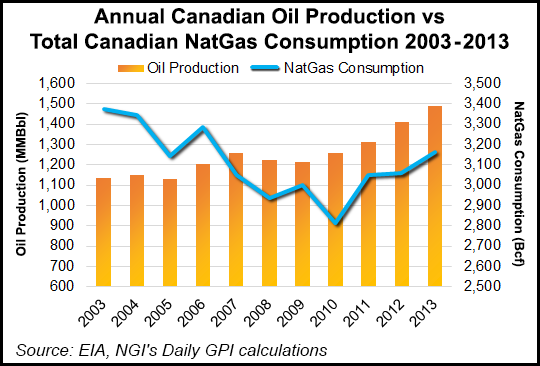

Oilsands Efficiency Gains Hard Fought as Gas Consumption Remains High

Natural gas consumption for thermal oilsands extraction — Canada’s biggest, fastest-growing industrial fuel burner — stubbornly resists efficiency efforts and could increase faster than bitumen output, according to a new industry review.

Gas use in still-expanding Alberta projects may climb to 4.4 Bcf/d by 2035 — fully 1.06 Bcf/d more than previously forecast, according to an update to the Canada’s Energy Future textbook crafted by the National Energy Board (NEB).

The most fuel-hungry extraction methods — cyclic steam stimulation (CSS) and steam assisted gravity drainage (SAGD) — drive 70% or more of the emerging next generation of oilsands production, according to records of the NEB and Alberta Energy Regulator (AER).

Both techniques boil bitumen into separating and flowing out of sandy black ore in situ, or underground, by injecting steam from gas-fired boilers into deposits too deep for the open-pit mining that dominated the field’s pioneer stages in the 1960s, ’70s and ’80s.

Even the world’s biggest shovels and trucks only work in 4,750 square kilometers (1,900 square miles) or 3% of the Florida-sized, 140,000-square-kilometer (56,000-square-mile) bitumen belt that spans northern Alberta. As total production, currently about 2 million b/d, keeps on rising toward a projected range of 3 to 5 million b/d, the role of in-situ methods is expected to expand continuously.

In CSS, also known as huff-n-puff, periods of steam injection and underground heat soaking or simmering alternate with oil pumping. Arrays of multiple angled or vertical wells perform both roles.

In newer SAGD, parallel pairs — or more recently, triplets — of horizontal wells pump steam in and oil out simultaneously. Both methods will be used by the newest in-situ plant, the Carmon Creek project currently under construction to produce an initial 80,000 b/d with 800 wells from a lease estimated to contain 4.9 billion bbl.

Despite efficiency campaigns since in-situ production began in the 1980s, steam volumes and gas use remain highly variable, NEB said.

The industry benchmark — the steam-oil ratio (SOR), comparing barrels of water boiled to barrels of oil produced — still ranges from 1.5:1 to 6.8:1, according to the NEB and AER records.

Performance has modestly improved since 2009, when high gas prices and environmental pressure for water conservation inspired efforts to reduce SORs of 2:1 to 7.5:1.

“It is unclear where the overall values are trending,” according to the update to Canada’s Energy Futures.

The new report emphasizes that the NEB is not predicting supply and demand, but only using the latest available information to calculate “sensitivities” or effects of technical and economic factors on scenarios for oilsands development and gas consumption.

“Much of the incremental production…will involve exploiting new reservoir types with methods which have unknown natural gas intensities,” the report said.

Gas use in the oilsands remains farther beyond control by plant engineers than previously expected. The nature of Alberta bitumen deposits is turning out to be highly variable as established projects expand and new ones spread out across the formations.

The geology includes horizontal rock layers that provide natural insulation, disrupting orderly heat and oil flows. Quality and shapes of bitumen layers also vary, forcing projects to adapt continuously to changes in underground conditions.

“Recent projects have encountered increasing levels of heterogeneity in the reservoir rock. This has increased the steam requirements for many facilities,” NEB said.

Industry continues to work on an array of improvements, including substitutes for gas-fired steam, such as solvents that wash oil out of sandy ore, and electric heating elements that create an underground toaster effect.

Along with roller-coaster oil prices, unknowable results of forays into new technology that take years to scale up from laboratory experiments into field trials and commercial plants keep the future of Alberta bitumen production hard to predict, NEB said.

“Higher or lower SOR values, implying higher or lower productivity and-or natural gas requirements by projects, may alter project economics and impact production growth and therefore affect total oil sands natural gas requirements.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |