Canadian Pipeline Tolls Ruling Raises LNG Export Costs

A tall new cost hurdle has popped up on the path of liquefied natural gas (LNG) exports from British Columbia (BC), in the form of a restrictive ruling Wednesday by Canada’s National Energy Board (NEB) on pipeline tolls.

The decision rejected, as “cross-subsidization,” plans by TransCanada Corp. to spread payment for LNG facilities thin by rolling their price tag into tolls for all shippers on the BC and Alberta network of subsidiary Nova Gas Transmission Ltd. (NGTL).

The NEB approved construction of NGTL’s proposed North Montney Mainline for C$1.7 billion (US$1.4 billion), as a 301-kilometer (187-mile) connection for its namesake shale gas field in northeastern BC. The 42-inch diameter pipeline would initially carry 2 Bcf/d and could bump up the volume to 2.9 Bcf/d as overseas markets develop by adding compressor horsepower.

North Montney would carry northern shale gas south to TransCanada’s proposed Prince Rupert Gas Transmission, an even larger 48-inch diameter pipeline intended to relay up to 3.6 Bcf/d west to LNG export terminals on the northern Pacific Coast. The jumbo pipe across 900 kilometers (720 miles) of BC mountains, forests and muskeg is forecast to cost C$4-5 billion (US$3.2-4 billion).

But only one export project is committed to use the North Montney line to date: 95% of its capacity is booked by the senior partner in Pacific NorthWest LNG, Progress Energy as the Canadian arm of Malaysian state energy conglomerate Petronas. Three other undisclosed shippers have booked small volumes of delivery service.

Pacific NorthWest LNG is widely regarded as the most likely of 18 BC export terminal schemes to make it into construction first. Progress-Petronas has set the firmest, earliest targets for a final investment decision and the project is 38% owned by other Asian backers: China Petrochemical Corp., Japex Montney Ltd., Indoil Montney Ltd. and Petroleum Brunei Montney Holdings Ltd.

The NEB granted Petronas-Progress and NGTL a break by authorizing them to use a rolled-in toll calculation method to hold down shipping costs on North Montney for an initial “transition period.” But the break is only intended to last about two years, while Progress builds up shale production and sells it on North American markets reached across the established NGTL grid during construction of the LNG export terminal.

When overseas tankers begin loading, NGTL would be required to revert to “stand-alone” tolling or create a new regime that still separates the North Montney connection from the rest of its 24,500-kilometer (14,700-mile) Alberta and BC pipeline network.

Even during the transition period, the NEB decision requires separate records to be kept of costs and revenues for the North Montney connection, and maintenance of a “deferral account” showing how much its income falls short of its expenses.

The board estimated that the shortfall would be C$169 million (US$135 million) during the short transition period alone. NGTL and TransCanada would be entirely responsible for making up for the loss.

In addition, the NEB found that a C$600 million (US$480 million) stretch of the North Montney line would only be used during the transition period, then wind up as an excess capacity cost burden on the rest of the NGTL network.

The board’s ruling said, “The separation of cost pools places the accountability and risks…on NGTL and its North Montney shippers and, therefore, the potential risks of any mis-sizing of facilities will not be borne by shippers on the existing NGTL system.”

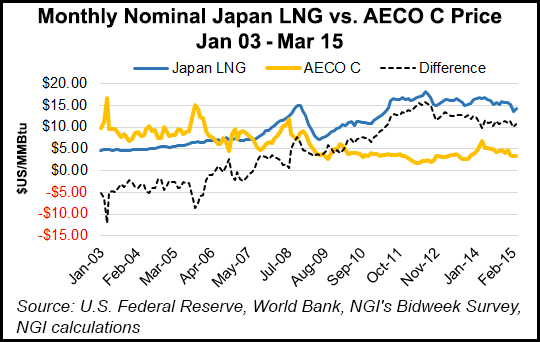

During lengthy NEB hearings, the Canadian Association of Petroleum Producers (CAPP) refrained from fighting NGTL’s rejected rolled-in tolling plan. CAPP supports LNG exports as the marketing safety valve that would siphon off the supply glut that has depressed North American gas prices since 2008.

As BC’s former mainstay pipeline grid, Westcoast Energy (Spectra) fought the North Montney scheme as unfair competition with natural rolled-in cost advantages of the far larger NGTL Alberta network. Longstanding northwestern United States customers for BC gas exports lined up with Westcoast, as did the FortisBC and Atco distribution systems in the name of protecting their supplies and holding down costs.

After taking the time to digest the NEB’s 188-page decision, TransCanada-NGTL and Petronas-Progress steered clear of direct comment on the tolling aspect in statements. While praising the B.C. and federal governments for concessions granted to date, the companies remained non-committal about final investment decisions. The B.C. government, meanwhile, raised a possibility of additional concessions offsetting the new toll hurdle by introducing legislation enabling special provincial royalty deals to be cut with favored projects.

But Progress-Petronas, CAPP and LNG export terminal sponsors have repeatedly emphasized that government and regulatory policies must do as much as possible to help Canadian projects compete internationally by enabling them to hold down costs.

During the NEB hearings the board ruling said, “NGTL confirmed it will not seek to construct the [North Montney] project…if the LNG exports and associated facilities forecast in the [construction] application either develop at a significantly slower pace than forecast or do not develop at all. NGTL further submitted that it will not commence construction of the project unless Progress has made a positive final investment decision on the proposed Pacific NorthWest LNG project.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |