Texas Rig Count Proves Again: The Bigger They Are…

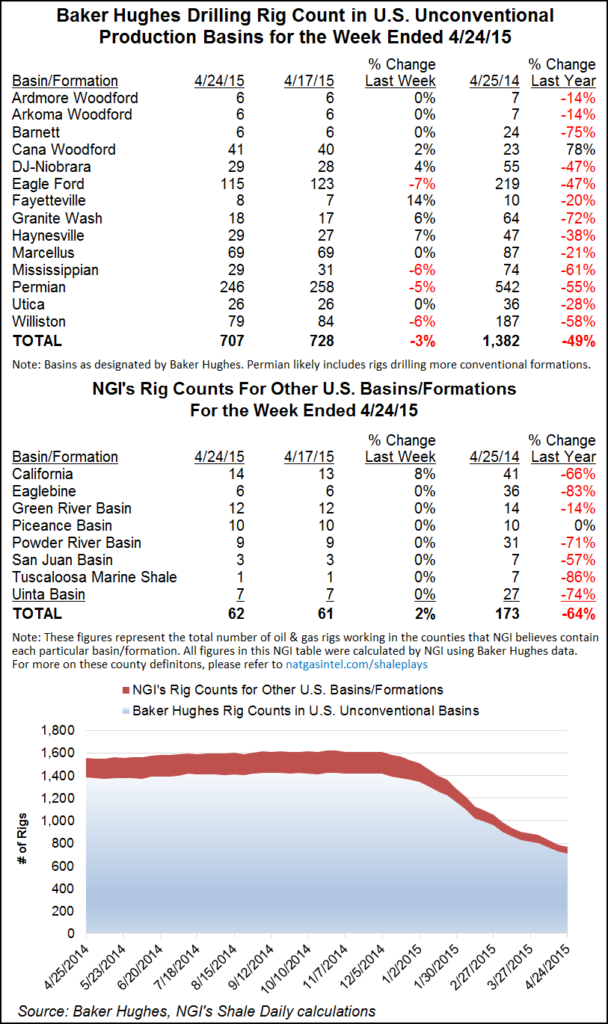

The count of active rigs drilling for either oil or natural gas in the Lone Star State busted below the 400 barrier in the latest Baker Hughes Inc. rig count as the rout continued in the nation’s oil patch. The U.S. crude-directed rig count fell 31 to 703 in the latest count.

That’s down 4.2% for the week and 56.3% since the Oct. 10 peak. Meanwhile, the U.S. Department of Energy crude oil production estimate is up about 12% from last year.

At 393 rigs active in the April 24 count, Texas saw 19 rigs lie down to wait for higher commodity prices. The Permian Basin lost 12 rigs, and the Eagle Ford gave up eight. The Barnett Shale held steady at six, which is one-quarter its year-ago census of 24.

Meanwhile, other shale gas plays got more attention from drillers. The Fayetteville Shale gained one rig, and the Haynesville added two.

Societe Generale in a Thursday note said it is looking for crude production to plateau “soon, in May. Based on this, we have higher conviction in a balanced second half,” the firm said. “We also have evidence that the global rebalancing process, taking place on the back of U.S. shale oil, is finally getting under way.” The firm raised its crude price forecast but said it’s still bearish for May and June due to builds in crude stockpiles.

There was less joy to be found in a note last Monday from Raymond James & Associates Inc.

“We hope everyone (well, if you’re long) enjoyed the recent mini-rally in oil prices. Enjoy t while you can because we don’t see much more room for oil to run in the near term,” Raymond James said. “It remains our view that both WTI and Brent need to be meaningfully higher by late 2015 to enable a rebound in next year’s capital budgets, but over the next six months or so, we think oil will be mostly range-bound.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |