Rigs Fell Faster Than Expected, But Raymond James Sees Second-Half Upturn

Declines in U.S. oilfield rig activity will likely continue through May before improving during the second half of this year, analysts at Raymond James & Associates Inc. said in an April 13 note on the U.S. rig count, in which they admitted surprise at how far and how fast the count has fallen to date.

“Less than three months ago, we had forecasted the rig count would fall by 850 rigs from peak to trough, bottoming out in late 2015. At the time, that lower activity outlook was significantly below consensus. Since then, the U.S. rig count decline has already surpassed our full expectations in just three months!” they said. “While the brunt of the pain has already been felt, we expect the U.S. oilfield activity declines to continue through May before gradually improving in the back half of 2015.”

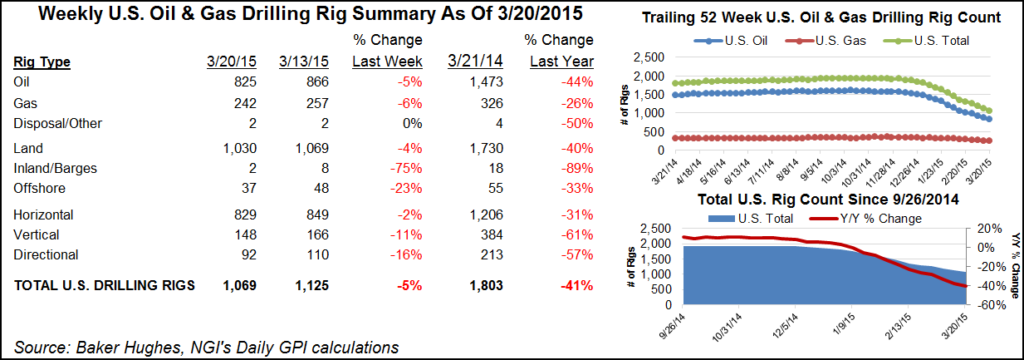

Overall, Raymond James said its analysts now think that the U.S. rig count will fall by about 1,000 total rigs, an approximately 52% change from peak to trough of 1,931 to 930 rigs, respectively. That’s an average annual decline of 787 rigs, or about 42% year over year (y/y).

The firm’s 2015 average total U.S. rig count estimate is now 19% lower than its previously published estimate.

“In 2016, we expect the average total U.S. rig count will increase by 10% (or 106 rigs) y/y,” Raymond James said. “We expect the horizontal U.S. rig count to hold up relatively better, falling about 37% (or 467 rigs) y/y in 2015. As we look forward to 2016, we expect the horizontal U.S. rig count to be up about 13% (or 103 rigs) on average, modestly outpacing the recovery in the total U.S. rig count.”

According to Friday’s Baker Hughes Inc. rig count, the United States lost 34 rigs to end at 954. That’s down from 988 in the previous count, the first one in the current downcycle to breach 1,000. Canada lost 19 rigs to end at 80.

In a separate comment, consultancy Douglas-Westwood said current economic conditions suggest “a more modest outlook for the land drilling rig market through to 2019.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |