Utica Shale | E&P | NGI All News Access | NGI The Weekly Gas Market Report

EVEP Selling Stake in Utica East Ohio Complex to Williams for $575M

EV Energy Partners LP (EVEP) said Monday that it has agreed to sell its 21% interest in Utica East Ohio Midstream LLC (UEO) to Williams Partners LP for $575 million in a deal that would give Williams majority ownership in the sprawling processing and fractionation complex.

Through its subsidiary, Utica Gas Services LLC, Williams already owns a 49% interest in UEO, which it absorbed in its merger with Access Midstream Partners LP (see Daily GPI, June 16, 2014). EVEP announced last year that it would monetize its 21% interest in the facility along with other assets in Ohio and Texas (see Shale Daily, Nov. 11, 2014). The deal marks the completion of its midstream divestitures in the Utica, after the master limited partnership sold its 9% stake in Cardinal Gas Services LLC last year for $162 million (see Shale Daily, Sept. 23, 2014).

Williams will pay $575 million in cash for the acquisition, which is expected to close in the third quarter. It plans to fund the deal with a mix of equity offerings and debt, including borrowings under its revolver. UEO’s other member, M3 Midstream LLC, however, has an option to acquire 8% of EVEP’s interests, which would reduce Williams acquisition to the remaining 13%.

“Acquiring these cash-generating assets supports our strategy to grow our natural gas midstream position in key basins,” said Williams CEO Alan Armstrong. “This fixed-fee business will be accretive to Williams Partners beginning in 2015, and the partnership has attractive growth opportunities as the Utica continues to develop.”

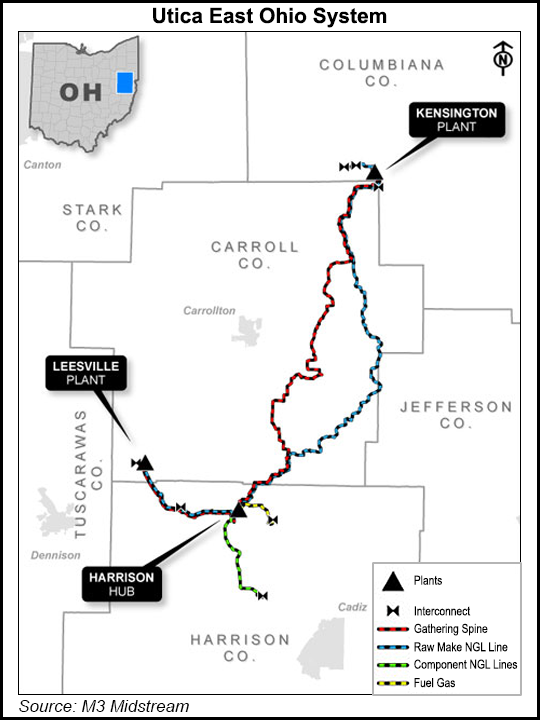

UEO provides processing, fractionation, natural gas liquids storage and rail-loading services in the play. It has facilities that stretch from Columbiana to Harrison counties in eastern Ohio. Late last year, the complex brought online a second cryogenic processing plant in response to producer demand, increasing its capacity to more than 1 Bcf/d (see Shale Daily, Nov. 4, 2014; May 12, 2014).

EVEP has cut this year’s capital expenditures by 40% compared to 2014. It said last year that it would sell its remaining interest in UEO, along with a sizable portion of its operated and non-operated acreage in Ohio, where it has a joint venture with Chesapeake Energy Corp. and Total E&P USA. It put that acreage sale, along with another planned in the Eagle Ford, on hold earlier this year because of the commodity price environment (see Shale Daily, Feb. 3).

EVEP said Monday that it would use proceeds from the UEO sale to repay debt and fund future activities, such as acreage acquisitions. Its net capital contribution to UEO has been $294 million.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |