NGI Data | NGI All News Access

April Bidweek Tumbles as Analysts Redo NatGas Price Forecasts

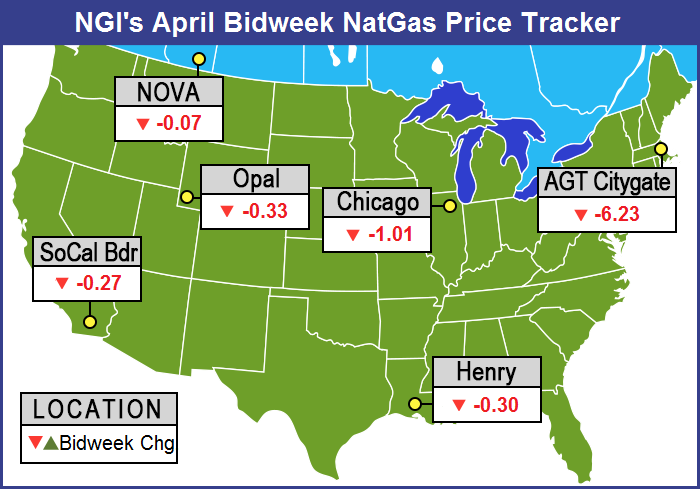

April bidweek prices were slam-dunked as all actively traded points experienced losses. TheNGI National Bidweek Average came in at $2.35, down a whopping 75 cents m/m, and $2.08 y/y. The only point to show a month-over-month gain was Dominion North, whose 13-cent increase still left it at just $1.44.

Most points were down about 30 cents, but losses of $1.00 or more were seen in the Midwest. The weakest points were Algonquin Citygates, with a drop of $6.23 to $3.28, and Tennessee Zone 6 200 L, with a decline of $6.59 to $3.30.

Regionally, the Northeast was down $1.61 to $1.97, and the Midwest was right behind, $1.03 lower at $2.72.

The Midcontinent fell 46 cents to $2.42, while South Louisiana and the Rocky Mountains were off by 32 cents to $2.55 and $2.29, respectively.

California was down 29 cents to $2.57, and South Texas fell 28 cents to $2.51. East Texas was off 27 cents to $2.52.

April futures settled at $2.590, a decline of 30.4 cents from the March settlement.

Even with the prospects of lower prices on the horizon, traders did not seem inclined to change up their bidweek trading. “If you are a gambler, you might want to say, ‘if it warms up, and production is as high as everybody says it is, and storage doesn’t need to be filled as quickly, we should see a tumbling of prices,’ I guess,” said a Houston-based pipeline manager.

“That would be the obvious choice, but if you are a utility, you get paid not to gamble. You just buy what you need. You’ve got your baseload, you buy for storage because you have ratchets you have to provide for, and on any day if it gets cold, you buy for that.”

The direction of April cash prices is unknown, but market analysts can’t seem to put on their bear suits fast enough.

Steve Mosley, publisher of SMC Natural Gas Price Forecasting and Advisory Services, suggested that prices may be poised to fall 10-45 cents. The market “initially tried to resume some upside movement, but it then proceeded to give back all of the previous week’s gains. It fell further after a somewhat bearish storage report and made a serious challenge of our Feb. 6 winter seasonal low point of $2.567 in the final minutes of the week as the April contract expired.

“Thus, while a sharp rally like we saw between March 16 and 18 tends to be a good indicator that a winter seasonal decline is complete, it didn’t turn out to be so this time. As such, it appears that we may see the market actually break at least somewhat lower here in the waning days of March and actually achieve our $2.20-2.55 winter target range.”

Barclay’s Commodities Research analyst Michael Cohen is sticking with a lower price regime. “Lingering cold weather has failed to keep natural gas prices supported as the shoulder season begins. Production is rebounding from freeze-offs during the winter and has led to the first net storage injection of the year. As we forecast last month, we maintain our view that prices will fall to average $2.45 over the course of Q2 and will average $2.75 during 2015,” he said in a report Monday.

At BMO Capital Markets, analysts have knocked 75 cents off their forecast price. “The 2014-2015 winter heating season proved to be a bust for North American natural gas prices and the outlook for the summer is no better,” said analyst Randy Ollenberger. “We are lowering our Henry Hub assumption to $2.75/Mcf from $3.50/Mcf and our 2016 assumption to $3.25/Mcf from $4.00/Mcf. We continue to recommend that investors largely remain on the sidelines over the first half of the year.”

Despite projections of lower prices, marketers said they were pleased with the low prices. “We locked in $2.91, including the basis for Consumers for April and that was a good deal,” said a Michigan marketer.

“We also had a large client, a hospital, that wanted to lock in a fixed deal, July through June. They said ‘Hey, it could go lower, but we are really pleased with the number, so let’s just do it.’ We talked them into doing just 60% instead of the 100% they wanted to do in order to maintain some flexibility.

“We never like to do 100%. You always like to have the opportunity to supplement it.”

At the end of bid week, trading for next-day gas Tuesday was highly skewed, with multi-dollar losses at some New England points contrasting sharply with gains of a few pennies at most market points. Overall, the market was down 4 cents to $2.52, but take away just three stout losses in the Northeast, and the average market change was a penny higher.

Weak next-day peak power helped drop New England prices, but otherwise, temperatures were close to seasonal norms. Futures trading added another uninspired session with May falling 0.4 cent to $2.640 and June falling 0.3 cent to $2.691. May crude oil dropped $1.08 to $47.60/bbl.

Wednesday gas deliveries at New England points fell hard as weather conditions across the country were forecast to advance above seasonal norms, and power prices also fell. Forecaster Wunderground.com predicted that the high in New York City of 51 on Wednesday was expected to rise to 61 Thursday, six degrees above normal. Chicago’s expected high on Wednesday of 61 was seen hitting 62 Thursday, 9 degrees above its late March norm.

Next-day gas at the Algonquin Citygates tumbled $4.77 to $4.47, and deliveries to Iroquois Waddington lost 5 cents to $2.96. On Tennessee Zone 6 200 L gas changed hands $3.44 lower at $4.31.

Peak New England power plunged, but Mid-Atlantic next-day peak power was steady. Intercontinental Exchange reported on-peak power for Wednesday delivery to ISO New England’s Massachusetts Hub fell $23.13 to $43.00/MWh, and peak next-day power at the PJM West terminal rose 37 cents to $36.78/MWh.

Next-day gas in the Marcellus firmed about a dime, and observers attributed the rise mostly to weather. Wednesday gas on Millennium rose 8 cents to $1.88, and deliveries on Transco Leidy added 11 cents to $1.87. Packages on Tennessee Zone 4 Marcellus rose 13 cents to $1.76, but parcels on Dominion South were quoted 8 cents lower at $1.92.

“I don’t know of anything that is affecting those prices other than weather. Infrastructure is the same. We haven’t made any big changes,” said a Houston-based pipeline veteran.

As bidweek draws to a close NGI Markets Analyst Nate Harrison observed that only a few points showed a positive basis differential to the Henry Hub. “The forward market is showing all but the following five points in the red: Algonquin Citygates +0.686 Chicago Citygate +0.095, FGT Zone 3 +0.022, Michigan Consolidated +0.138, PG&E Citygate +0.310.”

Analysts suggested that maintaining any kind of upward price momentum “will be challenged by the likelihood of another counter-seasonal storage injection on Thursday. While our expected 7 Bcf increase is small, it would force further narrowing in the deficit against five-year averages,” said Jim Ritterbusch of Ritterbusch and Associates.

Others see a small withdrawal when the Department of Energy’s (DOE) Energy Information Administration issues its weekly storage report. Tim Evans of Citi Futures Perspective senses that there are “expectations that Thursday’s DOE storage report for the week ended March 27 will revert to a more typical seasonal withdrawal, with early estimates bracketing our own model’s 11 Bcf net withdrawal forecast. While less than the 22 Bcf five-year average decline for the date, the draw may be enough to hold sellers at bay for now. However, the temperature outlook still suggests above average storage injections going forward. We continue to view natural gas as arguably undervalued, but lacking a fundamental trigger that would set an upward correction in motion.”

First Enercast Financial calculated a draw of 12 Bcf.

“Our opinion of this market is in many ways analogous to that of the oil [market],” Ritterbusch said. “Although natural gas isn’t sitting on a supply surplus, production is continuing to increase even as gas rig counts remain on the decline. But as is the case in the petroleum [market], we still see high probability of a price drop to the $2.50 area and possibly to as low as $2.40 if the next couple of months prove mild” with limited elevation in cold degree days or heating degree days.

“Much of our bearish trading thesis across the coming month remains predicated on rising production that will be boosting injections with the longstanding supply shortfall against normal levels eventually being erased,” said Ritterbusch. “While we will reiterate that we see no overcrowding as far as storage capacity is concerned next fall, we do feel that much smaller injections will be required to meet ample end-of-season supply than was the case last year. This, of course, should relate to a significantly lower pricing environment. We still see contango expansion ahead.”

Weather models turned slightly cooler overnight. WSI Corp. in its Tuesday morning report said the “six-10 day forecast is a bit colder across the northern tier of the nation but warmer across the southern U.S. due to model trends. Period GWHDDs are nearly unchanged near 65 for the CONUS. Forecast confidence is average at best as medium-range models are in modest agreement with the general pattern.

Tom Saal, vice president at INTL FC Stone in Miami, in his work with Market Profile, said he saw pricing patterns developing that indicate less likelihood of still lower prices. “Counting four non-trend days (very unusual) signifies strong horizontal pricing at the bottom of the move. These non-trend days infer a lack of aggressive selling, most likely by speculators. Who else is there [to sell]?” he said in a Tuesday note to clients.

———————-

NGI noted the extended comment period for the proposed breakout of its Chicago Citygate index closed March 31. While keeping the combined Chicago Citygate index unchanged, NGI on May 1 will begin additional listings of separate price breakouts for the individual local distribution companies that serve the greater Chicago area. This is in response to subscriber requests for more detail. The Chicago Citygate index is a weighted average of transactions delivered into Nicor Gas, NIPSCO, North Shore and Peoples. Providing separate detail for these four LDCs will in no way impact how NGI calculates its existing Chicago Citygate index.

NGI also will be making several additional price listing changes, which had been cited in its March 1 call for comments. The aim is to adapt the price listing to changing patterns in gas flows and trading. See the April 1 note on the main web page under “Data.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1258 | ISSN © 2577-9877 |