Range Resources Betting on NatGas Demand Growth Later This Year

Range Resources Corp. is counting on better results in the second half of this year after a first quarter in which low commodity prices squeezed profits and cut revenue, despite strong natural gas and liquids production from the Marcellus Shale.

The Houston-based operator produced 1.32 Bcfe in the first quarter, up 4% sequentially from 1.27 Bcfe and 26% from 1Q2014’s 1.05 Bcfe. While liquids accounted for about 33% of volumes, they are expected to decline to about 30% in 2Q2015 as prices have fallen by 55% since 1Q2014 to $12.20/bbl.

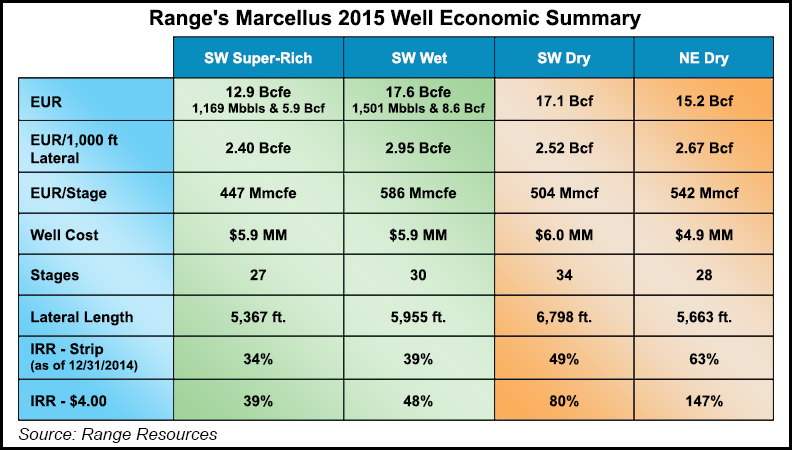

The company is continuing to shift its rigs to dry gas acreage in Pennsylvania, where it’s the state’s leading natural gas liquids (NGL) producer (see Shale Daily, Feb. 17).

Most of the quarter’s production came from the southern Marcellus division, which produced 887 MMcfe/d. The division tested a Marcellus well in Washington County, PA, at a 24-hour rate of 43.4 MMcfe/d, which the company said is a record.

CEO Jeff Ventura continues to promote an upcoming rebound in natural gas prices, and he cited several factors that may improve demand: more fuel switching from coal to gas; gas and ethane exports that may start later this year; a drop in associated gas from fewer oil wells; and narrowing Northeast basis as Appalachian infrastructure is built. “Additional natural gas demand is coming, and coming in a very meaningful way,” he told financial analysts on Wednesday during a call to discuss first quarter results.

COO Ray Walker said “our growth profile over the next three quarters shows production being more heavily weighted to the third and fourth quarters, just as it has been in the past and it should set us up well with momentum going into 2016.”

Range management had little to say about its 360,000 net acre position in the Midcontinent. Ventura noted that the program is averaging about 75 MMcfe/d and continued to say a sale was not out of the question (see Shale Daily, Feb. 25). About 95% of this year’s $870 million capital budget has been allocated to Pennsylvania’s Marcellus, where Ventura said the company could be looking to shift more capital as early as next year to its deep dry gas Utica prospects.

In December, the company tested its first Utica well in southwest Pennsylvania’s Washington County at peak rate over 24 hours of 59 MMcf/d (see Shale Daily, Dec. 15, 2014). Range turned that well to sales in January, and it has since produced 1.2 Bcf. The company has another two wells scheduled to come online at the same pad later in the year.

“We’re doing a lot of planning for a success case,” Ventura said. “How would we move the gas? And also the key then will be as we get to the end of the year and we have three wells and longer production history, what do the economics and returns look like? It could be a change in capital efficiency or another way to grow with better returns. To the extent it looks like that at the end of the year — and it could — we could work the Utica into our 2016 and 2017 programs and beyond.”

Next quarter, Range expects to start sales of 20,000 b/d of ethane on the Mariner East pipeline to the Marcus Hook terminal near Philadelphia through an export agreement with INEOS Europe AG (see Shale Daily, Sept. 28, 2012). It also expects to save more on the propane its ships on Mariner East at that time.

Net income dropped in 1Q2015 to $27.7 million (16 cents/share) from year-ago profits of $32.5 million (20 cents) and from 4Q2014 earnings of $284 million ($1.68). Revenue was flat year/year and slid 47% sequentially to $463 million. Realized gas prices continued to fall, to $3.54/Mcf in 1Q2015 from $4.20/Mcf in 1Q2014.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |