Analysts See Bottom Nearing on Rig Count Decline

Rig counts are still declining, but they appear to be stabilizing, according to analysts at Wunderlich Securities Inc. Presumably, exploration and production (E&P) companies are working within their right-sized budgets for 2015, they said in a note on oilfield services companies Thursday.

Natural gas prices are still relatively weak but have seen some recovery from multi-year lows, Wunderlich said. Oil prices still have some weakness ahead.

Aside from a surprising 40-rig drop in the previous week’s Baker Hughes Inc. rig count (see Daily GPI,April 10), the declines seem to be stabilizing, Wunderlich said. “…[T]his slower reduction in the overall rig count (versus the first few months of the year) to us feels like we are nearing a bottom, given current commodity prices and E&P budgets.”

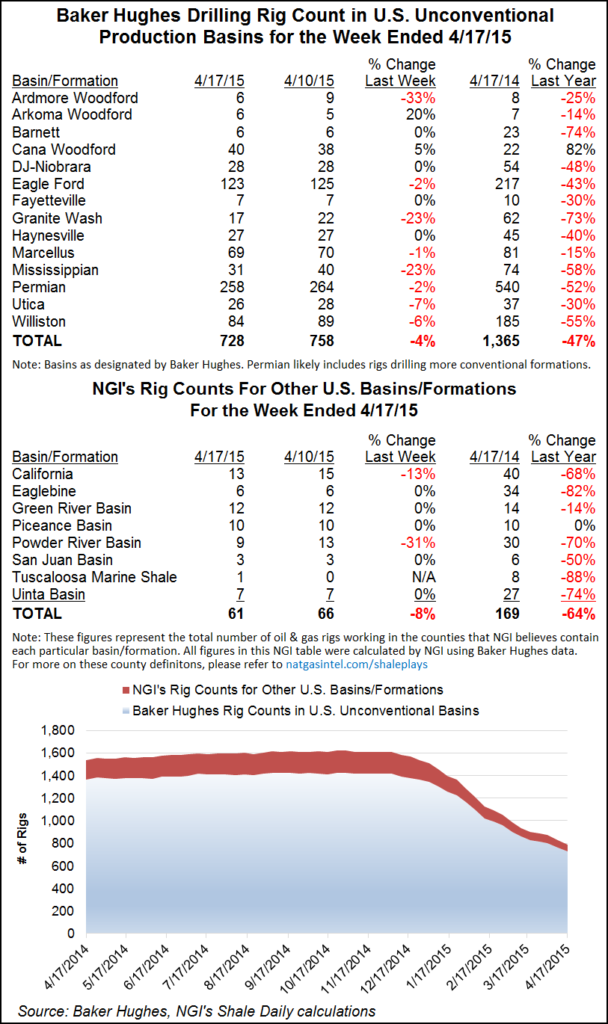

On Friday, Baker Hughes reported that another 30 rigs were cut in U.S. unconventional production basins during the week, which puts the current count of active rigs at 728. The largest drop percentage-wise was recorded in the Ardmore Woodford, which dropped 33%, from nine to six rigs. In the Powder River Basin, NGI calculates that there was a 31% drop for the week, from 13 to nine rigs.

The dropping of rigs is about to have its payoff in production numbers, according to Wells Fargo Securities LLC.

“Given the magnitude and speed of the U.S. rig count reduction, the pendulum has swung back, and consensus seems to be U.S. production begins to roll in either May or June,” Wells Fargo said in a Wednesday note.

The firm said its discussions with industry participants have led it to see a consensus expectation of $65-70/bbl West Texas Intermediate (WTI) crude by the end of this year. Slowdowns in the shale patch and increasing global demand are what is thought to be driving the expectation. Wells Fargo is forecasting $64/bbl WTI in the fourth quarter, which it predicts will forestall a necessary culling among small cap companies.

“From and E&P perspective, our fear if prices do hit these levels is that given cost reductions, many mid- and small-cap producers will be thrown a life raft,” Wells Fargo said. “Longer term, this is not healthy for the industry as we believe we need to see contraction and consolidation.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |