Contractors Fret as Physical NatGas, Futures Grind Lower

Natural gas for delivery Friday eased in Thursday’s trading as traders generally elected to get deals done before the mid-morning release of government storage data.

The overall market was down 2 cents at $2.41, and all sections of the country were lower by about a nickel with the exception of the Northeast, where forecast freezing temperatures lifted quotes nearly a dime.

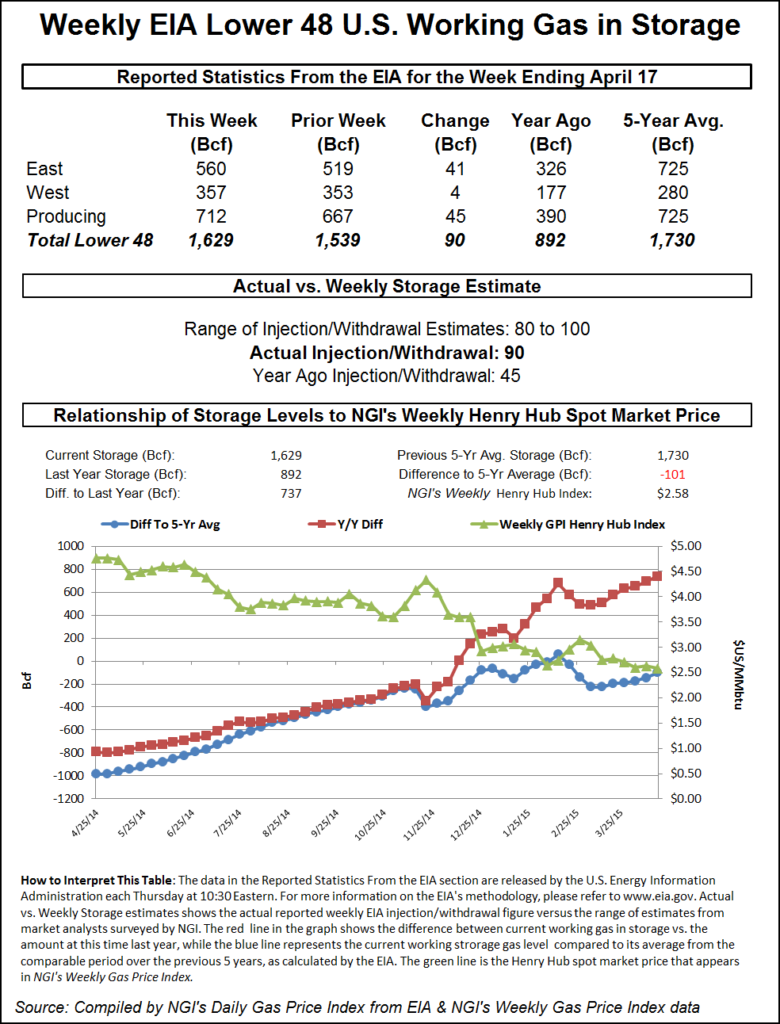

Futures trading was equally uninspired, with the market unable to get out of its own way and posting losses following the release of storage data. The Energy Information Administration (EIA) reported a build of 90 Bcf, just a couple of Bcf higher than what the market was expecting, and at the close May was lower by 7.5 cents to $2.531 and June was off 8.5 cents to $2.569. June crude oil rose $1.58 to $57.74/bbl.

Forecasts of New England cold kept eastern and Marcellus quotes well bid. Wunderground.com predicted the high Thursday in Boston of 51 would reach 55 Friday and 57 Saturday. The seasonal high in Boston is 58. Providence, RI’s Thursday high of 49 was seen reaching 55 Friday and climbing to 59 by Saturday, still 2 degrees below normal.

Gas at the Algonquin Citygates for Friday delivery changed hands at $3.80, up 23 cents, but deliveries to Iroquois Waddington were down a penny at $3.00. Gas on Millennium rose two cents to $1.29.

Marcellus points were also firm. Gas on Transco Leidy added 15 cents to $1.53, and parcels on Tennessee Zone 4 Marcellus gained 15 cents to $1.29. Gas on Dominion South was flat at $1.69.

The National Weather Service (NWS) in southeast Massachusetts said, “Freezing temperatures are expected in at least 50% of north-central and northeast Connecticut [Friday]. Freezing temperatures are possible in parts of northwest Rhode Island. Expected coverage is less in southeast and coastal Massachusetts. NWS said it would also issue freeze warning for eastern Connecticut and western Rhode Island.

Out west the issue wasn’t so much cold as wind. Heavy winds across the Pacific Northwest prompted a decline in next-day power prices as well as physical gas.

“The Mid-Columbia has gone from $20/MWh down to $16/MWh for next-day bilateral deals, and the gas sendout has dropped about 70,000 MMBtu between the 21st and 22nd,” said a trader with Energy GPS, a Portland, OR-based power and natural gas consulting firm. “There was a pretty big drop in gas nominations and prices dropped. Friday gas at Malin is about $2.40, down 4 cents.”

Genscape said, “While load in the BPA [Bonneville Power Administration] market has been relatively flat in the past few days, wind generation has spiked. From April 16-20, wind generated an hourly average of just 214 MWh/hr. On April 21 that number jumped to 2,034 MWh/hr and 3,349 MWh/hr yesterday.

“Meanwhile, thermal generation is down 11% from the prior seven-day average. Gas demand for power generation has averaged 384 MMcf/d the past after having run as high as 445 MMcf/d on April 21.”

In Wednesday for Thursday trading, quotes on Northwest Sumas plunged 23 cents to $1.67. In Thursday trading Northwest Sumas was seen at $1.70, up 3 cents.

Quotes at other western points were soft as well. Gas at Malin fell 5 cents to $2.40, and packages at the PG&E Citygates dropped 3 cents also to $2.90. Deliveries on Northwest Pipeline WY came in a nickel lower at $2.30.

The current oil and natural gas supply glut that is putting downward force on energy pricing is not exactly music to the ears of drilling equipment vendors. Weatherford International plc expects that half of its North American drilling equipment may be stacked by the end of June following a “miserable” performance in the first quarter, CEO Bernard Durock-Danner said Thursday. Onshore drilling contractor Patterson-UTI Inc. already has stacked about one-third of its hydraulic fracturing equipment because there’s “no real demand” for rigs anywhere, CEO Andy Hendricks said. Helmerich & Payne Inc. now is forecasting that the U.S. land market may trough at 750-850 rigs. “That is a reasonable fairway, given the oil price environment and discussions with customers,” CEO John Lindsay said (see Shale Daily, April 23).

At mid-morning Thursday the reported storage build by the EIA just 2 Bcf higher than market expectations was enough to keep futures pinned to the mat. May futures fell to a low of $2.520 after the number was released and by 10:45 a.m. EDT May was trading at $2.549, down 5.7 cents from Wednesday’s settlement.

Prior to the release of the data analysts were looking for an increase just under 90 Bcf. A Reuters survey of 22 traders and analysts showed an average 88 Bcf build with a range of 80 Bcf to 100 Bcf. ICAP Energy calculated an 86 Bcf increase, and Genscape’s flow model estimated an 89 Bcf increase.

“It was really a non-event. We have traded about 55,000 May contracts which is about normal for this time on a report day,” said a New York floor trader shortly after the figure was released….We are still in the range of $2.50 to $2.75, and this market is going nowhere fast.”

Despite just a 2 Bcf miss the number was considered bearish, according to Drew Wozniak, vice president at United ICAP.

Inventories now stand at 1,629 Bcf and are 737 Bcf greater than last year and 101 Bcf less than the five-year average. In the East Region 41 Bcf were injected and the West Region saw inventories increase by 4 Bcf. Stocks in the Producing Region rose by 45 Bcf.

Next week’s storage report is not likely to get much of a boost from unexpected heating requirements. The National Weather Service forecasts that for the week ended April 25, New England is expected to endure 110 heating degree days (HDD) or 10 fewer than normal, and the Mid-Atlantic should see 102 HDD or two more than its normal seasonal tally. The greater Midwest from Ohio to Wisconsin is expected to experience 110 HDD or seven more than normal.

The early read for next week’s storage report is for a build of 80 Bcf, according to Reuters. The early sample had a range of 74 Bcf to 94 Bcf and would compare to 77 Bcf a year ago and a five-year average of 55 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |