E&P | Infrastructure | NGI All News Access | NGI The Weekly Gas Market Report

Western Canada Sedimentary Basin Production Growth Seen Making A Comeback

Natural gas production will rise by 4.3 Bcf/d, or 30%, to 18.4 Bcf/d as of 2025 from the Western Canada Sedimentary Basin (WCSB), according to TransCanada Corp.’s pipeline network in Alberta and British Columbia (BC).

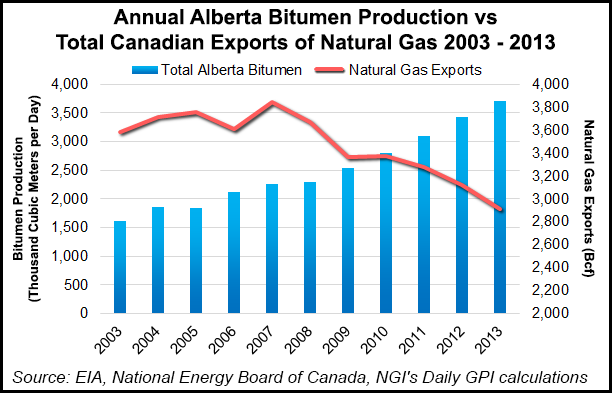

Homegrown industrial consumption — chiefly by thermal oilsands and power plants — will replace exports to the United States as the prime Canadian growth driver, said Nova Gas Transmission Ltd. (NGTL) in new supply and demand projections.

After a six-year lull marked by a drop of 2.8 Bcf, or 16%, from the last WCSB peak of 16.9 Bcf in 2001 the gas rebirth has begun, according to the 24,500-kilometer (14,700-mile) pipeline grid that carries about three-quarters of the region’s production.

NGTL canvassed producers and shippers as well as added up service orders to prepare the forecast as support for an application to the National Energy Board (NEB) to build C$1.14 billion (US$912 million) worth of new facilities by April 1, 2017.

The construction program highlights emerging features of the born-again WCSB. The proposed grid additions include pipeline legs and compressors in both northwestern and northeastern Alberta.

In the northwest the facilities are designed to fetch shale gas supplies from deposits being tapped with horizontal drilling and hydraulic fracturing in both Alberta and BC.

In the northeast, “NGTL has seen substantive growth in intra-basin [WCSB] delivery markets in recent years, driven primarily by developing oilsands operations, gas-fired electrical generation and oilsands upgrading requirements,” the forecast said.

Gas deliveries in the Florida-sized, 142,000-square-kilometer (54,800-square-mile) bitumen belt more than doubled in 2005-2014 to 2.4 Bcf/d from one Bcf/d. As of 2018, shippers have booked additional transportation capacity for 1.1 Bcf/d.

Apart from minor calculating differences the NGTL outlook paints the same picture of continuing northern Alberta industrialization, through the current oil price low, as recent forecasts by the NEB and the Canadian Association of Petroleum Producers (CAPP).

An oilsands project count by the NEB shows new plants and improvements to operating sites raising output by 1 million b/d as early as 2018. Thermal extraction systems use an average 1 Mcf of gas per barrel of production.

CAPP surveys of its members, which do about nine-tenths of Canadian production, show output growing by 150,000 b/d in each of this year and 2016 alone. Capital spending on oil sands growth remains a hefty C$25 billion (US$20 billion) in 2015 even after a collective C$8 billion (US$6.4 billion), 24% drop from last year.

Over the next 10 years NGTL expects Canadian industrial gas demand to rise by 2.2 Bcf/d, or 46%, to 7 Bcf/d. Thermal power plant gas consumption is forecast to grow by 1.1 Bcf/d, or 92%, to 2.3 Bcf/d.

Gas demand in the WCSB is expected to grow by 3.1 Bcf/d, or 53%, to 8.9 Bcf/d. Deliveries outside of the western hotbed of thermal oil extraction and power generation are forecast to rise by 1.1 Bcf/d, or 13%, to 9.5 Bcf/d.

But the modest growth anticipated in long-distance sales of WCSB production beyond its own region is expected to be on overseas markets for liquefied natural gas (LNG) instead of into traditional central Canadian and U.S. pipeline destinations.

NGTL expects tanker exports of LNG from Canada to grow by additions of terminal capacity to 0.7 Bcf/d in 2019, 2 Bcf/d in 2020, 2.7 Bcf/d in 2021, 3.6 Bcf/d in 2022, and 4.2 Bcf/d in 2023, with the growth halting at a plateau of 4.3 Bcf/d in 2024 and 2025.

The forecast said NGTL has been advised that a leading candidate to build the first LNG terminal on the northern Pacific coast of BC — Progress Energy, Canadian arm of Malaysian conglomerate Petronas — only postponed and did not drop its plan by calling a timeout on a final investment decision in December. The Progress-Petronas project is the prime delivery service customer for a BC addition to the NGTL network that is currently advancing toward NEB approval.

But NGTL also concedes that LNG projects in the U.S. will surpass their Canadian rivals. Overseas tanker deliveries from U.S. terminals will grow swiftly to 8.2 Bcf/d by the early 2020s, predicted the BC and Alberta pipeline network.

Prices only have to improve modestly and gradually to support the emerging gas supply development rebirth, NGTL predicted. As in the United States, shale drilling and production costs are dropping steadily as experience with the technology sets a long-range “equilibrium” point of US$4.80/MMBtu as a sweet spot low enough to encourage demand growth yet high enough to sustain remote Canadian field operations, NGTL said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |