Sempra’s Profits Hit Record; Execs Bullish on LNG

The management team of San Diego-based Sempra Energy Tuesday talked up U.S. Gulf Coast liquefied natural gas (LNG) export projects, as well as prospects to add more gas storage, during their first quarter conference call, noting active interest by the market.

President Mark Snell said in the current low-priced oil and gas commodity market, “people lose sight of the fact that there is still increasing demand for LNG worldwide, and we have continued interest” in two proposed export facilities in Cameron, LA and Port Arthur, TX. The proposed facilities “should be the lowest cost providers of LNG around the world.

“We have met with several potential counterparties and customers, and we’re working on agreements to move these projects forward,” he said. “We don’t have anything to announce yet, but we feel good about our prospects.”

Said Sempra CEO Debra Reed, “There is a lot of activity ongoing and a lot of interest in the marketplace still.”

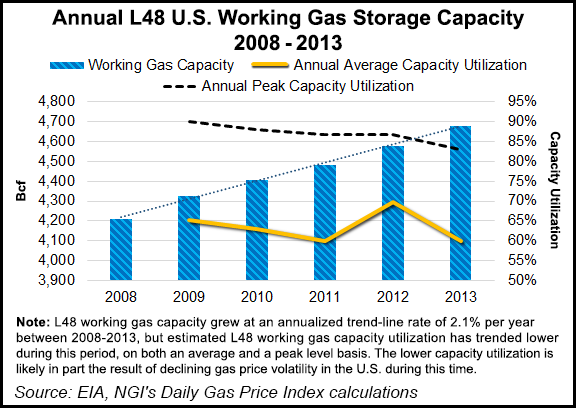

Snell also said there are increasing prospects to add gas storage, albeit on a modest basis. “Things are slightly better on a spot basis, and on a term basis, we’re seeing things that are much better for storage…It is still a very low-priced environment for storage compared to what it was a few years ago, but I would say it is definitely on an uptrend.”

For LNG specifically, Snell said Sempra and others “see the opportunity for storage” along the Gulf Coast, which would be tied into multiple export terminals planned in the region.

“The difference between this type storage and other types in other areas is that the facilities that will serve the LNG terminals will have a lot more compression so their injection rates will be a lot higher than the typical storage facility,” Snell added.

Sempra is currently working with two customers on its Louisiana storage facility, and he expects to be able to talk about that more before year-end. “It looks exciting, and we will have something to talk about.”

Net profits in the first quarter reached a record $428 million ($1.71/share), compared with $256 million ($1.03) in 1Q2014. Gas utility Southern California Gas Co. added about $113 million in profits during 1Q2015.

The LNG unit’s profits fell by $5 million year/year because of a decline in gas prices, Snell told analysts. Gas was trading for about $3.00/Mcf in the first quarter, versus $5.00 a year ago, and marketing profits should pick up as gas prices move higher, he said.

CFO Joe Householder said Sempra soon may seek board approval to form a total return vehicle (TRV) around some of its assets,. such as renewables, LNG operations and projects in Mexico.

On a financial basis, a TRV is more akin to a master limited partnership (MLP) than to a so-called “yieldco,” said Sempra executives. The TRV is a “publicly traded partnership” in the vein of an MLP, Householder said.

Sempra would be the general partner in a publicly traded MLP. That partnership would hold Sempra midstream and LNG assets, and other assets that would qualify under the rules. The publicly traded parent unit in the setup would essentially be an MLP, Householder said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |