Cash NatGas Unchanged, But Bears Stirring Following Storage Data

Natural gas for delivery Friday overall traded flat at $2.56 in Thursday’s exchanges, but significant differences arose among market zones.

Prices in the East fell as major population centers were expected to enjoy warm spring-like weather, but in the West a major weather system was expected to lower average temperatures by about 10 degrees and Rockies and California quotes rose.

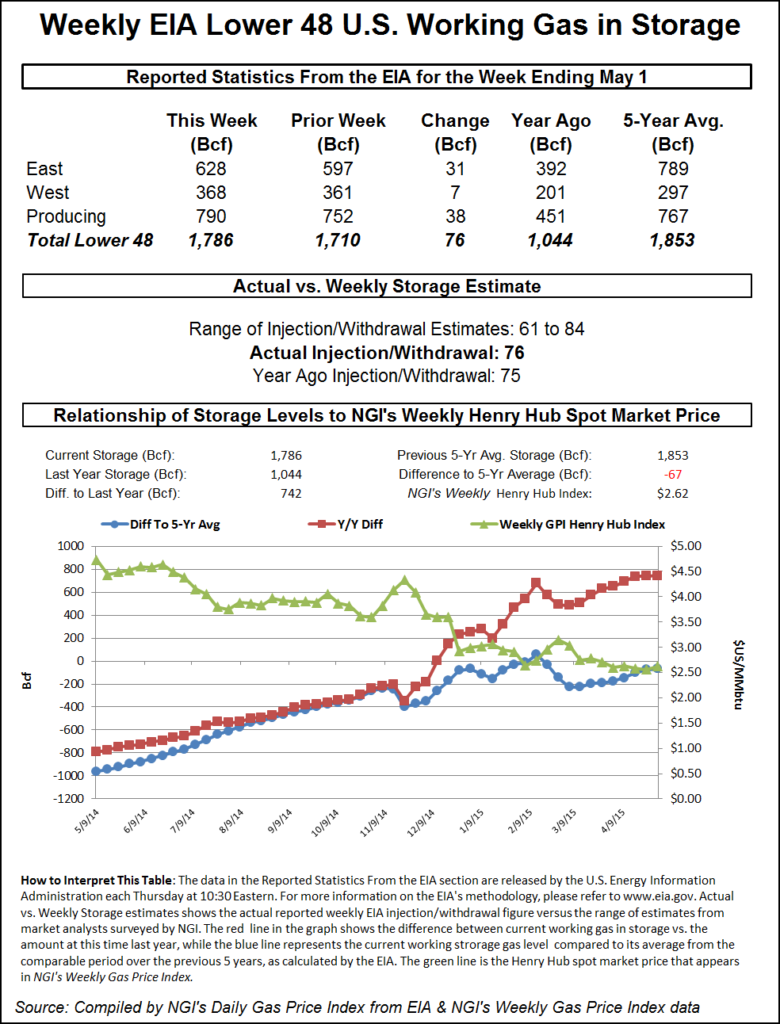

The Energy Information Administration (EIA) announced an increase of 76 Bcf in working gas storage, a figure largely anticipated by the market, but prices retreated nonetheless. At the close, June was down 4.2 cents to $2.734 and July was off 4.3 cents to $2.785. June crude oil tumbled $1.99 to $58.94/bbl.

Traders had all eyes on the screen when the EIA announced natural gas inventories at 10:30 a.m. EDT. Current thinking is that this will be the last injection of less than 100 Bcf before what are expected to be some monster 100-plus Bcf builds. This week’s build is about in line with historical averages, so no major changes to the year-on-year surplus or year-on-five-year deficits were expected.

The reported 76 Bcf build fit nicely with last year’s 75 Bcf increase and was a touch ahead of the five-year pace of 68 Bcf. IAF Advisors calculated a 75 Bcf build, and Genscape split the difference between its pipeline model and its supply-demand model. “Our estimate for [Thursday’s] EIA storage announcement is for a 79 Bcf injection for the week ended May 1, about 4 Bcf higher than last year’s same-week injection,” said analyst Tony Franjie. “Our pipeline-based model estimates an 82 Bcf injection, while our supply-demand model has a 61 Bcf. The S-D model has last week’s production at 73.5 Bcf/d and demand at 67.6 Bcf/d.”

The reported number was close to expectations, hence market volatility was somewhat subdued. Once the number hit trading screens, June futures fell to a low of $2.741 and by 10:45 EDT June was trading at $2.754, down 2.2 cents from Wednesday’s settlement.

“I had heard 75 Bcf as an average, and the range was 68 Bcf to 84 Bcf. The initial knee-jerk reaction was lower,” said a New York floor trader. “I think it was about in line with expectations, and we are not seeing [prices] out of any of the ranges. We are literally right in the middle of the $2.50 to $3 trading range.”

Inventories now stand at 1,786 Bcf and are 742 Bcf greater than last year and 67 Bcf less than the 5-year average. In the East Region 31 Bcf were injected and the West Region saw inventories increase by 7 Bcf. Stocks in the Producing Region rose by 38 Bcf.

Such a modest market response may be history in the weeks to come as the larger 100-plus expected builds give more room for “error” and a variance between trader expectations and actual data. Tim Evans of Citi Futures Perspective is looking for builds of 131, 121 and 139 Bcf, which will take the current year-on-five-year deficit of 75 Bcf to a surplus of 52 Bcf by May 22. He sees the market currently as a contest between short-covering and whether the anticipated hefty supply builds can “put a cap back on prices.” Evans is currently nursing a long position in the June futures contract established at $2.514 when the May contract expired and recommends stop protection at $2.59.

The 100-plus Bcf injections appear formidable, but another factor weighing in on how much gas is likely to make it into storage is coal to gas switching. The trend is for gas to gain market share for power generation at the expense of coal, especially in the East, according to Genscape.

“Coal retirements and lower gas prices have allowed gas to gain its greatest share of East region power burn in at least six years. In April, gas accounted for 34% of total generation from coal and gas combined, exceeding the 33% gas share record set in 2012. This came amid population weighted temperatures this April coming in slightly cooler than 2012,” the company said in a report. “11.12 million MMBtu/d of gas was consumed for power generation in the EIA East last month, versus 21.64 million MMBtu/d of coal was consumed. While that is gas’ highest value in percentage terms, 2012’s volumetric consumption was higher at 11.65 million MMBtu/d for April as some of the region’s load has been served by increased renewables, fewer (smaller) nuke outages, and some efficiency gains.

“Nonetheless, gas’ increased share within the coal-to-gas ratio is consistent with the pricing action and is likely to be sustained throughout this summer. Prompt-month Central Appalachia coal is currently trading at $52.85/ton. After factoring in rail and emissions costs, and an assumed heat rate of 10, power generated from CAPP coal is roughly $30.21/MWh. Power from gas in the Northeast is cheaper than coal as long as the input price of gas remains below $4.00/MMBtu,” Genscape said.

In the day’s physical trading eastern points retreated as a mild temperature regime was forecast into the weekend. Deliveries to the Algonquin Citygate slipped 11 cents to $1.95 and gas on Iroquois Waddington fell 2 cents to $2.91. Gas on Tennessee Zone 6 200 L tumbled 25 cents to $1.98.

Gas bound for New York City on Transco Zone 6 fell 3 cents to $2.77, and deliveries to Tetco M-3 changed hands 29 cents lower at $1.65.

In the West just the opposite weather dynamic was in play. Near-term temperatures were forecast more than 10 degrees below normal with spring-time snowfalls expected in the Rockies. Gas at the Cheyenne Hub rose 8 cents to $2.59 and deliveries to CIG Mainline were seen 4 cents higher at $2.55. At Opal next-day deliveries were quoted 5 cents higher at $2.57 and on Northwest Pipeline WY gas was seen at $2.55, up 7 cents.

AccuWeather.com reported that “a storm will bring a wide range of weather to the West into the Mother’s Day weekend as it drops across California and turns eastward toward the Rockies and High Plains. In addition to spreading cooler air through much of the Southwest, the storm system will bring everything from gusty thunderstorms with spotty hail and locally drenching downpours to blowing dust, a couple of tornadoes and snow.

“Cold air aloft associated with the storm will first create spotty downpours through Friday from California to much of Nevada, Utah and northern Arizona. Rain of any amount is generally welcomed in California at this stage. However, the nature of the pattern will not deliver enough rain to significantly impact the extreme drought,” said meteorologist Alex Sosnowski.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |