Natural Gas Futures Lower Following Storage Report

Natural gas futures gave ground after the release of government inventory figures showing an increase that was only slightly greater than what traders were expecting.

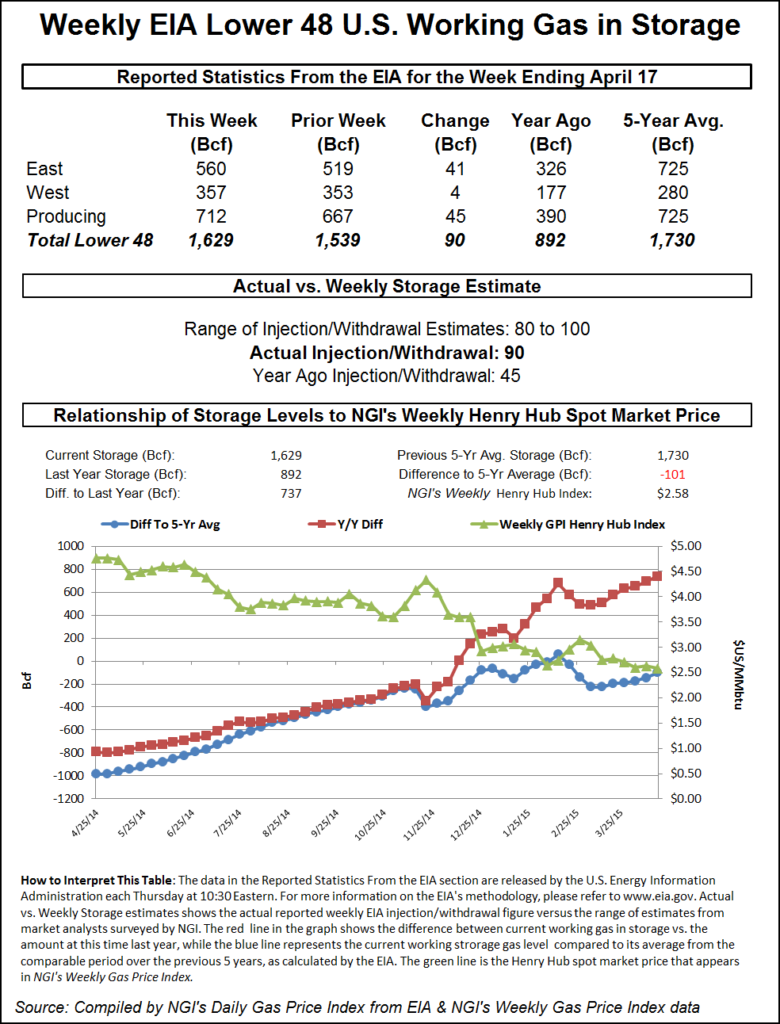

For the week ended April 17, the Energy Information Administration (EIA) reported an injection of 90 Bcf in its 10:30 a.m. EDT release. May futures fell to a low of $2.520 after the number was released and by 10:45 a.m. May was trading at $2.549, down 5.7 cents from Wednesday’s settlement.

Prior to the release of the data, analysts were looking for an increase just under 90 Bcf. A Reuters survey of 22 traders and analysts showed an average 88 Bcf build with a range of 80 Bcf to 100 Bcf. ICAP Energy calculated an 86 Bcf increase, and Genscape’s flow model estimated an 89 Bcf increase.

“It was really a non-event. We have traded about 55,000 May contracts, which is about normal for this time on a report day,” said a New York floor trader. “We are still in the range of $2.50 to $2.75, and this market is going nowhere fast.”

Despite just a 2 Bcf miss, the number was considered bearish, according to Drew Wozniak, vice president at United ICAP.

Inventories now stand at 1,629 Bcf and are 737 Bcf greater than last year and 101 Bcf less than the five-year average. In the East Region 41 Bcf was injected and the West Region saw inventories increase by 4 Bcf. Stocks in the Producing Region rose by 45 Bcf.

The Producing Region salt cavern storage figure was up by 20 Bcf to 191 Bcf, while the non-salt cavern figure increased 25 Bcf to 520 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |