Gulfport Shifting to Dry Gas on Slumping Liquids Prices

Gulfport Energy Corp. plans to deploy a fourth rig later this year on the 24,000 net Utica Shale acres it recently acquired to focus on natural gas production in the near-term while crude oil and natural gas liquids (NGL) prices remain depressed.

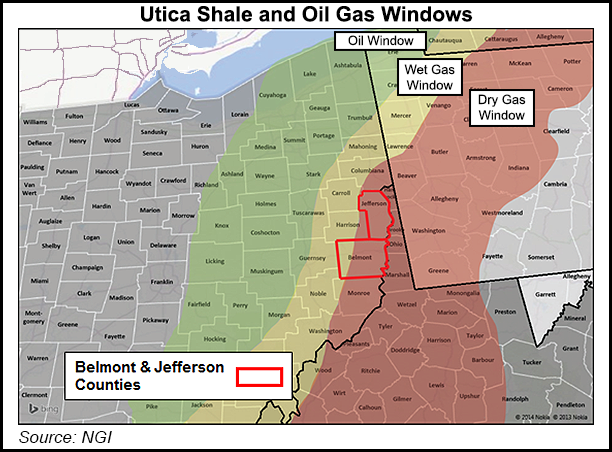

The company acquired the assets in April from private equity-backed Paloma Partners III LLC for $300 million in a deal that should be completed later this year (see Shale Daily, April 16). CEO Michael Moore said a rig would likely be deployed on the properties in Ohio’s Belmont and Jefferson counties in the fourth quarter, with production expected to start sometime early next year. The properties fit “hand in glove” with this year’s shift to dry gas production.

“Our realized NGL price came in slightly lower than anticipated,” Moore said during a call with financial analysts on Wednesday to discuss first quarter earnings. “Gulfport, as well as our peers, expect NGL weakness to continue throughout 2015…To keep all this in perspective, remember that NGLs will account for less and less of production as we approach year-end. We continue to focus on our high return dry gas opportunities in the Utica.”

Gulfport dropped three of its six rigs at the end of last year, but it’s been increasingly focused on the Utica. Canadian oilsands production also has been idled and it has scaled back operations in Louisiana. The company has dedicated 96% of this year’s capital budget to the Utica, where year-over-year production spiked sharply in the first quarter.

Since early last year, Gulfport has continued to beat its guidance (see Shale Daily, Oct. 15, 2014; May 8, 2014). Of the 424.4 MMcfe/d it produced in the first quarter, 396 MMcfe/d was produced in the Utica, a 213% increase from the play’s volumes at the same time last year.

Overall first quarter production increased by 161%, and exceeded quarterly guidance of 378-390 MMcfe/d, helping the company increase revenue and report a profit.

While commodity prices, including hedges, were cut nearly in half, from $8.65/Mcfe in the year-ago period to $3.79/Mcfe in 1Q2015, the increase in sales volume and additional cost-cutting measures helped insulate the company from falling prices. Year-over-year revenue increased from $118 million to $176.3 million.

It has no plans to run a rig in Louisiana this year, where its wells produced 4,545 boe/d in the first quarter. Moore added that an estimated 10% reduction in oilfield services costs are expected to begin in the second quarter. The company may eventually sell its West Cote Blanch Bay and Hackberry fields on Louisiana’s Gulf Coast as well.

“Certainly we’ve been pretty open about potentially monetizing that asset at some point in time, but in this commodity price environment, I don’t think it makes sense to pursue any of those opportunities,” he said, adding that the company is interested in acquiring more Utica assets this year.

Gulfport reported first quarter net income of $25.5 million (30 cents/share), down on lower commodity prices from the year-ago period when net income was $82.6 million (96 cents) and the fourth quarter when it reported a profit of $110 million ($1.28).

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |