Oil-Directed Rig Count Falls as ‘New Resiliency’ Noted For Production

The Texas rig count fell again in the latest Baker Hughes Inc. tally of active rigs, released Friday (May 1), and oily plays led the charge as producers continue to seek to balance supply with demand.

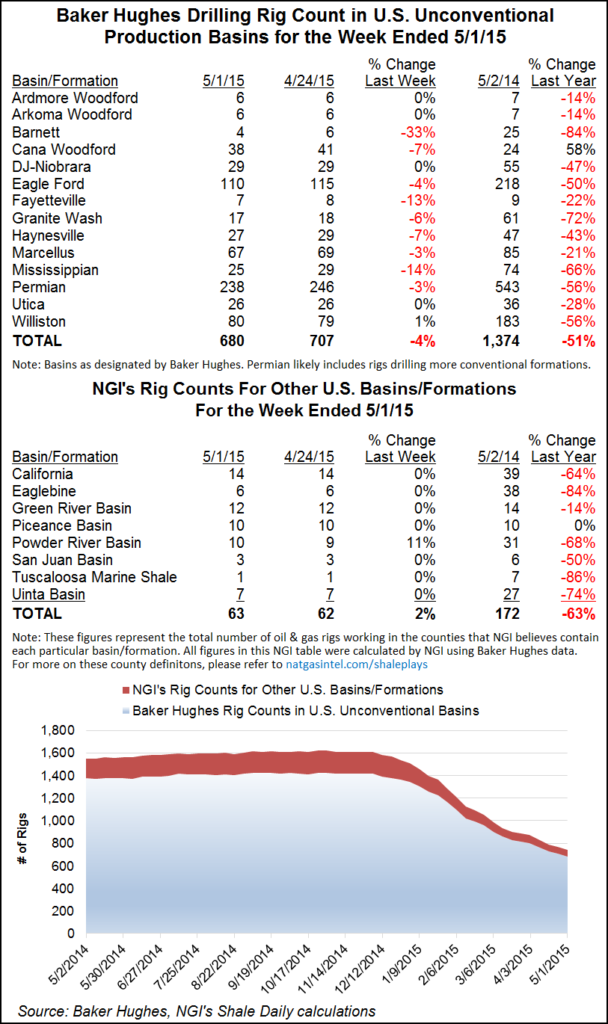

The Lone Star count fell to 380 from 393 in the previous week, led by declines in the Permian Basin (down five) and Eagle Ford Shale (down eight).

The Williston Basin added one rig. Overall for the United States, the oil-directed rig count declined by 24, all of the rigs departing from land jobs. Canada gained one oil-directed rig.

“To sustain the recent oil price rally, the market must be supported by firm demand and a tangible supply response,” Barclays analysts said in a note published last Monday. “These drivers must not only clear the current market imbalance, but also draw down inventories built over 2014. Inconsistent supply and demand data points, as well as volatility in recent economic data (especially from the U.S.), lead us to take a cautious view on further oil price appreciation over the near term.”

Barclays cited recent data from the U.S. Energy Information Administration that reveal that “… production from the Lower 48 states show a new resiliency of U.S. tight oil production compared to last year’s estimates.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |