West Virginia Oil, Gas Severance Tax Collections Double in 2014

West Virginia’s oil and natural gas severance tax collections more than doubled in 2014, the latest period for which data is available, according to the state Department of Revenue.

Income rose to about $188 million last year from $79.2 million in 2013. Operators report production annually each March, with 2014 data to be released later this year, according to the West Virginia Department of Environmental Protection.

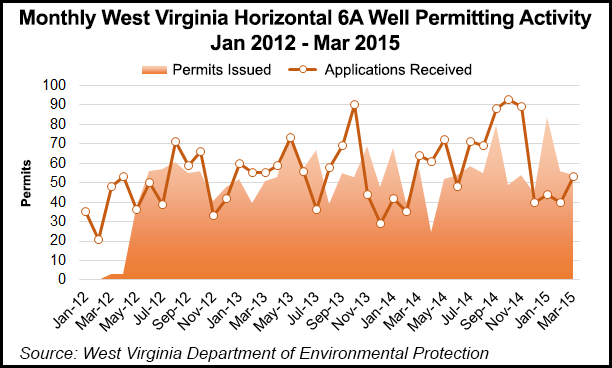

Severance tax collections could increase again in 2015, ahead of what West Virginia Oil and Natural Gas Association Executive Director Corky DeMarco said might be a slowdown in production toward the end of the year.

“It’s hard to say. What we’ve had is a cutback in [capital expenditures] and a lot of companies idling rigs,” he said of production gains and the impact on increasing severance tax revenues. “We may not be operating as many rigs this year as we were last year, but the bottom isn’t going to fall through; these are prolific wells.”

Overall natural gas production increased to almost 742 Bcf in 2013 from roughly 539.5 Bcf in 2012 (see Shale Daily, Feb. 12). Combined conventional and unconventional oil production spiked sharply as well between 2012-2013, to 6.9 million bbl from about 2.6 million bbl.

DeMarco, who reviewed the state’s oil and gas severance tax collections, said higher priced gas and shut-in wells that came online early in 2014 helped to increase tax revenue. The state charges a 5% tax on the gross volume of oil and gas. Nearly all revenue generated by the severance tax, or 90%, goes to the state’s general fund.

West Virginia is the nation’s second largest coal producer, accounting for about 12% of the country’s volumes, but unlike oil and gas, coal severance taxes dropped by about 23% in 2014 to $407 million from a peak of $530 million in 2012. Remaining funds from the oil and gas tax not allocated to the general fund have helped to fill that gap, with 75% going to oil and gas producing counties and 25% allocated to other counties.

According to the West Virginia State Treasurer’s office, Harrison, Doddridge, Wetzel and Marshall counties all received more than $1 million from the severance tax last year.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |