Markets | NGI All News Access | NGI Data

Natural Gas Cash Weakens; Futures Fall Near Three-Year Lows

In all but a handful of locations natural gas traded Thursday for Friday delivery fell anywhere from a few pennies to 50 cents or more. Hardest hit was the Northeast and Mid-Atlantic, but the Marcellus posted double-digit declines as well as warmer temperatures were expected to creep into a number of regions.

Elsewhere the Midwest, Midcontinent, Gulf and California were anywhere from a few pennies to a nickel lower as temperatures in major population centers were forecast to surpass seasonal norms.

Overall, the physical natural gas market fell 7 cents to $2.41. The Energy Information Administration (EIA) reported an inventory build of 15 Bcf for the week ended April 3, just a few Bcf more than expected, and traders took the opportunity to sell early and sell often. At the close, May was down 9.1 cents to $2.528 and June had fallen 8.9 cents to $2.577. May crude oil rose 37 cents to $50.79/bbl.

Prices in New England fell as Friday temperatures were forecast more than 20 degrees higher. Wunderground.com predicted that the high in Boston Thursday of 37 would jump to 59 Friday before sliding to 55 on Saturday. The seasonal high in Boston is 53.

Gas for Friday on Tennessee Zone 6 200 L fell 9 cents to $3.47, and parcels at Iroquois Waddington came in 10 cents lower at $2.85.

Gas at the Algonquin Citygates, however, rose as power prices proved supportive. Intercontinental Exchange reported that peak power for delivery Friday at ISO New England’s Massachusetts Hub rose 76 cents to $38.17/MWh. Gas at the Algonquin Citygates changed hands at $3.82, up 24 cents.

Gas bound for New York City on Transco Zone 6 retreated 57 cents to $2.16, and deliveries to Tetco M-3 shed 45 cents to $1.56.

The Marcellus saw prices slide by double digits. Gas on Millennium fell 20 cents to $1.48, and gas delivered to Transco Leidy was off 26 cents to $1.41. On Tennessee, Zone 4 Marcellus next-day packages were quoted at $1.32, down 19 cents, and gas on Dominion South was seen at $1.41, down 32 cents.

In the East and Midwest the outlook was for higher temperatures surpassing seasonal norms. Wunderground.com forecast that the high Thursday in New York City of 47 would rise to 67 Friday before receding to 62 Saturday, 3 degrees above normal. Chicago’s 71 high on Thursday was expected to slide to 61 Friday and 58 on Saturday, 1 degree above normal.

Eastern and Mid-Atlantic power also softened. Intercontinental Exchange reported Friday peak power at the New York ISO Zone G Hub (eastern New York) fell $1.50 to $34.50/MWh and on-peak power at the PJM West Hub dropped $4.10 to $36.65/MWh.

Futures prices fell hard once the EIA reported a build of 15 Bcf, only about 5 Bcf greater than market expectations. The settlement of the May futures contract at $2.528 puts the natural gas market at a 34 month low.

“It was definitely a negative day. The storage report wasn’t all that bearish,” said Tom Saal, vice president at FC Stone Latin America LLC. “We made a new low for the year, and typically a new low in January or February is pretty supportive, but in this case it looks like we could move into lower numbers.”

Longer term, Saal pointed to a technical pattern suggestive of a long-term bottom, an inverted head and shoulders formation on the daily bar charts. The left shoulder was formed Sept. 2009 at $2.409, the head April 2012 at $1.902, and the right shoulder is now building with Thursday’s close at $2.528.

In spite of the day’s decline and technical deterioration Saal sees a buying opportunity. “Prices could get a little lower, but historically by any metric you look at these prices are on the low end of the last five years. It’s at the low end of the range, and I would encourage end-users to take advantage of these low prices with scale-down buying.”

On the storage front, weather forecasters don’t see anything on the horizon that is likely to impede an orderly if not rapid near-term refill. Natgasweather.com said in a noon update Wednesday that “without any truly frigid Canadian air spilling into the U.S. over the next several weeks, heating demand will be mainly light, providing opportunity for supplies to make up ground on deficits in larger chunks after the next two weekly EIA [Energy Information Administration] reports. Simply put, the latest weather data continues to show a mild and active pattern will rule the U.S. potentially through the end of April, which we consider to be fairly bearish for weather sentiment.”

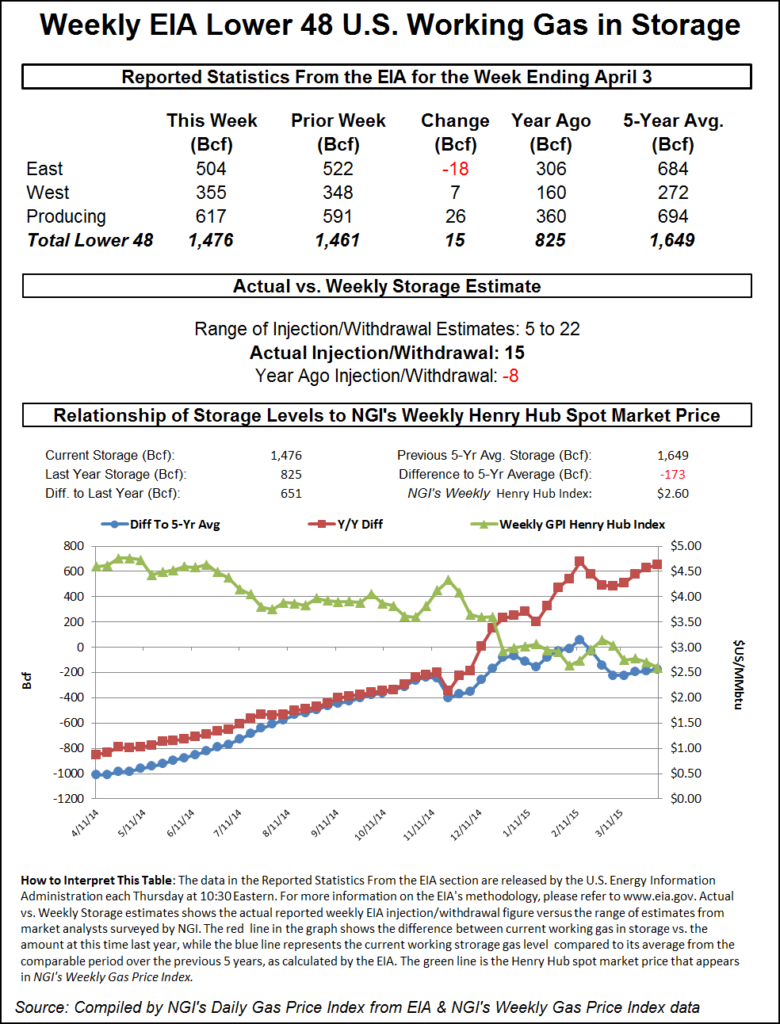

The release of storage data by the EIA was expected to show a build of about 11 Bcf. Ritterbusch and Associates calculated an 8 Bcf build, and a Reuters poll of 20 traders showed an average 11 Bcf increase with a range of +5 Bcf to +22 Bcf.

John Sodergreen, editor of Energy Metro Desk, said the “smart money is looking for a 15 Bcf draw out of the East (maybe a little less), a 20 Bcf build (at least) in the producing region and 6-7 Bcf build out west. It’s a tricky week. We expect the market to move nicely once the clock chimes 10:30 on Thursday.”

Move nicely it did. May futures fell to a low of $2.535 after the number was released and by 10:45 a.m. May was trading at $2.545, down 7.4 cents from Wednesday’s settlement.

“The market kind of fell out of bed. Volume is 62,000 contracts in the May, which is about average for a [storage] number day, but if we settle two days in a row under $2.50, that will be a bearish sign,” said a New York floor trader soon after the number was released.

Tim Evans of Citi Futures Perspective said, “The data follows a bullish surprise in the prior week, and so may reflect some timing issues between the two periods rather than a clear shift in the background supply-demand balance. The data also removes some risk of a bullish surprise and allows the market to focus forward again, with relatively mild temperatures pointing to larger than average storage injections later in the month.”

Inventories now stand at 1,476 Bcf and are 651 Bcf greater than last year and 173 Bcf below the five-year average. In the East Region 18 Bcf was withdrawn and the West Region saw inventories increase by 7 Bcf. Stocks in the Producing Region rose by 26 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |