,” Margolin said.

Meanwhile, the water supply forecast from the National Oceanic and Atmospheric Administration for The Dalles Dam shows expected flows through September to be just 76% of the 30-year norm, making 2015 the fifth-worst for stream flows in the past 55 years.

And yet, despite the positive news for gas demand in the region, prices failed to gain any significant traction this week.

Northwest Pipeline-Sumas June basis inched up just 1.5 cents from Monday to Thursday to reach minus 28.5 cents/MMBtu, according to NGI’s Forward Look. The balance of summer (July-October) tacked on 4 cents to hit minus 28.6 cents/MMBtu.

The impacts of a weak hydro season are also being felt in California, although the reliance on gas in that region has not been as significant as in the Pacific Northwest thanks to shrinking power load.

Increased generation from renewables and increased energy efficiency have both helped to keep a lid on gas’ share of the power portfolio, Margolin said.

While total power in the California Independent System Operator footprint came in near normal for April, gas’ share of the generation mix was down 5% from last year, he said.

“The main driver there is an 11% year-on-year increase in April renewables. Obviously, solar is the big star in renewables, but we’re also seeing a big ramp in in geothermal output that started in November,” Margolin said.

In addition, the state’s big push towards energy efficiency has helped moderate load, he said.

While load this April came in fairly normal, this was amid the second warmest April in 10 years, Margolin explained. So, load-per-degree declined, part of a trend that’s been in place the past two years following implementation of the state’s Title 24 building energy efficiency standards.

“As a result of these factors, April gas demand-per-degree (weather-normalized demand) fell to its lowest mark in Genscape’s history set,” Margolin said. “Whereas in April 2012, at normal temperatures, SoCal consumed 2,745 MMcf/d, this past April, SoCal consumed just 2,282 MMcf/d at the same temperatures.”

The gas demand destruction has been so pronounced that it has pushed absolute (non-weather adjusted) demand in April to a record low 2,306 MMcf/d, he added.

“This is notable in light of the fact this was one of the warmer Aprils in recent history,” Margolin said.

And the weak gas burn has had a rippling effect in other aspects of the market.

SoCal storage is currently injecting gas at an above-average pace, with inventories standing at 100 Bcf, more than double year-ago levels and 21 Bcf above the five-year average.

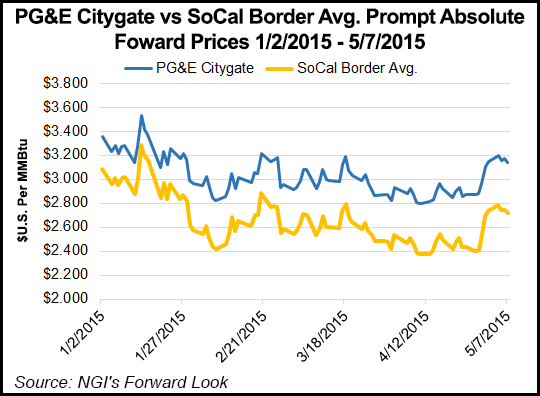

Forward gas prices in the region reflect the bearish picture for gas in the region.

At Pacific Gas & Electric citygates, June basis climbed 2.7 cents from Monday to Thursday to reach plus 40.5 cents/MMBtu, while the balance of summer rose 2.8 cents to plus 41.1 cents/MMBtu.

At Southern California Gas, June was up 1.5 cents to minus 2 cents/MMBtu, and the balance of summer was up 2.4 cents to plus 2.9 cents/MMBtu.

With several more weeks before any significant hot weather moves in the country, forward prices are expected to continue their modest shifts.

Forecasters with NatGasWeather are calling for “very comfortable temperatures” lasting well through the middle of May, but they cautioned that “we continue to see increasing potential for hotter temperatures over western Texas and the southern Plains after May 18, with highs approaching the mid- to upper-90s.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9915 | ISSN © 2577-9877 |