Futures Bound Higher, Yet Physical Gas Languishes; May Adds 7 Cents

Natural gas for delivery Friday drifted lower in Thursday’s trading with Midwest and Gulf points a few cents either side of unchanged, eastern points down about a dime, and the Rockies and California off about 3 cents. Overall the market gave up 3 cents to $2.31.

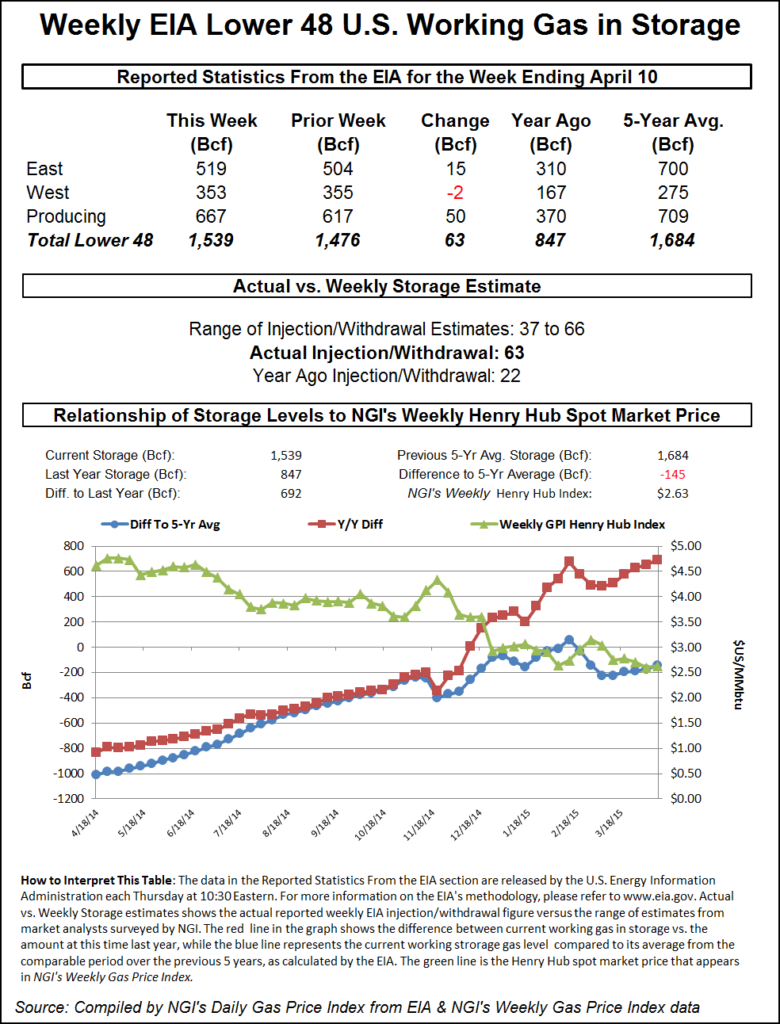

Futures managed a rebound from as much as 5.5 cents down following what was thought to be a bearish storage report to a gain of more than 7 cents. The Energy Information Administration (EIA) reported a build of 63 Bcf, somewhat greater than market expectations, but at the close May had risen 7.4 cents to $2.684 and June was higher by 7.7 cents to $2.726. May crude oil gained 32 cents to $56.71/bbl.

Observers readily discount the perceived bearishness in the market and point to the power sector. “The market isn’t going to drop another 50 cents,” contends Jeff Richter, principal with Energy GPS, a Portland, OR-based power consulting firm.

“Power burns are above last year by about 4 to 5 Bcf/d, but something is going on because loads are down, and burns are high. There is a lot of coal to gas switching, a few [coal] retirements, mainly the old clunkers, and nuclear outages are starting to increase.

“Even with the storage number today being bearish at 63 Bcf, you still have the speculative types willing to follow gains in oil. I think it is the defined seasonality. There is just not a lot of bearishness going on. Power demand is at its lowest point between now and the end of the month, but this is a seasonal low with the power burn high. It points out how not loose that system is. The grid is getting tighter,” he said.

The NGI NRC Power Reactor Status Report shows a hefty 18,361 MW offline, with U.S. nuclear capacity at under 82%, well off the 86.8% capacity posted on April 7.

Futures traders noted that the rise in the May natural gas contract piggy-backed the advance in some petroleum markets. “The RBOB was trading lower on the day, almost 4 cents, and settled at unchanged, and heating oil was down 3 cents at one point and added 1.9 cents,” said a New York floor trader. “Those two markets turning around gathered some fuel for the natural gas settling up at $2.68.”

In physical trading a few points in the Northeast managed to put up gains in an otherwise soft market. Algonquin Citygates gained 6 cents to $2.66, and gas on Tennessee Zone 6 200 L dropped a penny to $2.47. Gas on Iroquois Waddington eased 3 cents to $2.79.

Next-day peak power was firm at eastern points. Intercontinental Exchange reported Friday peak power at the ISO New England’s Massachusetts Hub rose $2.17 to $28.00/MWh and peak power at the PJM West terminal rose 5 cents to $37.46/MWh.

Deliveries to New York City on Transco Zone 6 fell 24 cents to $2.02, and gas on Tetco M-3 shed 12 cents to $1.55.

On the West Coast, prices also weakened. Gas for delivery Friday at Malin shed 4 cents to $2.32, and parcels at the PG&E Citygates were off a penny at $2.85. Gas at the SoCal Citygates came in 3 cents lower at $2.58, and packages at the SoCal Border were quoted 3 cents lower at $2.40.

The EIA storage report was at first thought to be bearish. May futures fell to a low of $2.545 after the number was released and by 10:45 a.m. May was trading at $2.565, down 4.5 cents from Wednesday’s settlement.

Prior to the release of the data, analysts were looking for an increase of about 60 Bcf or less. A Reuters survey of 24 traders and analysts showed an average 53 Bcf build with a range of 37 to 66 Bcf. ICAP Energy calculated a 60 Bcf increase, and Bentek Energy’s flow model estimated a 59 Bcf increase. Teri Viswanath, director of natural gas trading strategy at BNP Paribas was looking for a 57 Bcf injection.

“With this higher build, we did come off a little bit, but nothing dramatic. We are still stuck above $2.50 and we’ve never really gotten below $2.50, but that’s the big number from what we can see,” said a New York floor trader.

“The data continues to show relatively easy seasonal builds, outpacing market expectations for a second week in a row,” said Tim Evans of Citi Futures Perspective. “This implies some weakening of the background supply-demand balance, with bearish implications for the weeks ahead.”

Inventories now stand at 1,539 Bcf and are 692 Bcf greater than last year and 145 Bcf less than the five-year average. In the East Region 15 Bcf was injected, and the West Region saw inventories decrease by 2 Bcf. Stocks in the Producing Region rose by 50 Bcf.

Going forward, Viswanath still sees April storage builds outpacing those of a year ago. “For the last two weeks, daily storage injections have outpaced year-ago levels by more than 3 Bcf/d. Colder changes in the weather forecast, with overnight temperatures dipping back below freezing in the Midwest next week, will closer align supply-demand balances with year-ago levels. Consequently, we expect the industry to outpace last year’s daily injection by an average of just 1.5 Bcf/d this month, with the net build in working gas in storage amounting to 254 Bcf compared to last year’s 209 Bcf,” Viswanath said.

The best minds in the business may have been looking for 60 Bcf, but John Sodergreen, publisher of Energy Metro Desk hinted that there may be a surprise. “[A]ll the usual indicators point to a surprise. The spread between the three categories we track is 4.6 Bcf, well above the 3 Bcf that ordinarily points to a surprise. The range was over 20 Bcf so, high. We note that the past three reports EIA has come in with a number higher than market expectations — average delta is around 5 Bcf. We’ve not seen EIA ever come in more than three times in a row higher than the market, but we think this week might be the exception to that particular statistic.”

Analysts saw Wednesday’s stout 8-cent gain being derived from a change in the weather outlook. “With the transition into more spring-like weather, the daily forecasts had taken a back seat to the general pessimistic sentiment on supply, with prices falling sharply last week. Now, however, colder weather ahead this month will likely limit the potential stock build, which in turn is spurring a short-term recovery in natural gas prices,” Viswanath said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |