Southwestern’s Natural Gas Output Up on Efficiencies, Expanded Takeaway in Appalachia

Southwestern Energy Co. again managed to score some upside in a down market during the first quarter, capturing benefits through long-honed efficient drilling practices, as well as growing natural gas takeaway capacity in Appalachia.

The Houston-based independent, which has taken a bigger bet on Appalachia after building its business through the Fayetteville Shale, issued solid quarterly production results on Thursday, and management held a conference call to discuss the results on Friday morning.

“As we do every year, we have begun 2015 with the same focused approach on generating strong returns with a platform for significant growth for our shareholders in any price environment,” said CEO Steve Mueller. “Our first quarter results once again demonstrated the strength of our portfolio, which continues to deliver economic projects at current prices due to the quality of our assets, our focus on maintaining our low cost structure and our differentiating firm transportation capacity.”

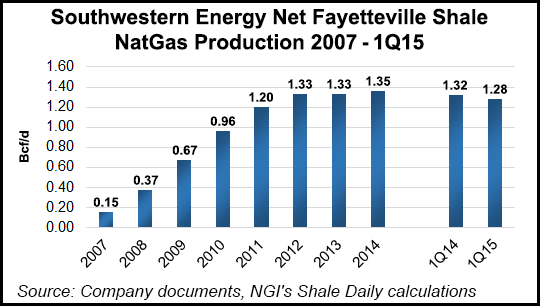

Natural gas, oil and liquids production totaled 233 Bcfe in 1Q2015, 28% higher year/year and nearly all gas-weighted. Most of the output continued to be from the bread-and-butter Fayetteville, where production was 115 Bcf, 4 Bcf lower than a year ago, which was attributed to an icy January. In northeastern Appalachia, gas output climbed 43% to 83 Bcf from 58 Bcf. Southwestern Appalachia acreage, acquired only a few months ago, contributed 30 Bcfe.

Companies “typically…like to guide production higher, and if I’m pushed today, I’d say we expect to be at or slightly above the upper guidance of 950 Bcfe/d in 2015,” Mueller said. However, “we’re not changing our production guidance yet because other key items are also in flux. We certainly want to see more of the second quarter before taking a better guess whether to revise our guidance on basis differentials” in the Northeast.

In addition, Southwestern already has identified $120 million “of capital reductions that do not affect production,” related to better deals with oilfield service companies and its vendors. “These include the way we fracture stimulate, 2015 cost savings and just plain fine-tuning of the budget,” said the CEO. “Even larger savings may be recognized with a little bit more knowledge…Just assume better production, lower capital and no detrimental effects to 2016 or beyond.”

Operations chief Bill Way, who took over as president in December, attributed the gains in Appalachia to two large transactions, one with Chesapeake Energy Corp. in October, the other with WPX Energy Inc. in December (see Shale Daily, Dec. 3, 2014; Oct. 16, 2014). Each of the transactions included not only producing acreage but firm transportation capacity agreements.

“We were moving approximately 1.15 Bcf/d in Northeast Appalachia on March 31 and realized a natural gas price of $2.92 for the quarter,” Way said. “This represents a benefit of $150 million, or $1.61/MMBtu, versus selling natural gas without the benefit of Southwestern’s firm capacity.”

The transaction with WPX closed in January, which “puts us in an even better position with our firm transportation portfolio, ensuring we will be able to continue our impressive growth in this asset and get our production to market with competitive pricing. In addition to the pricing benefits Southwestern received from its natural gas, the company was able to use some of the unused capacity from our firm transportation portfolio to generate additional margin on third-party gas, where we created $2.5 million in additional margin.”

Securing sufficient capacity to transport Appalachian gas to premium markets is a priority. With northeastern bottlenecks alleviated, Southwestern is attempting to expand takeaway from the southwestern area, which extends into West Virginia.

“On the marketing front, we’ve heard some feedback from some analysts that there’s some concern whether we’ll be able to get our production to market as we develop these assets,” Way said. “Well, after only four months of operating these assets, I can say that we’re well on our way to implementing the plan that we identified during the acquisition evaluation.”

Way was hesitant to offer many details but said they would be forthcoming “in the very near future. We are in active discussions with a number of parties and we are very confident of our ability to acquire sufficient capacity out of the region…We feel even more comfortable about the state of the available infrastructure than we did in our original assessment. We believe the potential pipeline challenges can be mitigated, just as we did in northeast Pennsylvania and Fayetteville before that.”

The Fayetteville still is part of the mix, but it’s a lower priority for the most part, said Mueller.

“Capital allocation is fairly simple as long as you don’t have constraints,” he said. “You’re always going to put the capital where the best economics are at. But you have constraints. We’ve debottlenecked, basically, Northeast Pennsylvania, and as we get more capital available, and as we get pricing that’s a little bit stronger, I expect us to go faster there and grow into that firm capacity that we recently purchased.”

Southwestern Appalachia has “comparable economics,” but more takeaway capacity is needed “and that will happen over the next couple of quarters. Once that happens, we can start going faster there.”

Meanwhile, the Fayetteville now “is swing for us. It’s got good economics, but it’s a little bit less than those two areas, so that’s where you are going to make your swing…If pricing doesn’t even come close, and we’re in a $2.00 world eight months or nine months from now, the first place we’re going to start backing down is the Fayetteville Shale.”

All hasn’t been said and done as far as expanding the portfolio. New ventures always are a possibility, but they have to be “something better economically than whatever we have…That should be a major reason we do it.”

On the operations front, 22 wells were placed on production in northeastern Pennsylvania in the quarter. The average initial production (IP) rate was 8,217 Mcf/d, with average lateral lengths of 5,090 feet and costs of $5.8 million/well. Those figures compare with the fourth quarter, when the average IP rate was 6,922 Mcf/d on 26 wells that had average lateral lengths of 5,333 feet and costs of $5.9 million/well.

At the end of March, 349 operated wells were producing in the region, with 95 wells in progress. Nearly all of the 348 Pennsylvania wells were horizontals, with 198 in Susquehanna County, 129 in Bradford County and 21 in Lycoming County. Of the 95 wells in progress, 35 were either waiting on completion or being tied to sales.

In the newly acquired West Virginia acreage, 13 wells ramped up during the quarter, and five new wells were drilled to total depth in 19 days. Four wells were completed and are scheduled to be tied to sales by the end of June. At the end of March, the company had 300 operated horizontals producing and 35 wells in progress across the southwestern Appalachia holdings. Nearly 85% of the operated horizontal wells producing were in wet gas acreage, while of the 35 wells in progress, 14 were waiting on completion. Two drilling rigs were running at the end of March, one company-owned, with plans to exit the year with four rigs.

Southwestern also placed 99 horizontals on production in the Fayetteville with average IP rates of 4,357 Mcf/d, completed well costs of $2.8 million/well, lateral lengths of 5,875 feet and time to drill to total depth of 7.2 days. That compares to the fourth quarter, when 97 Fayetteville horizontals were placed on production with average IP rates of 4,840 Mcf/d, lateral lengths averaging 5,547 feet, time to drill to total depth of 7.2 days, and completed per-well costs of $2.7 million.

Although production rates were higher, net income plunged year/year to $84 million (22 cents/share) from $231 million (66 cents). Net cash from operations was $493 million, compared with $617 million in 1Q2014. The big hit to profits came from operating income, down year/year to $78 million from $352 million, primarily on lower realized gas prices and increased operating costs/expenses from higher activity in the Northeast.

Average realized gas prices were down by more than $1.00 to $2.99/Mcf from $4.19. Hedging increased the gas price by 36 cents/Mcf, versus a decrease of 44 cents in the same period a year ago.

Southwestern, like many producers, typically sells its gas at a discount to New York Mercantile Exchange (Nymex) prices; the discount includes a basis differential, third-party transportation charges and fuel charges.

Disregarding the impact of hedges, the company’s average gas price in 1Q2015 was 35 cents/Mcf lower than average Nymex settlement prices (12 cents/Mcf across Appalachia operations), compared with 31 cents/Mcf lower in 1Q2014. Gas was 15 cents/Mcf higher in the northeastern part of the company’s Appalachia portfolio. As of April 21, 245 Bcf of remaining 2015 expected gas production was protected “from the potential of widening basis differentials” through hedging and sales at an average basis differential to Nymex of minus 23 cents/Mcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |