Handful of Rigs Creep Back to NatGas Plays in Latest Count

It’s too early for natural gas lovers to gloat, but judging by the latest Baker Hughes Inc. rig count from Friday, the dry stuff could be making a bit of a comeback compared with oil, for which gas was forsaken all those many months ago.

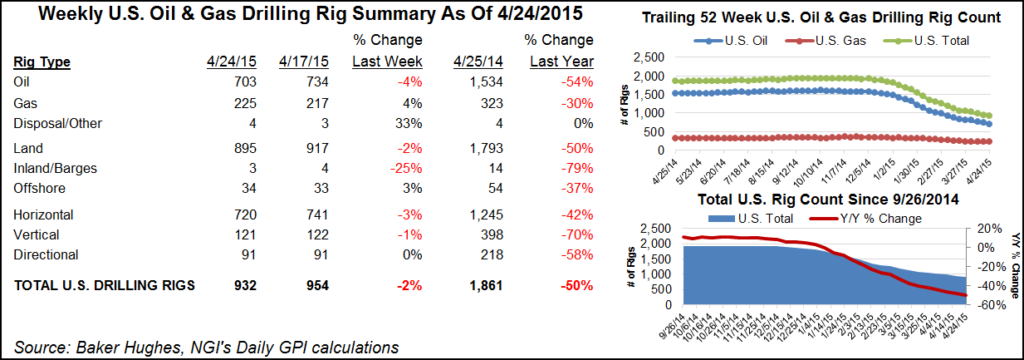

The United States lost 31 oil-directed rigs but gained eight gas-directed rigs in the latest count. In Canada, the number of oil-directed rigs fell by four, but the gas-directed tally added three.

Plays known for their dry gas — long out of favor since the days of $100/bbl oil and producer success at applying hydraulic fracturing in the oil patch — have been getting a bit of love lately. While the Barnett Shale only managed to hold steady with six rigs, the Fayetteville Shale gained one rig and the Haynesville added two. Back in December Comstock Resources Inc. said it would be an early re-adopter of the Haynesville (see Shale Daily, Dec. 18, 2014).

Meanwhile, Texas’ oilier Eagle Ford and Permian Basin continued to take it on the chin, with the Eagle Ford losing eight rigs and the Permian down by 12. Texas lost a total of 19 rigs in the latest count.

The Williston Basin rig count declined by five; it’s no coincidence that oily Bakken Shale home state North Dakota saw its count fall by five.

Producers shifting to natural gas from oil might have something to look forward to in the form of higher prices — but they’ll have to wait for it. The first tanker to leave the U.S. Gulf Coast loaded with liquefied natural gas — perhaps as early as by the end of the year — will be their Love Boat. And then there’s all that low price-driven gas demand growth.

BNP Paribas’ Teri Viswanath, director of commodity strategy for natural gas, has pored over the Energy Information Administration’s (EIA) Annual Energy Outlook, in which the agency projects natural gas price recovery in about two years. In a note Friday, she wrote that she’s more bullish than that.

“While we likewise see higher prices ahead, the heavier demand response we project suggests that the EIA may be underestimating both the timing and magnitude of the recovery,” Viswanath wrote. “…[R]ising export and domestic demand growth will ultimately push U.S. natural gas prices back above $4/MMBtu sooner than the market anticipates.”

“Sooner” doesn’t mean soon, though.

“…[W]e have revised our 2015 price forecast lower to $2.85/MMBtu compared to the $3.00/MMBtu predicted last month,” Viswanath wrote. “The hard-won balance we see occurring this year, however, still paves the way for structural demand recovery we see in 2016. Hence, we retain the same upward price profile introduced in February, with delivered prices still expected to gain $1.00, averaging $3.75/MMBtu in 2016.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |