NGV Growth Most Likely Through Incentives, Heavy-Duty Fleets, Say Experts

There was a noticeable lack of bullishness, just straight talk on the prospects for natural gas in transportation by a panel of experts at last week’s IHS CERAWeek in Houston.

The panelists offered an affirmative response to the question of whether alternative fuels and vehicles would survive low oil prices, but the consensus was that the use of natural gas vehicles (NGV) may not grow quickly.

The panel included In Ryder System Inc. Vice President Scott Perry, Clean Energy Fuels Corp. COO Mitchell Pratt, Daniel Sperling, professor and alternative transportation expert at the University of California, Davis (UC, Davis); and Levi Tillemann, a fellow at the New America Foundation. Tiffany Groode, IHS director of automotive scenarios advisory services, moderated.

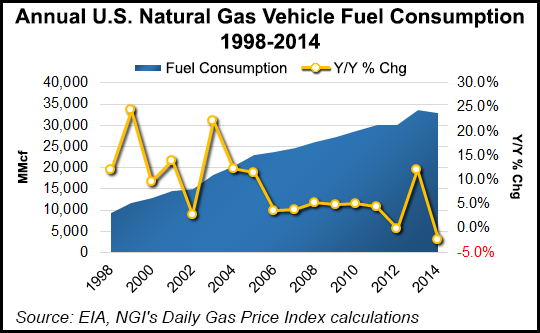

The future composition of automotive fleets is at best uncertain, and the NGV market share and other alternatives face both innovation and investment challenges, the panelists noted. Energy Information Administration (EIA) data on NGV fuel consumption backs up some of those concerns.

According to the EIA, 2014 marked the first year-on-year decline in fuel consumption for NGVs in the United States since the government agency began keeping track of the stats in 1997.

In 2013, U.S. natural gas vehicle fuel consumption registered at 33,624 MMcf, but in 2014, that number declined by 2.3% to 32,850 MMcf.

Groode said the panelists agreed that public policy incentives would remain a key driver for whatever innovations lie ahead. “While the price of oil factors into new vehicle purchase decisions, it is less relevant than other consumer preferences.”

The regulatory environment is “the most important driver” for innovation in heavy duty vehicles, according to Perry. Ryder rental and leasing operations increasingly involve a strong mix of NGVs and other alternative fueled vehicles (see Daily GPI, May 21, 2012).

Perry noted that Ryder is less enthusiastic about NGV trucks now compared to 12-18 months ago, but customers with longer term views still have significant interest in natural gas. Fleet operators can lease NGV trucks from Ryder and avoid the higher capital costs associated with the NGVs.

Pratt reiterated the importance of government mandates and tax credits in the adoption and innovations of alternative fuel vehicles. He downplayed the importance of the drop in oil prices, noting that natural gas prices are lower too. He said natural gas would continue to play a big role in the heavy duty vehicle fleets, given the abundance of U.S. supply, but beyond that a “build-up of economies of scale” with expanded fueling infrastructure is key.

Public policy incentives are needed to encourage fueling infrastructure, particularly in the hydrogen vehicle space, he said.

Sperling, who doubles as director of the Institute for Transportation Studies at UC, Davis, said gasoline and diesel are by far the preferred fuels and the internal combustion engine the leading technology for vehicle purchasers. However, he conceded that “motivations” have changed. He sees a greater emphasis on air quality and greenhouse gas emissions among fleet operators and individual automobile buyers.

Auto companies have succeeded in making more efficient engines and that is putting the transportation sector on the verge of a major transformation, Sperling said.

Tillemann concentrated on electric vehicles (EV), and predicted that they would do better in the long run than hydrogen vehicles. For now, there is a slowdown in EV sales, but that is just a sign buyers are waiting for the next generation of vehicles that will be more attractive and have longer ranges. Ultimately, public charging station infrastructure will be a key hurdle for EV adoption.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |