NatGas Futures Ease Following Hefty Storage Build

Natural gas futures retreated after the release of government inventory figures showing an increase somewhat greater than what traders were expecting.

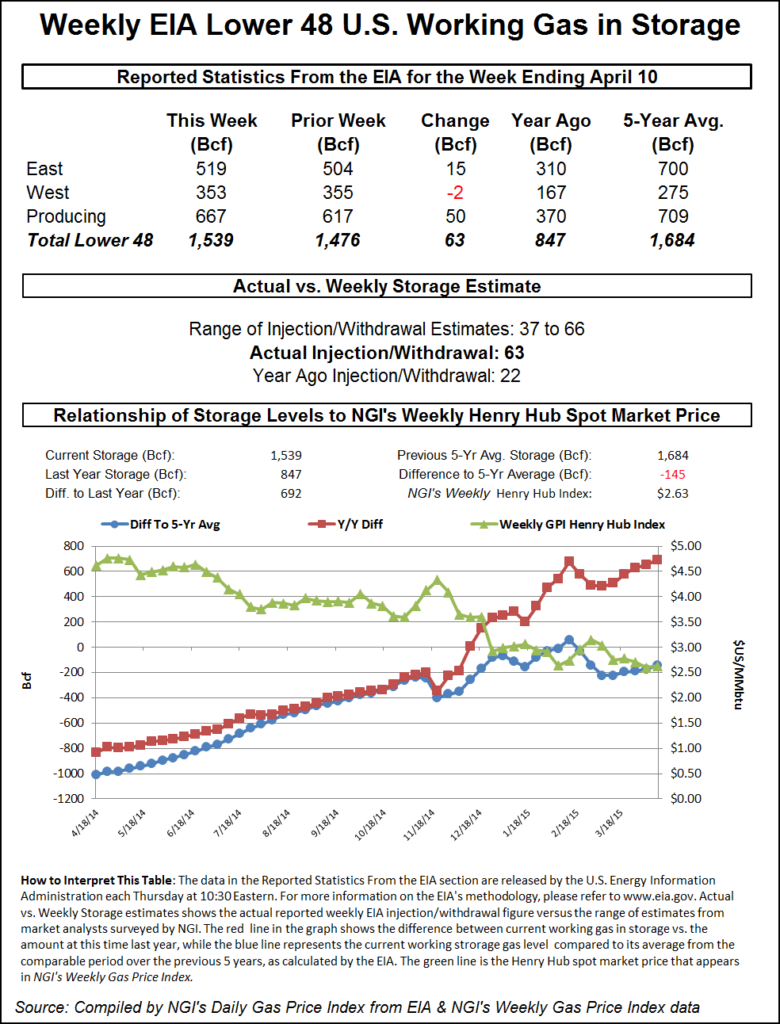

For the week ended April 10, the Energy Information Administration (EIA) reported an injection of 63 Bcf in its 10:30 a.m. EDT release. May futures fell to a low of $2.545 after the number was released and by 10:45 a.m. May was trading at $2.565, down 4.5 cents from Wednesday’s settlement.

Prior to the release of the data, analysts were looking for an increase of about 60 Bcf or less. A Reuters survey of 24 traders and analysts showed an average 53 Bcf build with a range of 37 to 66 Bcf. ICAP Energy calculated a 60 Bcf increase, and Bentek Energy’s flow model estimated a 59 Bcf increase.

“With this higher build, we did come off a little bit, but nothing dramatic. We are still stuck above $2.50 and we’ve never really gotten below $2.50, but that’s the big number from what we can see,” said a New York floor trader.

“The data continues to show relatively easy seasonal builds, outpacing market expectations for a second week in a row,” said Tim Evans of Citi Futures Perspective. “This implies some weakening of the background supply-demand balance, with bearish implications for the weeks ahead.”

Inventories now stand at 1,539 Bcf and are 692 Bcf greater than last year and 145 Bcf less than the five-year average. In the East Region 15 Bcf was injected, and the West Region saw inventories decrease by 2 Bcf. Stocks in the Producing Region rose by 50 Bcf.

The Producing Region salt cavern storage figure was up by 25 Bcf to 171 Bcf, while the non-salt cavern figure increased 24 Bcf to 495 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |